By Scott Welch, CIMA ®, Chief Funding Officer – Mannequin Portfolios, WisdomTree

By Scott Welch, CIMA ®, Chief Funding Officer – Mannequin Portfolios, WisdomTree

All aboard ha ha ha ha ha

Ay, ay, ay, ay, ay, ay, ay

Loopy, however that’s the way it goes

Thousands and thousands of individuals dwelling as foes

Perhaps it’s not too late

To learn to love

And overlook find out how to hate

Psychological wounds not therapeutic

Life’s a bitter disgrace

I’m going off the rails on a loopy practice

I’m going off the rails on a loopy practice

(From “Loopy Prepare” by Ozzy Osbourne, 1987)

OK, so the election is type of behind us—an excellent deal rests on the end result of the twin Senate runoff elections in Georgia in early January. If the Democrats win each of these seats, they are going to management the presidency and each homes of Congress, and coverage and legislative selections going ahead might take a really completely different flip than if there’s a “divided authorities.”

Within the meantime, regardless of the final result, People should cope with the present and anticipated financial and market regimes. Over the previous few months, we’ve revealed a Market Insights paper, a Mid-Yr Outlook and a follow-up asset allocation weblog publish that summarized our views previous to the election.

However the place can we see issues going from right here now that the election is (for probably the most half) behind us? In different phrases, whatever the political panorama, what’s going to the following Administration and Congress be handed from an financial and market perspective?

This can be a weblog publish and never a place paper, so we shall be succinct and deal with what we consider are the 5 main financial and market alerts which will present perspective on the place we go from right here: GDP progress, earnings, rates of interest, inflation and central financial institution coverage. The caveats to those alerts, after all, are the longer term course of the coronavirus pandemic and corresponding federal, state and native responses, and the end result of the continued fiscal stimulus negotiations.

However these are “recognized unknowns.” Let’s deal with what we are able to at the moment observe.

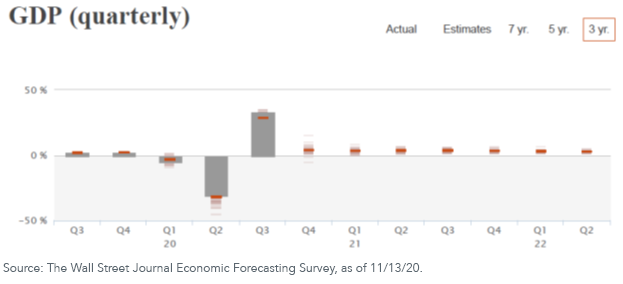

GDP Progress

The consensus forecast from The Wall Road Journal requires a continuation of the present financial restoration, with anticipated year-over-year progress charges of roughly 3%–3.5% by means of 2021 and into 2022:

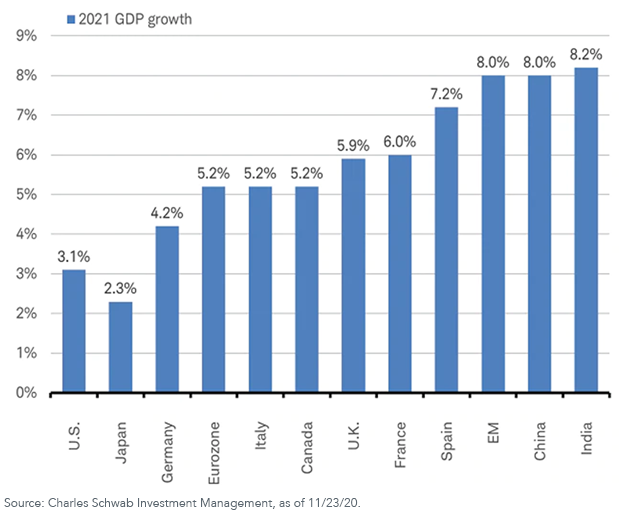

The outlook is much more optimistic for many non-U.S. economies:

Translation: A typically optimistic atmosphere for “threat on” belongings.

