In his 1991 ebook, "Crossing the Chasm," administration advisor Geoffrey Moore outlined an important hole between the early adopters of a brand new

In his 1991 ebook, “Crossing the Chasm,” administration advisor Geoffrey Moore outlined an important hole between the early adopters of a brand new know-how and the bigger populations of customers that come later. Decentralized finance (DeFi) could now be approaching a spot of its personal.

This text focuses on DeFi companies that permit deposits of ether (ETH), ethereum’s native asset, as collateral for loans issued in a dollar-pegged stablecoin, DAI. Lending is decentralized to the extent it’s managed by an open community of contributors, ruled by guidelines and incentives established in a pc program. Debtors could deposit these stablecoins to earn earnings, convert them to money or use them to make leveraged investments in ETH and different crypto property.

DeFi lending’s beneficial properties are spectacular, however their relationship to the ETH worth bears watching.

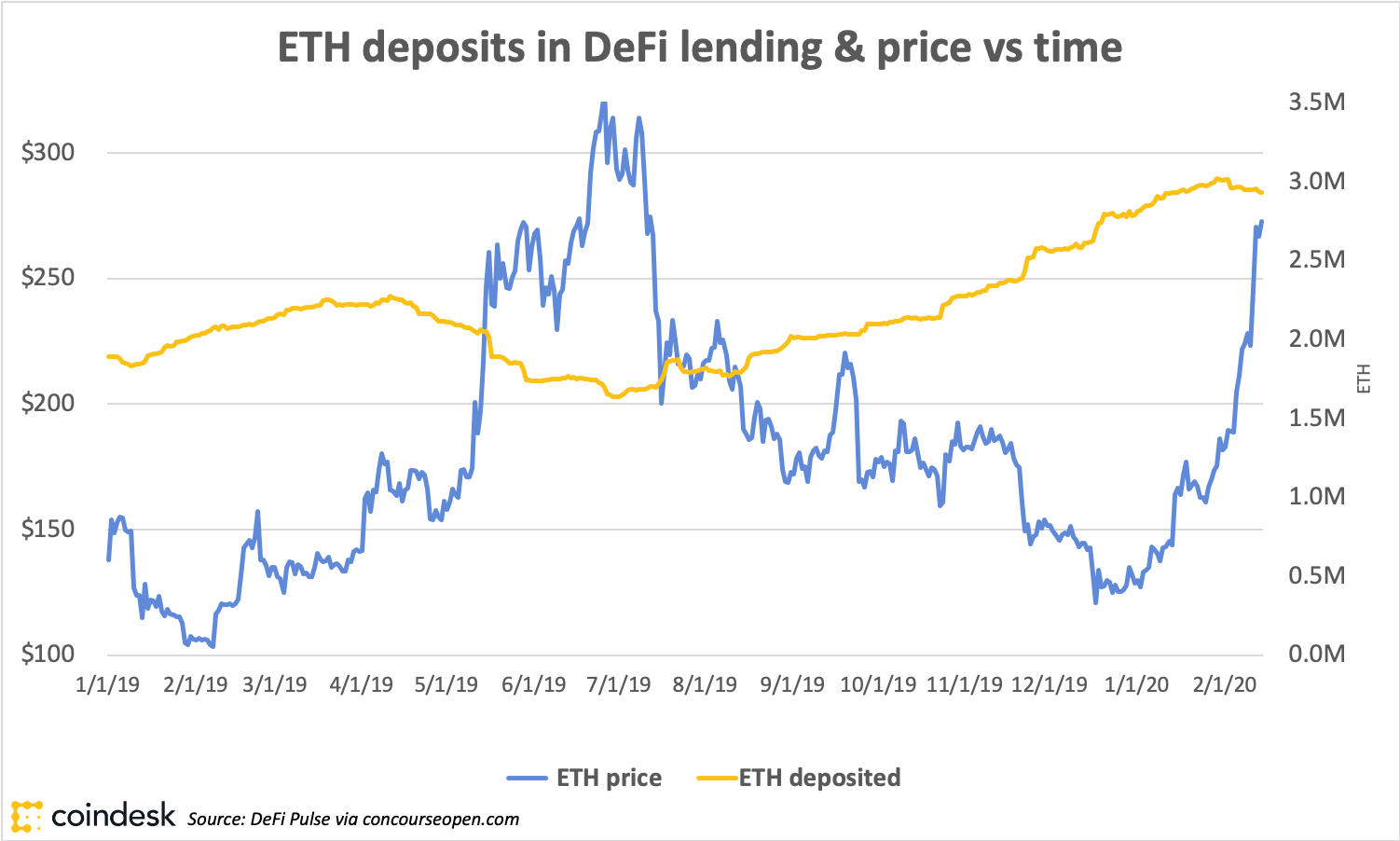

Demand for DeFi lending companies constructed on ethereum exhibits a sample of inverse relationship to the worth of ETH. When ether costs are falling, the quantity of ETH locked in DeFi tends to rise. Most up-to-date information point out the connection operates the opposite means, too. (Information is from DeFi Pulse through Concourse Open.)

If this obvious relationship persists, it might point out a round person adoption of DeFi lending that may very well be restricted to a small share of the variety of present ETH holders. That’s, present DeFi lending choices might not be sufficiently engaging to cross the chasm and draw new customers into ethereum.

The early adopter on this evaluation is the long-term holder of ETH, motivated by conviction that ETH’s worth will enhance sooner or later. For such buyers, DeFi lending presents a option to earn earnings or liberate capital, as outlined above.

A few of these makes use of, comparable to income-earning deposits and money conversions, could speed up throughout dips in worth, explaining the obvious inverse sample between ETH worth and ETH locked in DeFi lending. A declining worth will increase the price of promoting beneath duress.

Leveraged shopping for is a potential exception, and proponents of DeFi lending level this fashion. “What DeFi is creating is a virtuous cycle the place buyers who’ve increased danger tolerance are locking up ETH to generate Dai and leverage lengthy ETH,” Mariano Conti, head of sensible contracts at MakerDAO, informed CoinDesk Analysis.

At present, Maker, the most important DeFi lending operation by ETH deposits, has a minimal collateralization ratio of 150 %, which means $150 price of ether is required as collateral to borrow $100 price of DAI. The leverage implied by this ratio is 1.67X.

Liquid derivatives markets like BitMEX, Huobi and OKEx provide as much as 100x leverage on crypto property together with ETH. With these choices earlier than them, what number of long-ETH buyers are probably to decide on DeFi lending as a way to leveraged buying and selling?

It’s additionally troublesome to check adoption amongst a wider market of debtors not but initiated into crypto investing. Would a Most important Road borrower buy ETH as a way to receive a money mortgage price lower than mentioned ETH? Maybe, if DeFi lenders might settle for non-crypto collateral. This might not be a trivial growth.

“I see plenty of startups enjoying with identification sort options to scale back collateral necessities, however I feel these are a protracted methods out from meaningfully impacting the market,” Kyle Samani, managing companion of Multicoin Capital, informed CoinDesk Analysis. “There are a whole lot of exhausting, intertwined issues to make this work.”

(CoinDesk mentioned the problem with Samani and Jordan Clifford of Scalar Capital in a reside webinar on crypto lending, held in December. You can sign up to view it here.)

As for that inverse relationship between ETH worth and ETH deposits in DeFi lending, if it persists it might point out the class is approaching an adoption restrict. If the inverse relationship is damaged or reversed, that will sign DeFi lending has certainly discovered a set of use circumstances able to bringing it, and ethereum, to a wider market.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an unbiased working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.