Small-cap motion in indexes just like the Russell 2000 can portend to a wider transfer within the b

Small-cap motion in indexes just like the Russell 2000 can portend to a wider transfer within the broad market. Proper now, buyers are dialing up the chance once more, which might imply extra positive factors from the main indexes. Traders who haven’t got small-cap publicity simply but can look to the iShares Russell 2000 ETF (IWM) for publicity.

IWM seeks to trace the funding outcomes of the Russell 2000® Index, which measures the efficiency of the small-capitalization sector of the U.S. fairness market. The fund typically invests no less than 90% of its property in securities of the underlying index and in depositary receipts representing securities of the underlying index.

It could make investments the rest of its property in sure futures, choices and swap contracts, money and money equivalents, in addition to in securities not included within the underlying index, however which the advisor believes will assist the fund monitor the underlying index. With its comparatively low 0.19% expense ratio, IWM offers buyers:

- Publicity to small public U.S. firms

- Entry to 2000 small-cap home shares in a single fund

- Use to diversify a U.S. inventory allocation and search long-term development in your portfolio

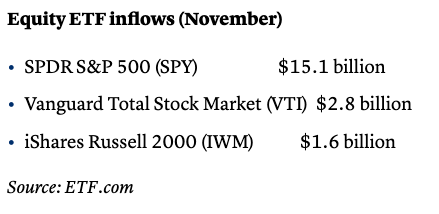

In accordance with knowledge from ETF.com, IWM has been seeing eager curiosity from buyers as of late as a result of vaccine rally–proof that enormous caps cannot have all of the enjoyable when constructive information hits the market. As a CNBC article famous, “Inflows into plain-vanilla fairness ETFs just like the S&P 500 (SPY), Vanguard Complete Inventory Market (VTI), and the Russell 2000 (IWM) have been significantly robust this month.”

Except for a vaccine rally, what’s transferring the markets of late? One variable is the expectation of upper earnings, particularly in expertise equities.

“Animating the robust inflows into shares: A perception that earnings for market leaders like expertise will keep robust in 2021 however that beaten-up sectors like vitality, banks, and industrials may also see a 2021 rebound that brings earnings again to 2019 ranges — and past,” the article added. “Earnings estimates for the S&P 500 are anticipated to be down 16% this yr however are anticipated to rebound in 2021 to ranges barely above the 2019 historic highs.”

“We’ve greater estimates for subsequent yr,” Mike Wilson from Morgan Stanley advised CNBC’s “Closing Bell.”

“We’re round $175 for the S&P 500, now we have a $183 bull case, so I feel we’re in all probability leaning towards that bull case with these vaccines getting on the market sooner than perhaps we have been anticipating, so $180 in earnings energy subsequent yr is an enormous quantity,” Wilson mentioned.

For extra information and data, go to the Modern ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.