Earnings

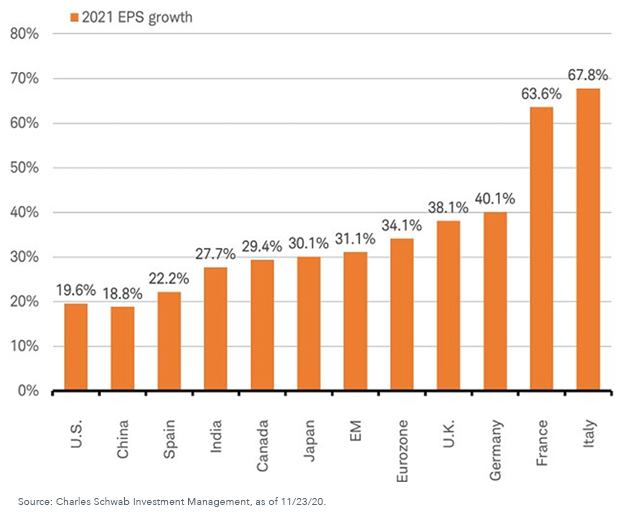

After the horrific (however priced in) second quarter earnings numbers, the consensus is for regular enchancment by means of 2021:

Once more, the outlook for earnings exterior the U.S. is even stronger (based mostly, partly, on the truth that the U.S. got here out of the preliminary pandemic-induced recession sooner due to greater stimulus ranges):

Translation: A typically optimistic atmosphere for “threat on” belongings.

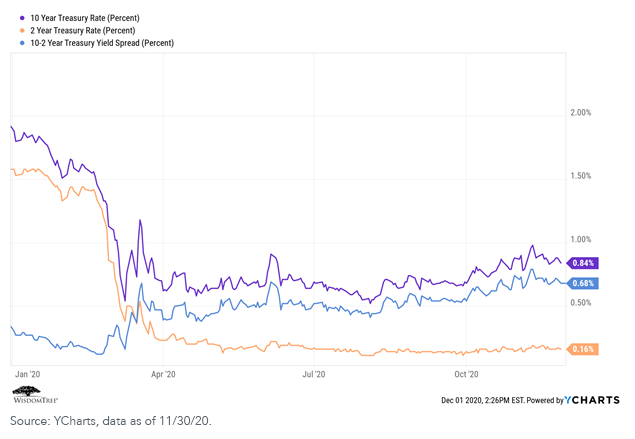

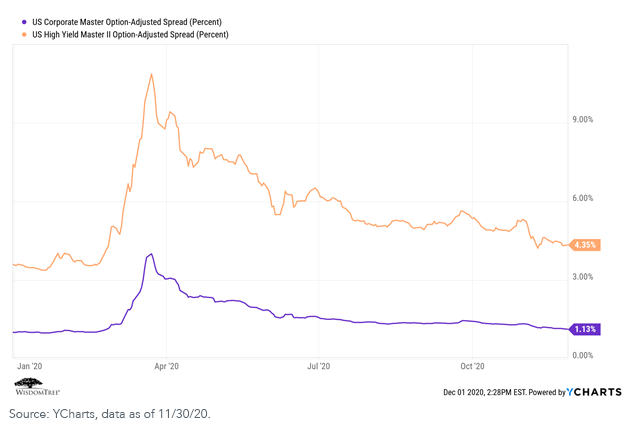

Curiosity Charges and Spreads

We preserve our outlook that (a) charges might grind greater from right here because the financial system improves and inflation picks up marginally, (b) the yield curve will proceed to steepen, (c) we typically stay in a “decrease for longer” price atmosphere and (d) credit score spreads have retraced most of their “blow out” within the early days of the pandemic, however nonetheless have potential to maneuver decrease:

Translation: We preserve our positioning of being under-weight length and over-weight credit score, with a deal with high quality safety choice, particularly in excessive yield.

