At the time of this writing on Monday, the markets are off by greater than -1.5%, which might qualify the buying and selling day as an “outlier day.” On occasion, we see outlier days happen in the midst of a bull market. Why? Effectively, markets fluctuate in a standard method on low/lowering volatility. In truth, for many of this 12 months, volatility has been declining. That is just like the compressing of a spring. When volatility will get low and compressed, it can ultimately “pop,” usually down, to alleviate a number of the pent-up strain.

The information media will attribute this present day to no matter they will. The newest headline I’ve learn relates the market’s single-day drop to rising COVID circumstances. Did this trigger the market to fall? It doesn’t matter. Volatility bought compressed and went to alleviate strain. We are going to proceed to watch the markets for any adjustments in setting, however more often than not, a day like Monday ends in the markets transferring again in the direction of regular market habits.

[wce_code id=192]

Market Breadth

In a market replace revealed final week, we wrote concerning the Advance/Decline Line and market breadth. Here’s a brief abstract of a few of these factors:

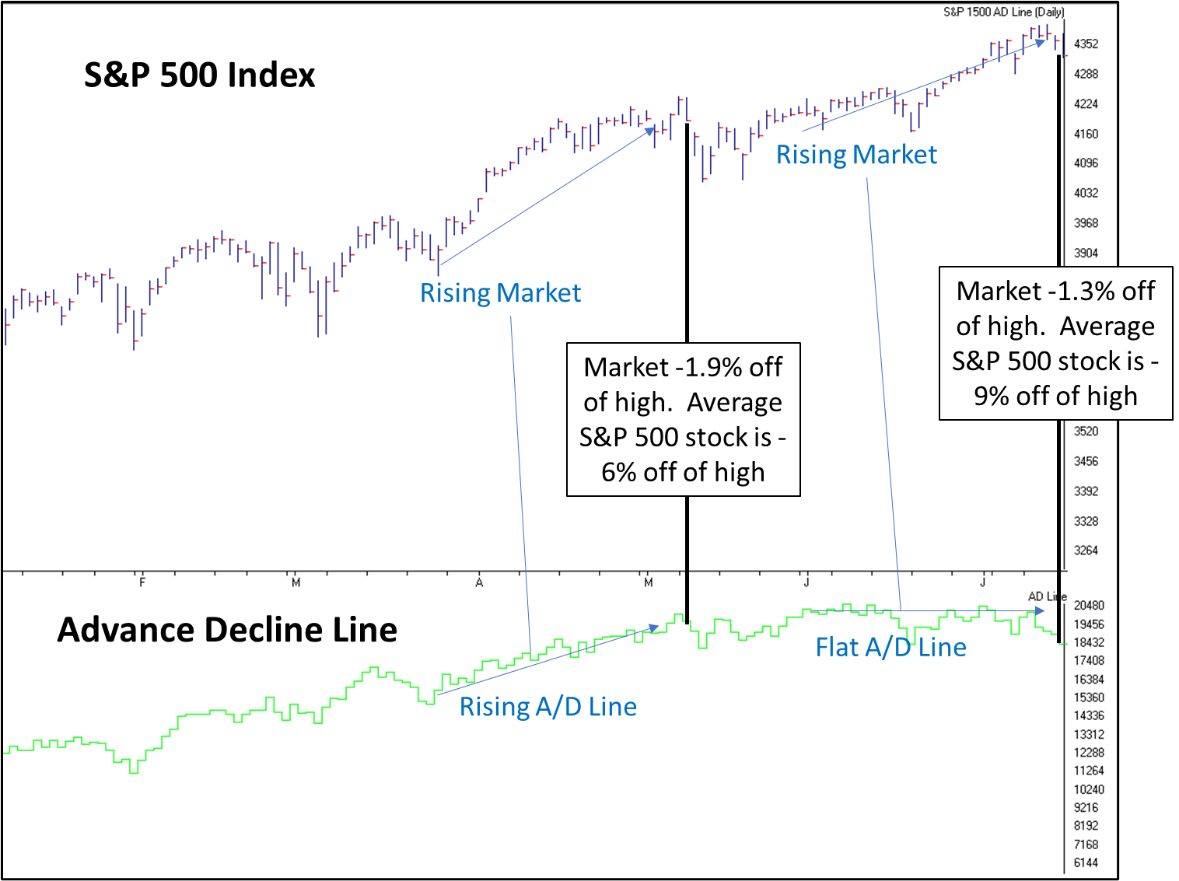

- The Advance/Decline line is flattening out. Which means there’s not as a lot broad participation amongst securities through the market’s latest rise

- Expertise is main the cost. Since Expertise-related shares make up the hefty majority of the market capitalization-weighted S&P 500, it has been carrying the markets larger whereas different market segments flatten out.

