Buyers’ seek for yield has pushed a extensively tracked ether choices market metric to its highest stage in 12 months. The put-call open curiosity

Buyers’ seek for yield has pushed a extensively tracked ether choices market metric to its highest stage in 12 months.

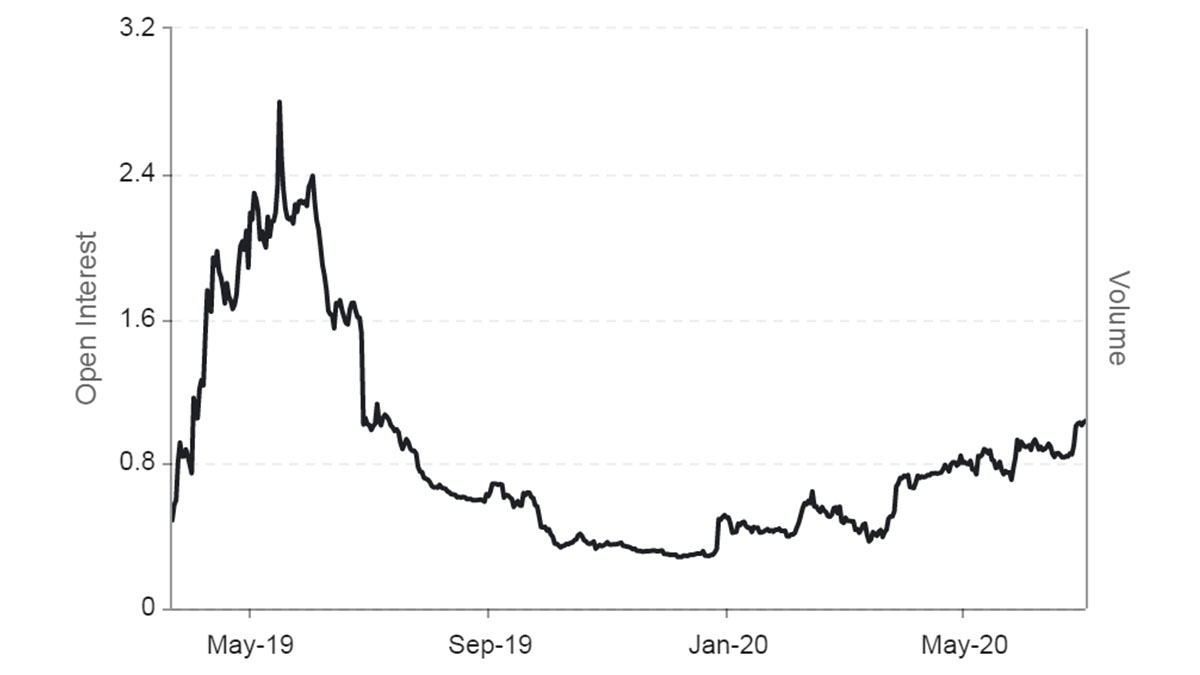

The put-call open curiosity ratio, which measures the variety of put choices open relative to name choices, rose to 1.04 on Thursday, a stage final seen in July 2019, in line with knowledge supplier Skew, a crypto derivatives analysis agency.

A put choice offers the holder the suitable however not the duty to promote the underlying asset at a predetermined value on or earlier than a selected date. In the meantime, a name choice represents a proper to purchase. Open curiosity refers back to the variety of contracts open at a selected time.

The metric has almost tripled in worth over the past 3.5 months and has witnessed a close to 90-degree rise from 0.84 to 1.04 within the final two weeks.

“Sometimes this suggests the market is extra bearish as traders are shopping for places to guard their portfolios from a fall within the underlying,” stated Luuk Strijers, COO at cryptocurrency trade Deribit, the most important crypto choices trade by buying and selling volumes.

Ether, the second-largest cryptocurrency by market worth, is flashing indicators of uptrend exhaustion. Costs have failed a number of occasions in the previous couple of weeks to maintain positive factors above $240. As such, some traders could have purchased places.

Nevertheless, on this case, the put-call open curiosity ratio has risen primarily because of elevated promoting within the put choices. “On this case, market makers have lengthy choices positions whereas the shoppers are internet sellers of places,” stated Strijers instructed CoinDesk, and added that, “shoppers, on this case, are producing further yields utilizing their ETH holdings.”

Merchants promote (or write) put choices when the market is anticipated to consolidate or rally. A vendor receives a premium (choice value) for promoting insurance coverage in opposition to the draw back transfer. If the market stays comatose or rallies, the worth of the put choice bought drops, yielding a revenue for the vendor.

It’s fairly probably that traders holding lengthy positions within the spot market are writing put choices to generate additional yield, given the market sentiment is bullish.

“There’s a number of pleasure round new DeFi tokens and a lot of the collateral locked up throughout these platforms is in Ethereum. As that excellent ether provide comes down and demand from Defi platforms hits escape velocity, ether will rally onerous,” tweeted John Todaro, head of analysis at TradeBlock.

Additionally learn: Ethereum Logged Its Busiest Week on Document

Validating Strijers’ argument are adverse readings on three-month and six-month skews, an indication name choices are costlier than places. Skew measures the value of places relative to that of calls.

Three- and six-month skews would have been constructive had traders been shopping for put choices.

One-month skew, too, was hovering at -4% on Thursday. Whereas it has bounced as much as 4.7% on Friday, the metric nonetheless stays effectively under highs round 10% seen on June 28.

Volatility metrics additionally recommend that the market typically is dominated by choice writers. “There appear to be extra sellers available in the market which can also be seen in particularly the shorter-dated implied volatility dropping to lowest ranges since a couple of yr,” stated Strijers.

Ether’s one-month implied volatility or traders’ expectations of how unstable or dangerous ether could be over the subsequent 4 weeks is seen at 47% at press time, the bottom since Skew started monitoring knowledge in April 2019.

Possibility implied volatilities are pushed by the online shopping for stress for choices and historic volatility. Stronger the shopping for stress, higher is the implied volatility.

Disclosure: The writer holds no cryptocurrency belongings on the time of writing.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an unbiased working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.