By Matt Wagner, CFA, Senior Analysis Analyst, WisdomTree Th

By Matt Wagner, CFA, Senior Analysis Analyst, WisdomTree

This has been a whirlwind yr in numerous methods.

The often staid matter of dividend bulletins has even had its fireworks, with vital dividend cuts constructed from a various set of family names like Wells Fargo, Boeing and Disney.

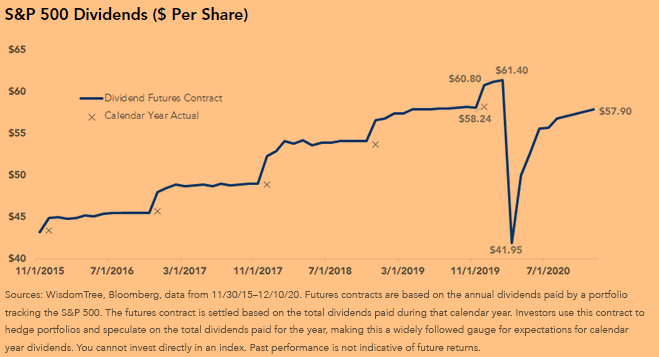

S&P 500 dividends per share in 2019 set a file of $58.24. With the backdrop of a gentle financial system, expectations coming into this yr have been for dividends to enhance about 4% from that file, to $60.80.

By the top of February, expectations had inched as much as $61.40 earlier than nosediving because the financial system plummeted right into a coronavirus-induced contraction. By way of March, expectations shifted to a 28% contraction in 2020 dividends relative to 2019—an consequence that will have set a file for damaging progress in S&P 500 dividends in a calendar yr.

Nearing the top of this yr, with nearly all dividend funds having been introduced, S&P 500 dividends are anticipated to be off by simply 1% relative to the 2019 excessive watermark—a welcome constructive consequence for income-oriented traders.

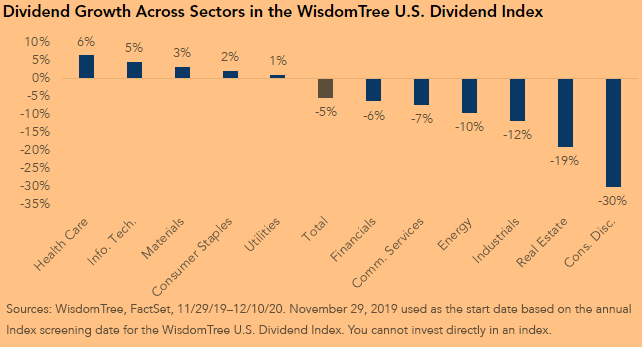

However this 1% decline obscures the dire outcomes that transpired throughout segments of all U.S. dividend payers—not simply the S&P 500 blue chip names.

Segmenting dividend progress throughout sectors throughout the WisdomTree U.S. Dividend Index (which incorporates large-, mid- and small-cap dividend payers) helps illustrate the best dividend ache and the place there was relative security.

The “stay-at-home” sectors—Well being Care, Information. Tech., Client Staples and Utilities—fared higher than the sectors now dubbed “reopening” performs—Client Discretionary, Actual Property, Industrials and Power.

One sector that fared comparatively properly, maybe opposite to some individuals’s expectations, was Financials. As a sector, dividends have been solely down 6%—about in step with the broader Index.

Of the most important U.S. banks—an inventory that features a number of the largest dividend payers globally—solely Wells Fargo and Capital One Monetary have been compelled to chop dividends. This can be a far cry from what transpired within the final recession when that sector was the epicenter of extreme dividend cuts.

This time round, regulators compelled banks to droop share buybacks, however dividends have been by and huge left untouched—in contrast to European friends that have been compelled to droop payouts.

Many would argue that U.S. banks have taken their drugs within the years because the monetary disaster and carry a lot larger capital at present than they did then. As a payoff to this restructuring of steadiness sheets, banks have been in a position to maintain payouts regular.

