Healthcare sector-related alternate traded funds present entry to a market phase that's consistentl

Healthcare sector-related alternate traded funds present entry to a market phase that’s consistently innovating to enhance our high quality of life.

“Well being care presents the chance to put money into firms which can be consistently innovating to enhance high quality of life and lift productiveness. It’s arduous to place a price on vaccines, most cancers medication, joint replacements, and pacemakers. On the identical time, well being care names don’t dominate the market like huge tech,” Nick Kalivas, Senior Fairness Product Strategist, Invesco, mentioned in a analysis word.

“Regardless of its underrepresentation within the S&P 500 relative to expertise, I consider well being care continues to supply buyers beneficial long-term alternative potential,” Kalivas added.

Kalivas highlighted 5 the explanation why healthcare publicity offers long-term progress alternatives. For starters, the sector gives the potential for robust earnings progress. Within the 5 years ended March 31, 2020, revenue progress within the S&P 1500 well being care sector rose at a compounded annual price of 8.1%, with earnings progress at almost 3.5x quicker than that of your complete S&P 1500, or the third-fastest sector progress price behind data expertise and financials.

5 Causes Why

Well being care is a play on demographics and an growing older inhabitants. An older inhabitants will doubtless spend extra on well being as their our bodies age, and medical care is required to keep up their well-being.

The coronavirus pandemic highlights the significance of well being care as a part of the nation’s nationwide safety. Authorities coverage may take a extra proactive method to well being care or change into extra pleasant towards well being care firms which have the assets and know tips on how to innovate and fight the well being care points which threaten society.

The rising medtech business gives the power to mix expertise with well being care and drive future progress alternatives. Medtech improves the supply and utilization of well being care services by synthetic intelligence, digitization, robotics, monitoring gadgets, and 3D printing, offering a brand new frontier for the well being care sector and buyers.

Lastly, Kalivas argued that well being care earnings may maintain up in financial downturns, with much less volatility. The S&P 500 well being care sector has demonstrated earnings progress during times the place earnings for the S&P 500 have contracted.

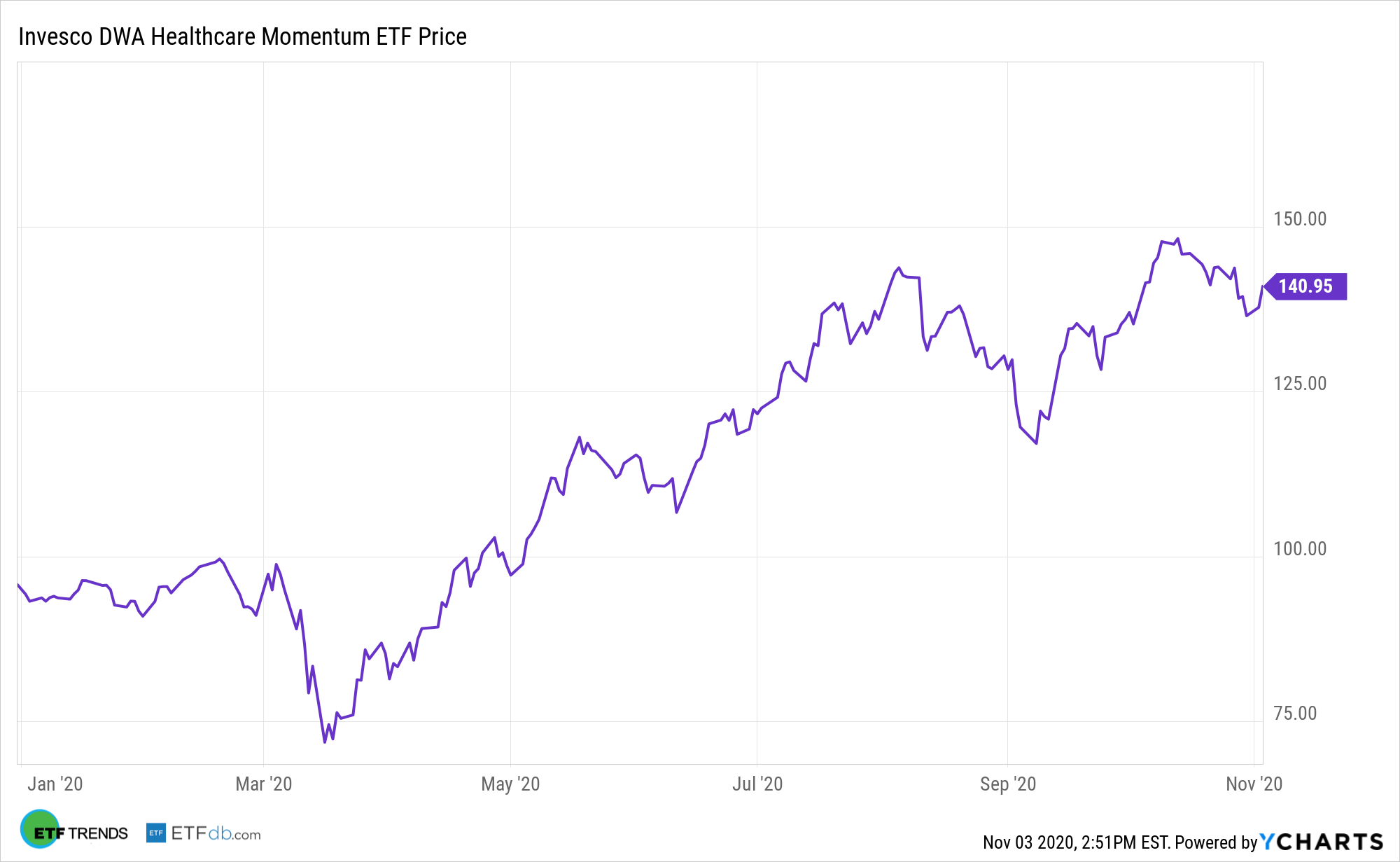

As a method to harvest this progress alternative, buyers seeking to seize tendencies within the well being care sector can flip to the Invesco DWA Healthcare Momentum ETF (PTH). PTH focuses on relative energy in its inventory choice course of, specializing in firms demonstrating the strongest efficiency within the well being care business.

PTH will make investments at the least 90% of its complete belongings within the securities that comprise the Dorsey Wright Healthcare Technical Leaders Index, which consists of at the least 30 securities of firms within the healthcare sector which have highly effective relative energy or “momentum” traits. Relative energy is the measurement of a safety’s efficiency in a given universe over time as in comparison with the efficiency of all different securities in that universe

“A momentum-driven technique has the potential to seize shares that are demonstrating rising energy and get rid of shares which can be displaying relative weak spot,” Kalivas added.

For extra information and knowledge, go to the Modern ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.