Waiting for infrastructure guarantees t

Waiting for infrastructure guarantees to materialize into actual time motion can attempt traders’ endurance, however a pair of development supplies producers may very well be signaling upside forward for change traded funds such because the FlexShares STOXX International Broad Infrastructure Index Fund (NYSEArca: NFRA).

Whereas neither Vulcan Supplies nor Martin Marietta Supplies are NFRA elements, the 2 firms not too long ago delivered stellar first quarter outcomes. That may very well be an indication of heightened demand for infrastructure supplies.

“The businesses struck upbeat tones of their commentary and calls with analysts. Congress might move a serious infrastructure invoice this summer season, and the businesses are highlighting the potential will increase in spending, together with different income boosters coming from a recovering economic system,” experiences Daren Fonda for Barron’s.

The place Does ‘NFRA’ Match In?

NFRA tries to replicate the efficiency of the STOXX International Broad Infrastructure Index, which identifies equities that derive nearly all of income from the infrastructure enterprise, offering publicity to each conventional and non-traditional infrastructure sectors.

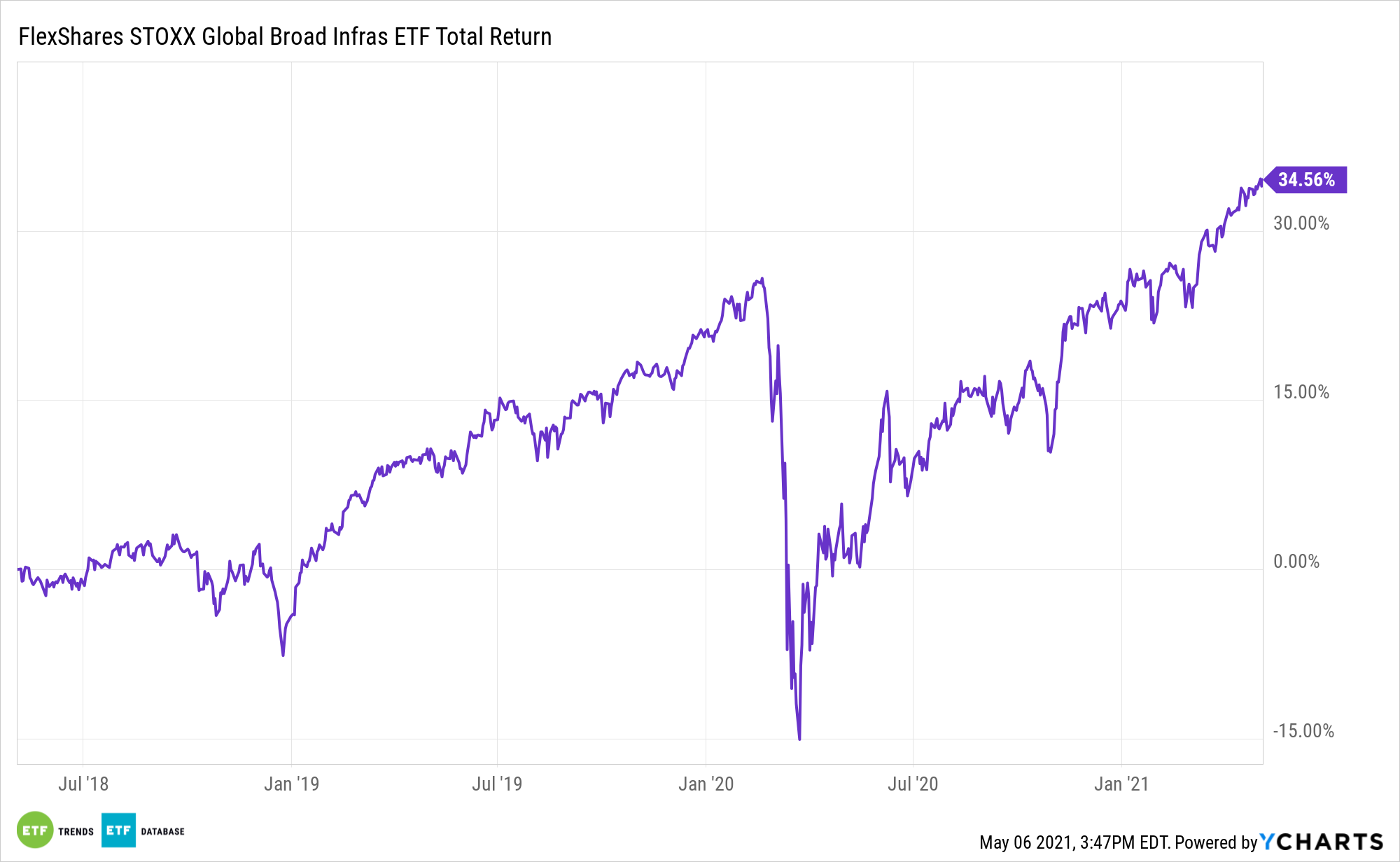

The fund is up 29.12% over the 12 months, helped by expectations that main infrastructure spending is coming to bolster the U.S. economic system.

President Biden is making good on that promise, pitching $2 trillion in infrastructure spending. Whereas some associated funding performs are dithering, NFRA is regular gaining 1.51% over the previous month. That may very well be a sign Congressional cuts will not have an effect on conventional infrastructure – the bread and butter for a lot of NFRA elements.

“The federal authorities’s funds for its 2021 fiscal 12 months consists of $45 billion for floor transportation tasks like freeway development. However annual spending might improve below proposals now in Congress. A measure within the Home would elevate annual freeway spending to $64 billion whereas Biden’s American Jobs Plan might elevate it to an annual common of $68 billion,” in keeping with Barron’s.

Whereas NFRA is not heavy on aggregates names like Martin Marietta and Vulcan Supplies, its broader industrial publicity, together with transportation names, is a plus towards the backdrop of not solely extra infrastructure spending, however the brand new housing growth as properly.

Ought to these themes show their momentum, NFRA might have a number of tailwinds heading into the again half of 2021.

For extra on multi-asset methods, go to our Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.