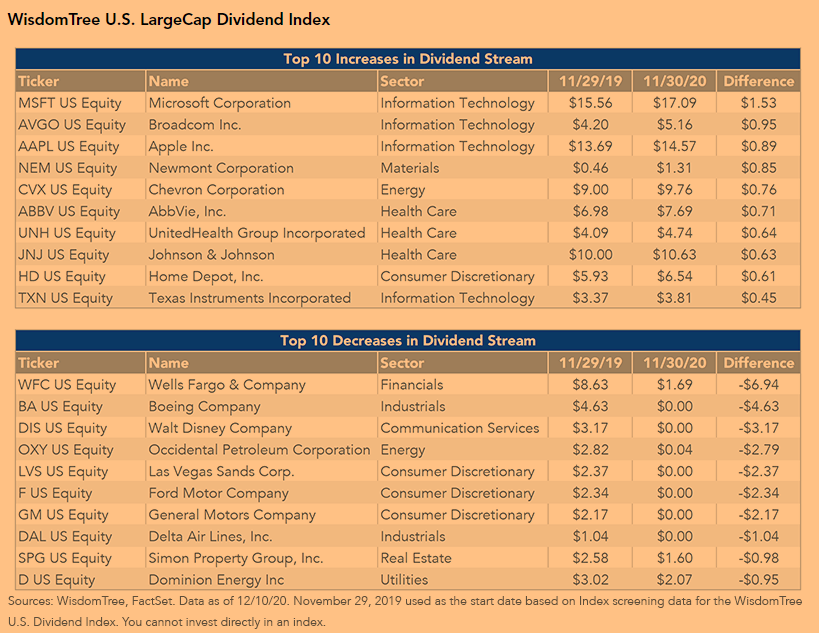

The beneath tables present some context to the person corporations with the best improve of their Dividend Stream® this yr, in addition to the best lower.

When you will not be stunned by a lot of the names on the highest 10 checklist, Chevron’s look could also be a little bit of a shock given the plunge in oil costs this yr.

Chevron is an instance of an organization that elevated its dividend previous to the onset of the recession in January. If oil costs don’t materially get well in 2021, a possible minimize from Chevron’s dividend—a transfer that will mirror strikes from its international oil rivals—may weigh on dividend progress subsequent yr.

Trying ahead, S&P 500 dividend futures point out an extra drop of two% in 2021 dividends relative to this yr, which is an enchancment from a 6% drop indicated simply 2 weeks in the past. This anticipated drop is probably going attributable to the roughly 60 corporations that suspended or minimize their dividends in 2020 that can have decreased first quarter dividend payouts in 2021 in comparison with these paid out in January and February this yr.

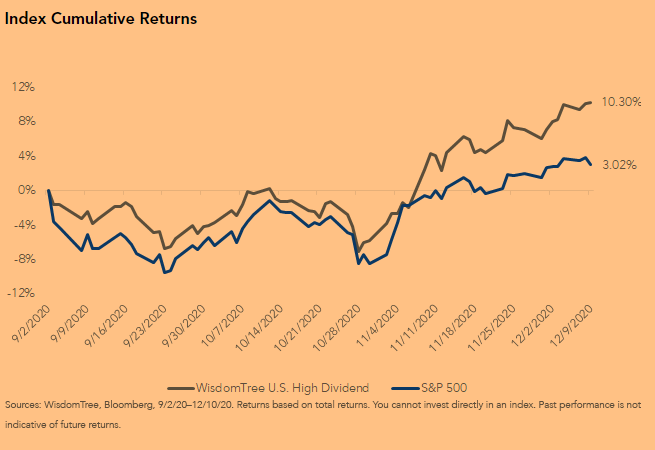

Because the market costs in larger confidence within the reopening of the financial system subsequent yr, we’ve seen the share costs of the high-dividend payers which have lagged essentially the most this yr start to outperform.

In latest months, the WisdomTree U.S. Excessive Dividend Index—an Index closely populated by corporations within the “reopening” sectors—has outperformed the S&P 500 by greater than 700 foundation factors. Each for traders with earnings wants and people seeking to faucet into the reopening theme, the high-dividend payers which have lagged for a lot of 2020 and the earlier years’ progress rally could also be a spot to contemplate.

Initially revealed by WisdomTree, 12/11/20

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding aims, dangers, costs, bills, and different info; learn and contemplate fastidiously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. Overseas investing entails foreign money, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations might expertise larger value volatility. Investments in rising markets, foreign money, fastened earnings and different investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency isn’t indicative of future outcomes. This materials comprises the opinions of the writer, that are topic to alter, and will to not be thought of or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work beneath all market situations. This materials represents an evaluation of the market surroundings at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The consumer of this info assumes the whole threat of any use manufactured from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Traders looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially symbolize the views of WisdomTree or any of its associates.

The MSCI info might solely be used in your inner use, will not be reproduced or re-disseminated in any kind and will not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a advice to make (or chorus from making) any type of funding resolution and will not be relied on as such. Historic knowledge and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the consumer of this info assumes the whole threat of any use manufactured from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can not make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.