Welcome to Opinionated, a brand new podcast that includes CoinDesk’s main columnists and contributors. I’m your host, Ben Schiller, CoinDesk’s opin

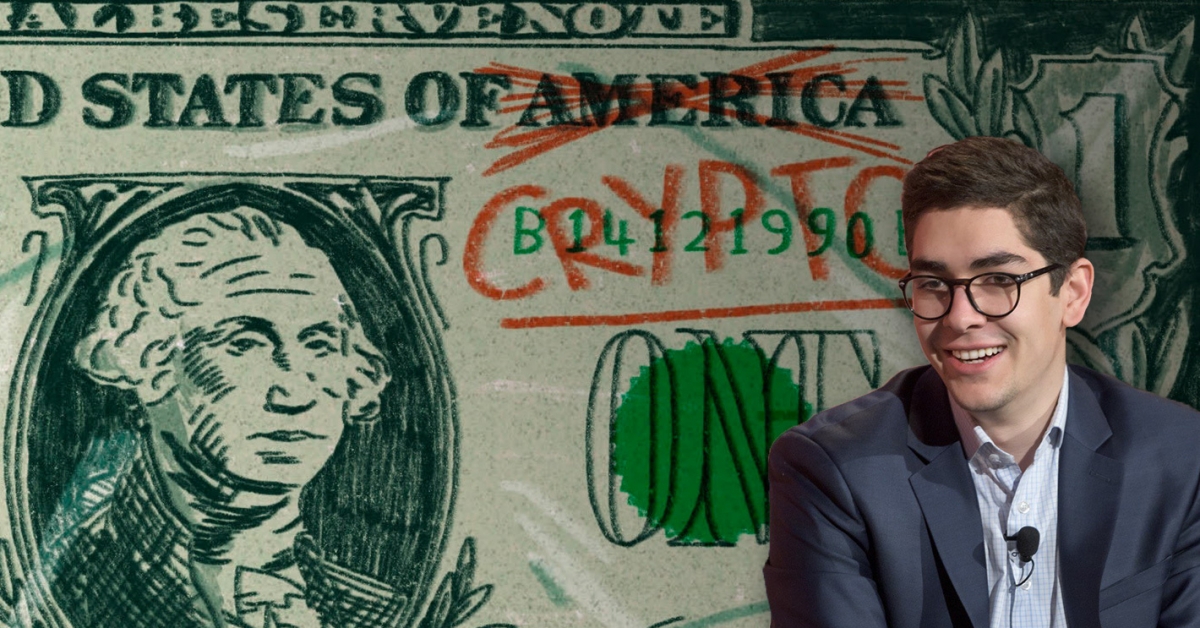

Welcome to Opinionated, a brand new podcast that includes CoinDesk’s main columnists and contributors.

I’m your host, Ben Schiller, CoinDesk’s opinion editor.

On this week’s present, we’re joined by Nic Carter, cofounder of Coin Metrics and accomplice at Fort Island Ventures.

Nic discusses this yr’s $20 billion surge in USD-backed stablecoins (what he calls “crypto-dollars”) and the doubtless huge implications of an offshore dollarization system primarily based on blockchain.

Fiat-backed stablecoins are “not what Satoshi meant,” Carter says, however their “preposterous” development this yr is the “a very powerful phenomenon within the trade.”

“It not solely tells us concerning the maturation of the crypto monetary infrastructure. It additionally tells us quite a bit about present geopolitics, too,” he says.

Nic has written two op-eds for CoinDesk about crypto-dollars:

U.S. policymakers worry dropping energy as dollar-flows more and more shift to stablecoins.

Central bankers might have much less capacity to set rates of interest. And the corresponding banking infrastructure, primarily based largely in New York, will course of fewer transactions as individuals transfer into property like tether and USDC as an alternative.

Nonetheless, Carter says the U.S. ought to embrace this new type of cash know-how.

One, it’s principally, for now, a U.S. trade, and overwhelming pegged to {dollars}. Extra {dollars} in circulation, whereas not essentially good for American staff, is nice for the greenback’s reserve forex standing.

Two, blockchains are inherently impartial – “equal alternative databases” that don’t exclude individuals and symbolize monetary freedom. That must accord with American values.

And third, if the U.S. doesn’t sanction stablecoin transactions, another nation or firm will, inviting in the specter of surveillance and a lack of energy anyway.

“The U.S. ought to contemplate embracing a impartial various to the extremely politicized New York corresponding banking system earlier than it’s too late and entire tranches of its allies defect to a Chinese language or a Russian system,” Carter says.

Nic had much more to say about stablecoins, the way forward for cash and nice energy rivalry. Test it out right here, and please subscribe to CoinDesk’s new podcast feed.