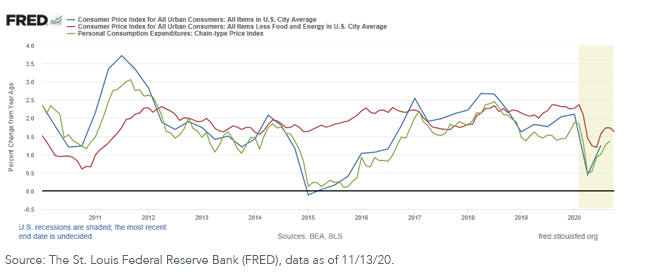

Inflation

There are pockets of upper inflation in particular sectors or industries (meals, vehicles, suburban dwelling costs, and many others.), however the total inflation image stays largely benign (keep in mind that the historic Fed “goal” price for inflation was ~2%):

Translation: A typically optimistic atmosphere for “threat on” belongings.

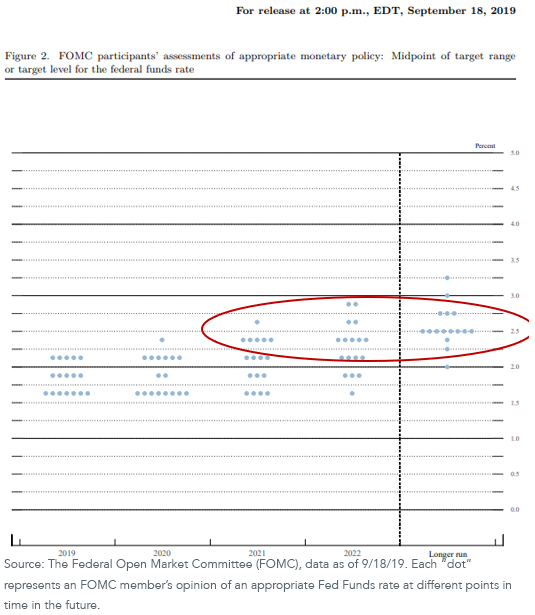

Central Financial institution Coverage

The Fed constantly has signaled that it’ll stay “accommodative” into the foreseeable future, and it’s keen to let inflation “run scorching” if it means permitting the financial system to proceed to recuperate:

Translation: A typically optimistic atmosphere for “threat on” belongings.

Conclusion

When specializing in what we consider are the first market “alerts,” we conclude that 2021 will get pleasure from a typically optimistic financial and market atmosphere. Our caveats to that conclusion are (1) uncertainly relating to the coronavirus and governmental response, (2) the end result of the Georgia Senate races, (3) the end result of fiscal stimulus negotiations, (4) present valuations, which in lots of areas are very excessive by historic requirements and subsequently maybe unsustainable, whatever the market atmosphere, and (5) at the moment unforeseeable “unknown unknowns” (e.g., U.S.-China relations, Iran, and many others.).

So, whereas we’re cautiously optimistic in our outlook for 2021, we proceed to advocate specializing in an extended time horizon and the development of “all-weather” portfolios, diversified at each the asset class and threat issue ranges, in order that your portfolios can deal with no matter might come their manner…even an unexpected “loopy practice.”

Initially revealed by WisdomTree, 12/3/20

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding aims, dangers, expenses, bills, and different info; learn and take into account fastidiously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. Overseas investing includes foreign money, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms might expertise higher value volatility. Investments in rising markets, foreign money, mounted revenue and different investments embody extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency shouldn’t be indicative of future outcomes. This materials comprises the opinions of the writer, that are topic to alter, and will to not be thought-about or interpreted as a suggestion to take part in any explicit buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work below all market situations. This materials represents an evaluation of the market atmosphere at a particular time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety particularly. The person of this info assumes the whole threat of any use product of the knowledge supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Buyers looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info might solely be used on your inside use, will not be reproduced or re-disseminated in any type and will not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding resolution and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes the whole threat of any use product of this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Occasion have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can’t make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.