With rain laborious to come back by within the western U.S. and a number of states within the area experiencing extreme drought situations, water infrastructure, assets, and rights are within the highlight.

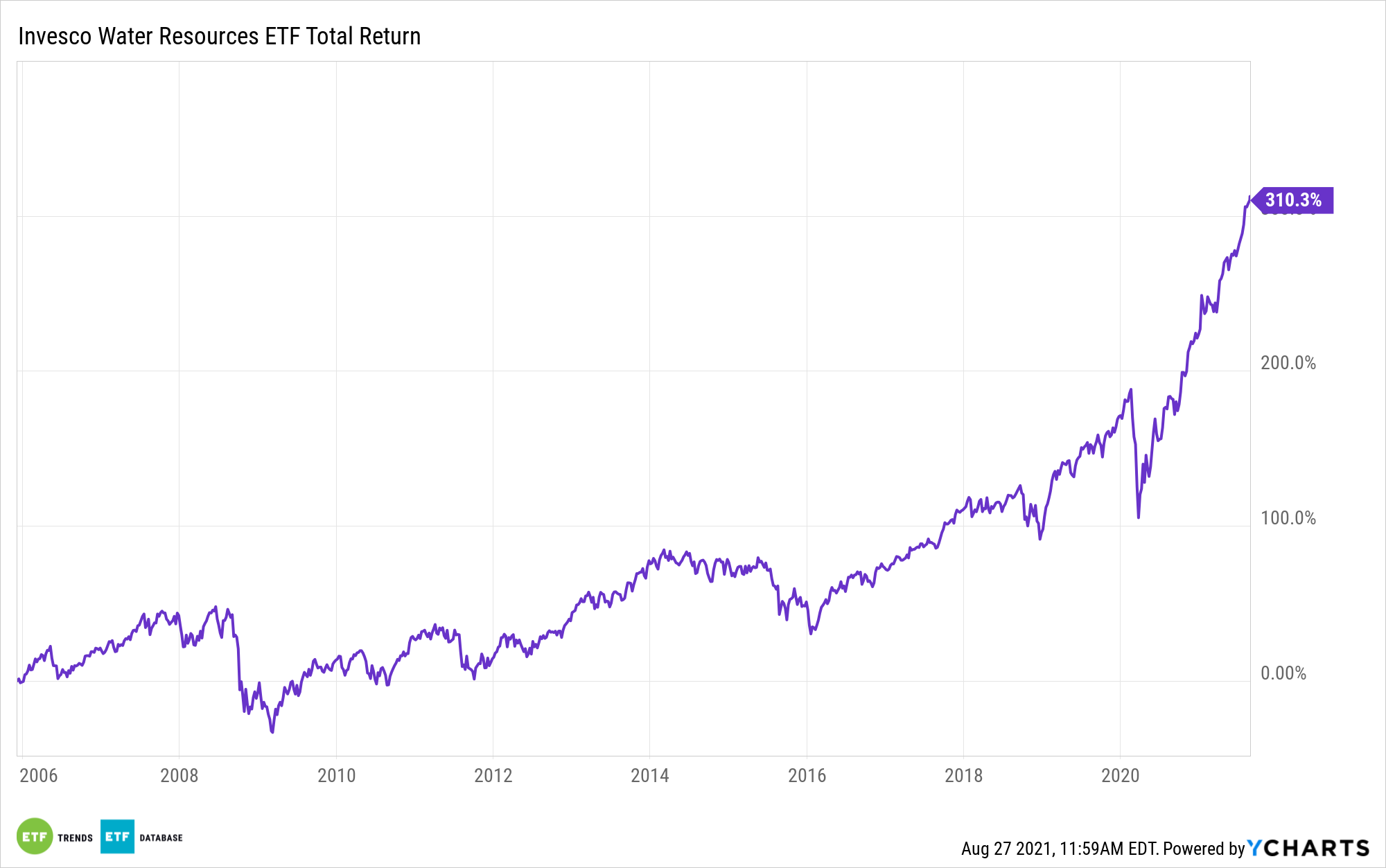

Within the funding area, the impression of these points and the drought is palpable. Simply take a look at the Invesco Water Assets ETF (PHO), which is increased by virtually 26% year-to-date and is at present residing close to report highs. The $1.97 billion PHO follows the NASDAQ OMX US Water Index.

That index “seeks to trace the efficiency of US exchange-listed corporations that create merchandise designed to preserve and purify water for properties, companies and industries,” in accordance with Invesco.

The sphere of water funds, together with ETFs and mutual funds, is bigger than many traders understand, and the house is rising because of a number of latest additions, however PHO is standing the take a look at of time. Dwelling to to 38 shares, the Invesco ETF carries a five-star Morningstar score and turns 16 years outdated in December.

“There are roughly 65 water funds globally which have about $35 billion in belongings below administration. It’s a distinct segment that’s been round for some time, however it’s one which continues to develop as considerations about climate-change-induced water shortages, and curiosity in investing in methods to adapt to or avert them, develop,” writes Morningstar analyst Bobby Blue. “Cash managers have launched six new water funds over the previous 12 months, and the group has seen inflows of $3.9 billion throughout that interval.”

Like many water ETFs, PHO encompasses a regular weight loss plan of business and utilities shares, with another shares combined in. As such, PHO is extremely correlated to the S&P 500 Industrial and Utilities indexes. Among the funds largest holdings, together with industrial conglomerate Danaher (NYSE:DHR) and Roper Applied sciences (NYSE:ROP), are ceaselessly present in rival funds.

Nevertheless, as Morningstar’s Blue notes, these corporations do not derive a major share of gross sales from water-related companies. Then again, discovering purity with water investments is troublesome. Water rights aren’t investable to most people, and there are devoted water equities for traders to think about, leaving an possibility like PHO as one of many extra fascinating concepts on this house.

“There are few pure-play water corporations, with conglomerates that oversee broad enterprise models controlling a lot of the revolutionary know-how within the house, and closely regulated utilities doing the shopping for, promoting, and treating of water,” stated Blue.

As a result of dearth of devoted water equities, PHO is not a large-cap-heavy fund. Truly, the ETF might be a good suggestion for traders in search of some mid-cap publicity as shares in that group account for over 46% of the fund’s roster. Small-caps symbolize one other 31%.

For extra information, data, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com