It shouldn’t come as a shock that regulators are beginning to pay shut consideration to cryptocurrencies this 12 months. For example, as the worth

It shouldn’t come as a shock that regulators are beginning to pay shut consideration to cryptocurrencies this 12 months. For example, as the worth of Bitcoin (BTC) continues to soar, it’s predicted that regulators will begin taking direct motion – probably even banning Bitcoin utterly.

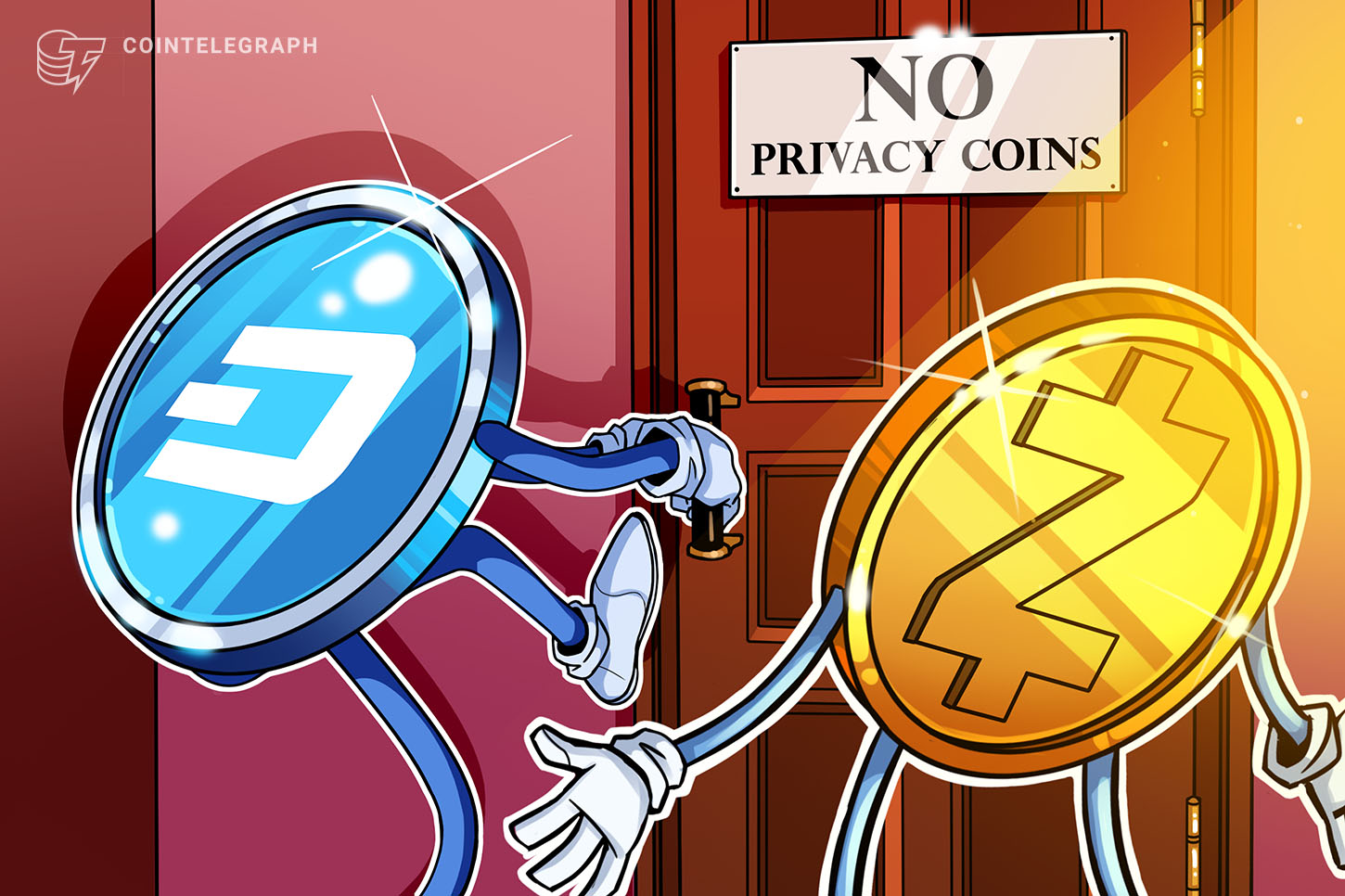

Whereas the ban might sound excessive, regulators have not too long ago honed in on the usage of privateness cash like Monero (XMR), Zcash (ZEC) and Sprint. For instance, in September this 12 months, america Inside Income Service supplied a bounty of as much as $625,00zero for intelligence companies that might break the untraceable privateness coin Monero.

