By Robert Ross Bitcoin celebrated its 11th birthday on Janu

By Robert Ross

Bitcoin celebrated its 11th birthday on January 3. And what a celebration it has been, with the world’s first and most well-known cryptocurrency now buying and selling close to $40,000.

Warren Buffett famously referred to Bitcoin as “rat poison squared.” The Oracle of Omaha may by no means personal the King of Cryptos. However even he has to confess that it’s charting a path greater… one that’s as distinctive because the asset itself.

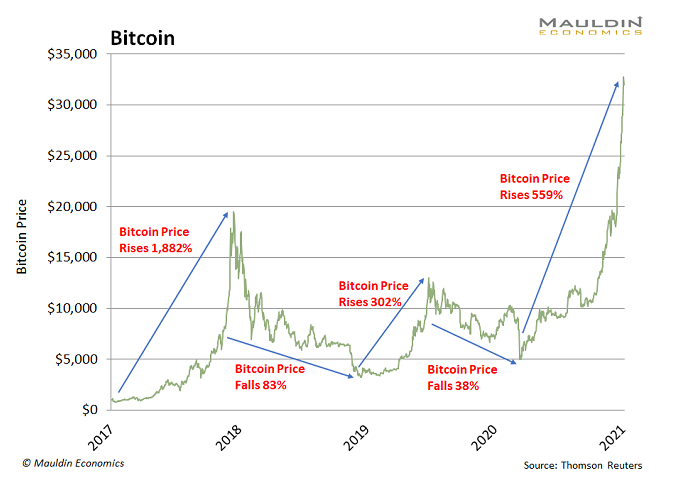

Bitcoin as soon as shot up 1,882% in just a little underneath a yr. It went from $998 in January 2017 to $19,783 in December 2017. One yr later, it dropped round 83% to $4,935.

Now we’re again in a Bitcoin bull market. For the reason that March 2020 lows, Bitcoin’s value has rallied over 500%. And there are many causes to imagine it should go lots greater.

Most individuals can’t abdomen that a lot volatility and danger. And you do not have to. Nor do it’s a must to miss out on the following leg of the Bitcoin bull market.

Even higher, you do not have to spend as a lot as a base-model Tesla (TSLA) on a single stake.

A Completely different Technique to Commerce Cryptocurrencies

You’re aware of monetary exchanges. These are firms that facilitate the shopping for and promoting of shares, bonds, commodities, and now—you guessed it—bitcoin.

A few of these exchanges assist futures buying and selling. At its easiest stage, futures contracts let individuals wager on how a lot the value of one thing will rise or fall.

Now, I am not recommending you commerce Bitcoin futures. However you may make cash off the buying and selling motion. That is as a result of the exchanges cost charges for these transactions.

When buying and selling quantity goes up, like it’s now, so does the underside line of the exchanges.

And now, so can yours…

2 Low-Danger Methods to Revenue from Bitcoin

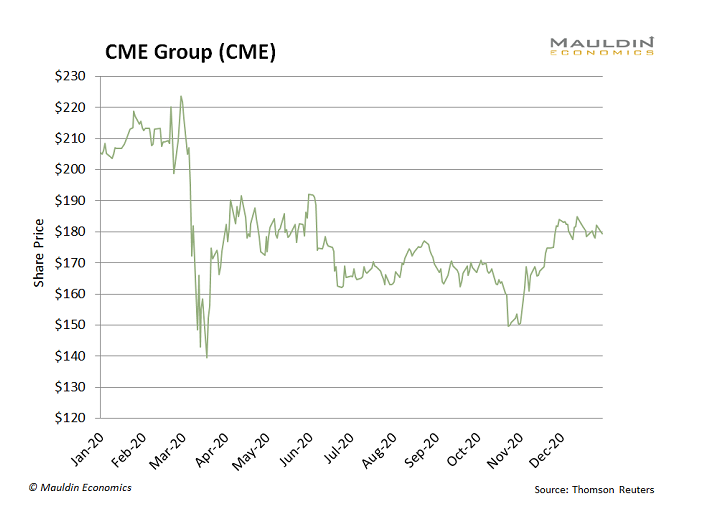

CME Group (CME) operates the main Bitcoin futures alternate. And enterprise is booming.

The corporate reported file quantity on its Bitcoin futures alternate on Could 13. It processed 33,700 contracts, equal to $1.35 billion.

And this can be a sliver of its $5 billion-per-year enterprise. That is why CME Group pays a secure and steady 1.6% dividend.

Then there’s the cherry on high: The corporate has a historical past of paying a particular dividend yearly. So a particular dividend may greater than double CME’s dividend yield.

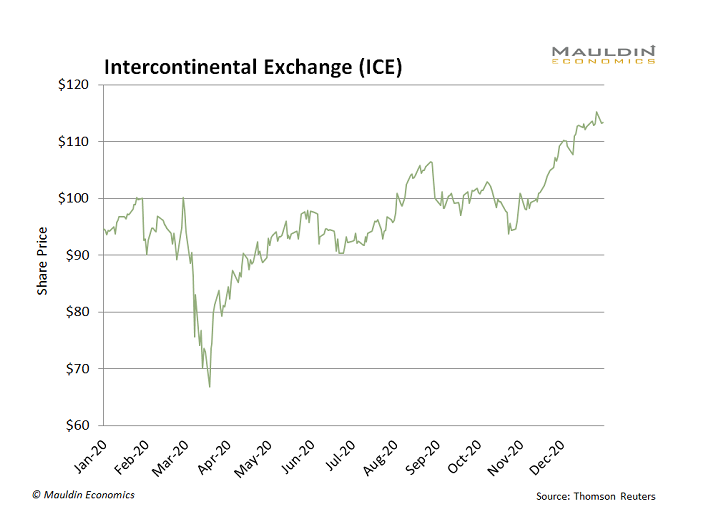

The second firm on my record is Intercontinental Alternate (ICE).

The corporate launched its bitcoin alternate in September 2019. It’s been an enormous hit, as the corporate noticed 16,000 contracts commerce on a single day in September 2020.

That was 36% greater than the earlier file set in July 2020.

Whereas ICE’s dividend is small at 1%, it’s rock-solid. The corporate has sturdy free money circulate and has a five-year common payout ratio of 27%.

I feel Bitcoin goes to smash much more data sooner or later in terms of the value of this cryptocurrency and the buying and selling quantity on exchanges like CME and ICE.

Each of those shares are buying and selling within the triple digits. Not solely do they provide a inexpensive method to wager on big-ticket Bitcoin, however they pay you to attend for the King of Cryptos to commerce even greater.

The Sin Inventory Anomaly: Accumulate Large, Protected Earnings with These Three Hated Shares

My brand-new particular report tells you every thing about making the most of “sin shares” (playing, tobacco, and alcohol). These shares are a lot safer and do twice in addition to different shares just because most traders attempt to keep away from them. Declare your free copy.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.