- There’s not at present a divergence between the A/D line and the markets. Usually, the formation of a serious bear market will happen when the markets are rising, however breadth is falling for an prolonged interval. To date, this has not occurred.

I wish to construct on these feedback about market breadth and the markets latest actions utilizing a couple of statistics.

By way of Friday’s shut, the S&P 500 was inside 1.3% of an all-time excessive. After we escape the person S&P 500 securities (of which there are 505), and have a look at how far every inventory is off of its trailing 12 month excessive, we discover that the common S&P 500 inventory is about -9% off of its excessive for the final 12 months.

How does this stack as much as latest historical past? Effectively, we talked about that market breadth has been flattening out, that means not all shares have been rising with the market index. If we have a look at the same time, which I arbitrarily selected to be mid-Could, we will see that the S&P 500 was off of it’s excessive by -1.9%, and the A/D Line was additionally close to its peak. The typical inventory inside the index at the moment was solely off of its trailing 12 month excessive by -6%. In different phrases, the S&P 500 was off its excessive by extra, however the common safety was doing higher relative to the market than it’s at this time (About 3% on common higher).

Supply: AIQ Buying and selling Knowledgeable Professional

A have a look at Sector Management

Within the desk under, we ranked sector indexes on a volatility, or risk-adjusted foundation. The highest Four sectors on a risk-adjusted foundation are actual property, communications, know-how, and Healthcare. Now, protecting in thoughts that the common inventory is -9% off of its 12-month excessive, we might anticipate that high ranked sectors would have their common inventory be higher than common. Effectively, that is largely true, with exception of 1 case:

| Sector Rank | Sector | Avg Inventory % off of Excessive |

| 1 | Actual Property (29 Shares) | -3.21% |

| 2 | Communications (26 Shares) | -15.96% |

| 3 | Data Tech (75 Shares) | -8.87% |

| 4 | Well being Care (62 Shares) | -6.82% |

Supply: Canterbury Funding Administration

Now, why would Communications be the second highest ranked sector, however the common communications inventory be off its 12-month excessive by -16%? Effectively, just like the S&P 500, sector ETFs are additionally market capitalization weighted—bigger shares have extra of an affect. Within the case of communications, Fb; Google; Disney; and T-Cellular account for 50% of the sector ETF’s actions. That’s 5 securities (Google has two completely different shares) accounting for 60% of the motion in a sector that has 20 different securities in it. These 5 securities are doing nicely.

What concerning the S&P 500? How may it’s inside 1.3% of its excessive whereas the common S&P inventory is off by -9%? Effectively, it’s due to market cap and market breadth. The index has just lately been led by the generals, whereas a number of the troops faulter.

If we have a look at the S&P 500 inventory weightings, the biggest 15 shares make up a 3rd of the index’s motion! Of these 15 largest shares, the common safety is inside 3% of a brand new excessive (as of Friday’s shut). The opposite 490 securities are off by a mean of -9.32%.

Backside Line

There’s a plethora of knowledge and numbers listed about, however the backside line right here is that the market is being led by a number of the largest elements, whereas the smaller elements are flat or struggling. This can be a very short-term problem, so we must wait and see what it unfolds into. What we don’t wish to see is a falling A/D line with a rising marketplace for an prolonged interval.

With the latest market actions, in addition to the outlier day skilled on Monday, the one main concern is whether or not or not we proceed to see the market be held up by the bigger, largely tech-related securities. As for the outlier day, a majority of these days can happen after we see volatility get low and compressed. Usually, the markets shift again to a standard market setting. It’s like getting hit within the face with a cool glass of water. You get up, are startled and don’t know the place you’re at. It takes a couple of moments to assemble your bearings. There’s a risk that we proceed to see some rotations in market energy because the markets attempt to acquire their footing after at this time.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.