The timing could not be extra auspicious for the actual pr

The timing could not be extra auspicious for the actual property sector. With the market recovering from a catastrophic collapse throughout the monetary disaster over a decade in the past, Covid-19 is placing a heavier emphasis on houses as a live-work area with social distancing measures in place.

This, in flip, is opening up alternatives for actual estate-focused ETFs just like the Hoya Capital Housing ETF (HOMZ). HOMZ seeks to offer funding outcomes that correspond typically to the entire return efficiency of the Hoya Capital Housing 100 Index, a rules-based Index designed to trace the 100 firms that collectively characterize the efficiency of the US Housing Business.

The Index is designed to trace the businesses with the potential to profit from rising rents, appreciating dwelling values, and a persistent housing scarcity. HOMZ is a passively-managed, diversified ETF that provides environment friendly and cost-effective publicity to residential actual property, one of many largest asset lessons on the earth.

HOMZ invests in 100 home firms concerned within the housing trade, together with residential REITs, homebuilders, dwelling enchancment firms, and actual property providers and know-how corporations. A focus in residential ETFs offers buyers publicity to a subsector that is experiencing progress amid the pandemic versus industrial actual property the place companies are shifting away from the necessity for workplace area.

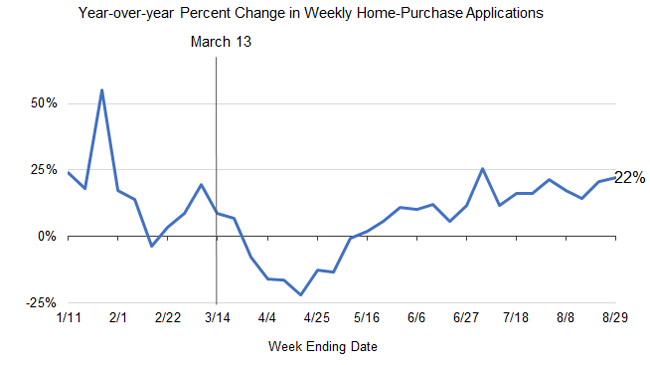

The housing sector can also be seeing a marked shift to extra dwelling possession from millennials. Buy purposes rose throughout the months of July and August with millennials representing half of the candidates.

“At 50%, Millennials represented the biggest share of homebuyers in 2020, adopted by Technology Xers (31%) and child boomers (17%), in keeping with CoreLogic mortgage utility information for January via August 29, 2020,” actual property analytics agency CoreLogic famous on their web site.

Further tailwinds can come from a continuance of low mortgage charges mixed with extra work-from-home exercise.

“The U.S. housing trade has supplied relative shelter amid the turbulence of 2020 and has constructed momentum in latest months as resilient demographic-driven housing demand together with decrease mortgage charges have stimulated renewed exercise throughout the housing trade,” an e mail famous from HOMZ, The Housing ETF. “The sharp rebound in housing market exercise comes as People are spending extra time than ever of their houses, and it has develop into extra clear that housing is maybe the final word important service.”

One other fund ETF buyers can have a look at for actual property publicity is the FlexShares World High quality Actual Property Index Fund (GQRE). The fund seeks funding outcomes that correspond typically to the worth and yield efficiency of the Northern Belief World High quality Actual Property IndexSM, which is designed to mirror the efficiency of a collection of firms that, in mixture, possess better publicity to high quality, worth, and momentum components relative to the Northern Belief World Actual Property Index.

For extra market tendencies, go to the ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.