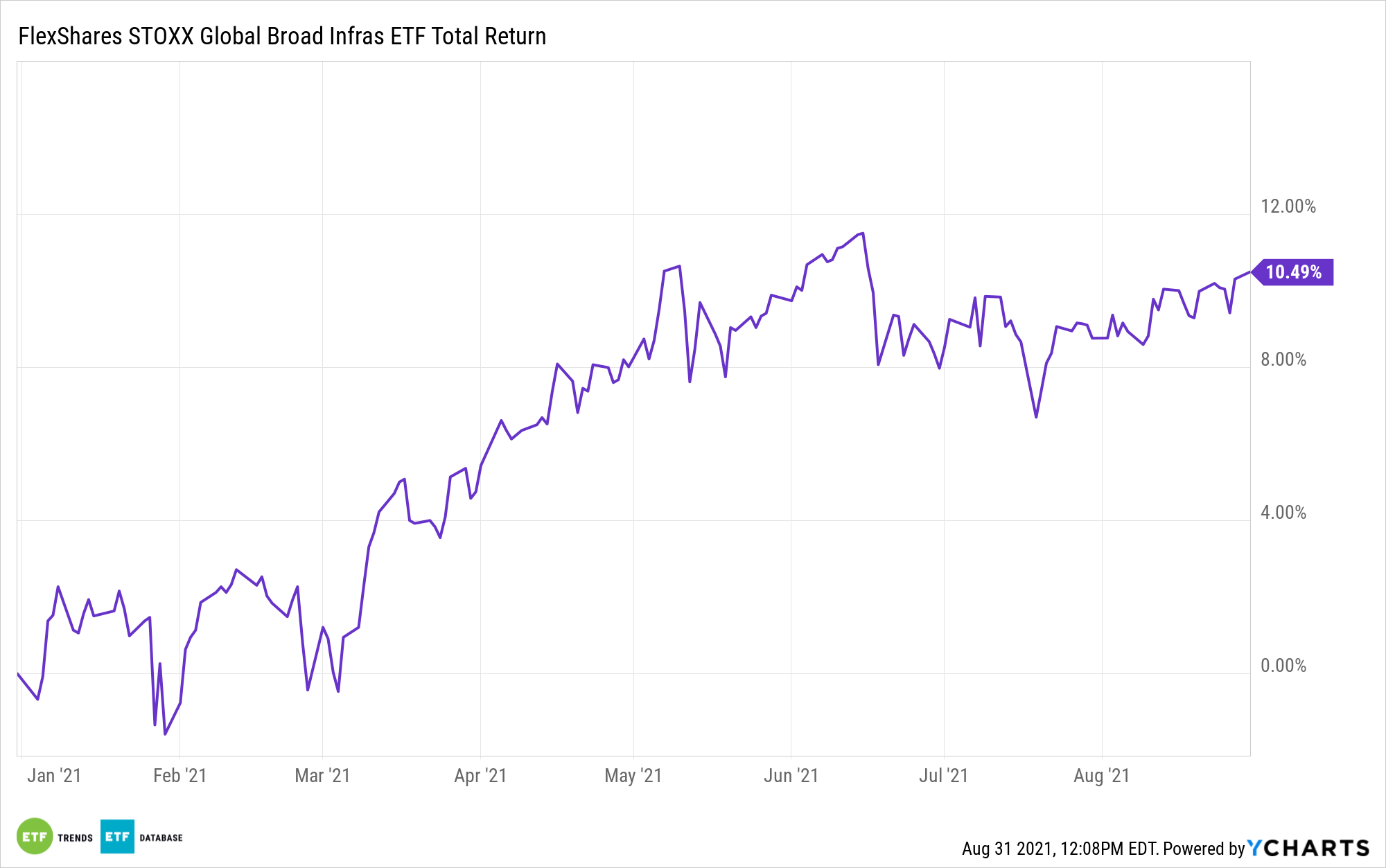

Getting infrastructure publicity was once relegated to institutional traders, however now all traders can entry the sector with funds just like the FlexShares STOXX International Broad Infrastructure Index Fund (NFRA).

Moreover, the arrival of exchange-traded funds (ETFs) has definitely modified the investing panorama. Funds like NFRA are in a position to encase particular equities that concentrate on infrastructure with out traders needing to carry separate positions in varied shares.

As an additional advantage, NFRA additionally incorporates a diversification element by holding equities from all over the world that concentrate on infrastructure. The fund primarily focuses on large-cap equities, so the volatility of smaller-cap shares is minimized.

Per its fund description, NFRA seeks funding outcomes that usually correspond to the worth and yield efficiency (earlier than charges and bills) of the STOXX® International Broad Infrastructure Index. The index displays the efficiency of a number of firms that, in mixture, supply broad publicity to publicly traded developed- and emerging-market infrastructure firms, together with U.S. firms, as outlined by STOXX Ltd. pursuant to its index methodology.

Infrastructure Invoice Might Be a Key Mover

Infrastructure traders will definitely be watching the most recent developments unfold on Capitol Hill. The trillion greenback infrastructure invoice is at present making an attempt to push by the Home of Representatives after efficiently passing by the Senate.

“The $1 trillion infrastructure invoice obtained 19 GOP votes within the Senate, together with one from Minority Chief Mitch McConnell, R-Ky., and will get 15 to 25 Republican votes within the Home. However it’s unclear if any Home Republicans would again the $3.5 trillion plan,” a CNBC article reported.

Whereas no person is aware of what’s going to occur within the Home, firms are already on board with supporting the transfer to raised the nation’s infrastructure.

“Everyone seems to be speaking concerning the bipartisan infrastructure invoice that handed the Senate and is within the arms of the Home of Representatives,” a Motley Idiot article stated. “Whether or not or not that spending plan involves fruition, there are firms already supporting infrastructure enhancements throughout the nation.”

For extra information, info, and technique, go to the Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com