Liquidations for XRP futures contracts have soared at 12 months’s finish as bullish alerts in November adopted by decidedly bearish information in

Liquidations for XRP futures contracts have soared at 12 months’s finish as bullish alerts in November adopted by decidedly bearish information in December whipsawed the token’s value.

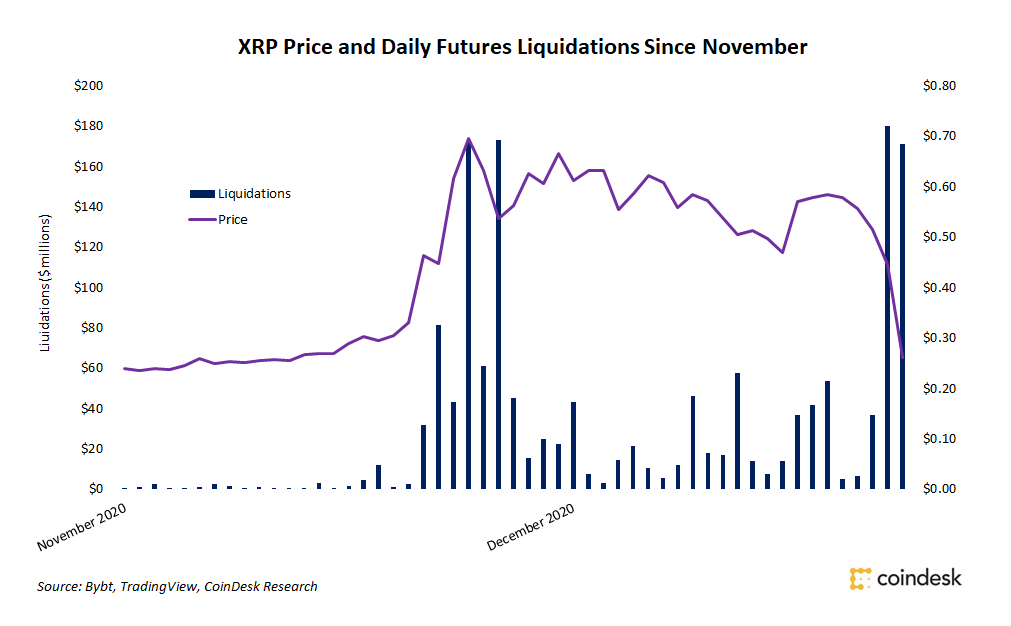

Over $1.5 billion value of XRP futures contracts have been liquidated for the reason that begin of November, per knowledge from analytics supplier Bybt. Barely $700 million in liquidated futures contracts have been recorded between March and October.

In November, the value of XRP skyrocketed over 220% to two-year highs slightly below $0.80 as merchants anticipated a scheduled token airdrop occasion by the Flare Community to all XRP holders. Briefly, anybody holding XRP would robotically obtain a portion of the brand new Spark token, spurring new patrons to build up XRP.

Including gasoline to the frenzy, main U.S.-based cryptocurrency alternate Coinbase introduced its plans to assist the upcoming airdrop, per CoinDesk’s earlier reporting.

“XRP skilled huge upward value actions in November as a result of retail traders’ curiosity on the Spark airdrop scheduled for Dec. 12, 2020,” mentioned Florent Moulin, a cryptocurrency researcher at knowledge supplier Messari. “The market additionally noticed skilled traders accumulating XRP in anticipation of a retail-led bull market.”

The acute XRP bull development rapidly ended when the U.S. Securities and Change Fee (SEC) filed a lawsuit towards Ripple for allegedly violating federal securities legal guidelines in promoting the cryptocurrency to retail customers, which raised $1.three billion over a seven-year interval.

Merchants reacted negatively to the information as XRP immediately began giving again massive chunks of its beneficial properties from the earlier month. Institutional traders adopted swimsuit with cryptocurrency cash supervisor Bitwise liquidating its index’s complete XRP place and outstanding brokerages like OSL notifying shoppers that they’ve halted all XRP buying and selling.

Each occasions – the airdrop and the lawsuit – have pushed XRP value volatility to its highest stage since July 2018, per Coin Metrics knowledge, with a greater than 130% improve in volatility since early November.

Sharp downward value motion for XRP might be as a result of a mix of things, Moulin advised CoinDesk. However essentially the most important is probably going the SEC’s lawsuit towards Ripple.

Additionally noteworthy is elevated promoting by Ripple co-founder Jed McCaleb, who offered over $120 million value of XRP in December, Moulin mentioned, an quantity over thrice bigger than earlier months.

A few of December’s downward value motion was additionally attributable to XRP holders promoting after receiving tokens from the airdrop occasion, Moulin mentioned.

Whatever the purpose, since information of the SEC’s lawsuit broke, XRP has dropped over 60% and fallen beneath its pre-airdrop frenzy ranges in early November, hitting $0.21 on Wednesday.

And with the value nonetheless dropping and over $350 million in futures contracts liquidated the 2 days earlier than Christmas Eve, XRP traders are left to face a not-so-happy vacation season.