Furthermore, on Oct. 8, William Barr, the legal professional common for the U.S., introduced the discharge of a doc entitled, “Cryptocurrency: An Enforcement Framework.” Produced by the legal professional common’s Cyber-Digital Job Pressure, the publication discusses a framework to fight the “rising threats and enforcement challenges related to the rising prevalence and use of cryptocurrency.”

Though the doc discusses cryptocurrencies typically, the report particularly addresses points involving “anonymity enhanced cryptocurrencies,” also referred to as AECs or privateness cash. The doc notes examples of those privateness cash to incorporate Monero, Zcash and Sprint, stating that they undermine the Anti-Cash Laundering measures:

“The acceptance of anonymity enhanced cryptocurrencies or ‘AECs’ — reminiscent of Monero, Sprint, and Zcash — by MSBs and darknet marketplaces has elevated the usage of this kind of digital forex. As mentioned above, as a result of AECs use personal or personal blockchains, use of those cryptocurrencies might undermine the AML/CFT controls used to detect suspicious exercise by MSBs and different monetary establishments.”

Regulatory issues and additional challenges

Following the discharge of the cryptocurrency enforcement framework, ShapeShift, a Swiss cryptocurrency alternate platform that runs operations out of Denver, Colorado, has delisted the exact same three privateness cash talked about.

Whereas ShapeShift declined to touch upon the matter, Ryan Taylor, CEO of Sprint Core Group, advised Cointelegraph that the Sprint community was labeled as a privateness coin in 2014. In response to Taylor, the assumptions behind this label — or much more basically what the label of privateness itself even means – has by no means been revisited. “We purpose to right this inaccurate categorization,” he remarked.

Taylor additional defined that there was no additional developments made for the reason that delisting of Sprint on ShapeShift. Nonetheless, he stays optimistic about partnering with the non-custodial alternate to get Sprint relisted. He elaborated:

“We have now had success in getting relisted on various exchanges in varied jurisdictions. These exchanges embody eToroX within the EU, Kraken and CoinSpot in Australia, and OKEx in Korea.”

But as a result of current laws round privateness cash, getting relisted could also be tougher than earlier than. Miko Matsumura, a co-founder of Evercoin — a cell pockets and alternate — advised Cointelegraph that the current U.S. cryptocurrency enforcement framework focuses a lot on privateness cash as a result of notion that they allow customers to evade sanctions set by the U.S. Workplace of International Property Management. “ShapeShift was a bit sluggish to undertake Know Your Buyer measures within the first place, so regulatory strain should be excessive,” he stated.

Other than the challenges of getting relisted, different cryptocurrency exchanges might observe swimsuit and begin delisting privateness cash. Nathan Catania, a accomplice at XReg Consulting — a crypto-asset regulatory agency — advised Cointelegraph that it’s seemingly many crypto exchanges will begin delisting privateness cash. “This may very well be resulting from outright bans, or better regulatory pressures for digital asset service suppliers to deal with privateness cash as greater danger for Anti-Cash Laundering functions,” he stated.

Asia’s two largest cryptocurrency alternate markets — Japan and South Korea — are already taking motion to delist privateness cash. Catania additional remarked that even when privateness cash should not banned, much more work and scrutiny can be required shifting ahead for crypto exchanges to work together with purchasers who want to use privateness cash. But Catania believes that for some exchanges, the dangers and prices wouldn’t outweigh the advantages of supporting privateness cash, so extra exchanges are more likely to delist privateness cash sooner or later.

Extensively used privateness cash predicted to stay on exchanges

Nonetheless, some consultants beg to vary. Invoice Barhydt, the CEO of Abra — a peer-to-peer funds platform that helps over 70 cryptocurrencies together with Sprint — advised Cointelegraph that Abra works carefully with third-party custody companions. He talked about that, to his data, these companions haven’t any plans to delist any cryptocurrencies which might be broadly used within the market at present. Sprint would fall into this class, as its present market cap rank is quantity 31 on CoinGecko, with 9.8…