By Jim Wiederhold, Affiliate Director, Commodities and Actual Belongings, S&P Dow Jones Indices

By Jim Wiederhold, Affiliate Director, Commodities and Actual Belongings, S&P Dow Jones Indices

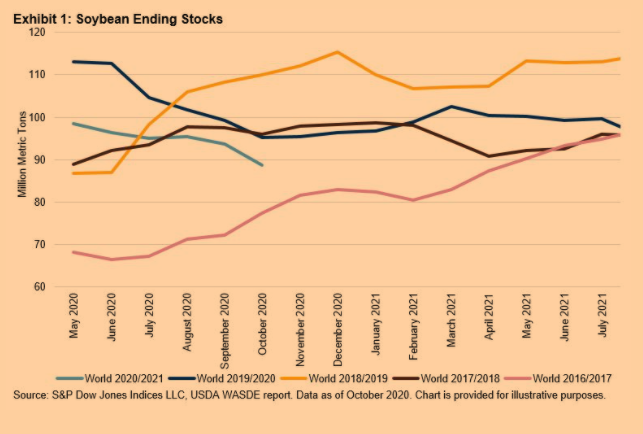

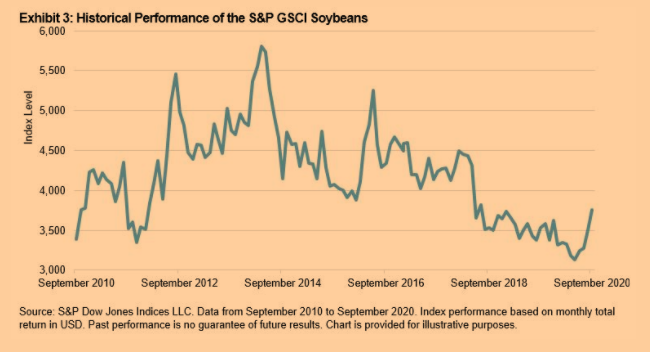

Only some months in the past, it appeared that world soybean provides had been greater than ample, and within the case of the U.S., a semi-permanent soybean mountain had been constructed within the wake of broken demand from its prime buyer, China. Quick ahead to late October 2020, and the S&P GSCI Soybeans is up 29% because the low in March of this yr, making a brand new excessive final week pushed by abrupt provide cuts and the speedy return of export demand. Earlier this month, the USDA’s month-to-month World Agricultural Provide and Demand Estimates (WASDE) report forecast a big, and considerably surprising, discount in world soybean shares. Exhibit 1 illustrates world soybean ending shares within the 2020-2021 crop yr dropping in October 2020 to the bottom stage in 4 years.

Brazil and the U.S. make up roughly 85% of complete soybean exports, and there have been provide points in each nations. There was restricted availability of exportable provides in Brazil as a consequence of COVID-19, and now there’s an elevated risk of South American provides tightening in 2021, significantly if the present La Niña climate sample results in drier circumstances in Brazil and Argentina. Equally, within the U.S., dry circumstances have negatively affected yields.

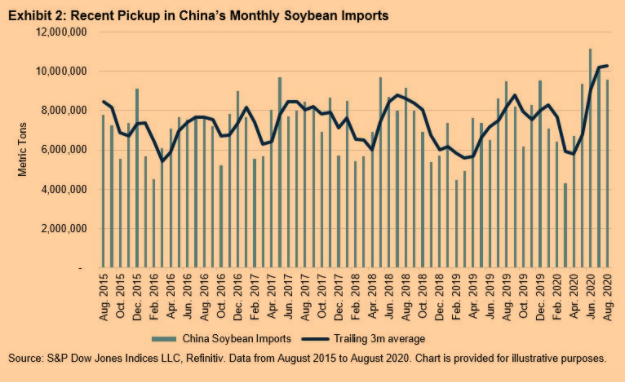

On the demand aspect of the ledger, China imports roughly 60% of complete world soybean exports. The restoration of China’s pork business from the African swine fever has spurred imports in 2020. Soybean meal is used as a supply of feedstock in animal manufacturing. Chinese language month-to-month imports of soybeans reached a brand new five-year excessive this Northern Hemisphere summer time (see Exhibit 2).

In accordance with the USDA, excellent gross sales to China from the U.S. in mid-September 2020 totaled practically 17.zero million metric tons, practically equal to the file set in 2013. Complete excellent gross sales for all markets in mid-September 2020 had been at a file 32.zero million metric tons, a three-fold enhance in contrast with these in 2019. The 2018-2019 crop yr coincided with the beginning of the China-U.S. commerce conflict, which was the catalyst for U.S. soybean exports to plummet. Two years later, China’s dedication has rebounded considerably.

The S&P GSCI Soybeans is designed to supply buyers with a dependable and publicly accessible benchmark for funding efficiency within the soybean market. S&P Dow Jones Indices affords totally different variations of this index to cater to the wants of market individuals. These variations embrace enhanced roll yields, dynamic roll yields, coated calls, forwards, 2x leveraged, and foreign money and regional indices. Single-commodity indices can provide buyers an environment friendly approach to entry the return streams of distinctive property reminiscent of soybeans.

Initially printed by Indexology, 10/26/20

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.