By Scott Welch, CIMA ®, Chief Funding Officer – Man

By Scott Welch, CIMA ®, Chief Funding Officer – Mannequin Portfolios

Partially I of this two-part weblog collection, we targeted on private sentiment and confidence indicators, in addition to revenue and consumption metrics. We concluded that, basically, people, households and small companies are exhibiting a way of “cautious optimism” because the COVID-19 vaccinations proceed apace, large fiscal stimulus has been handed and the economic system continues to get well from its pandemic-induced recession of final yr.

How is that common optimism translating into precise investor habits?

Investor Habits

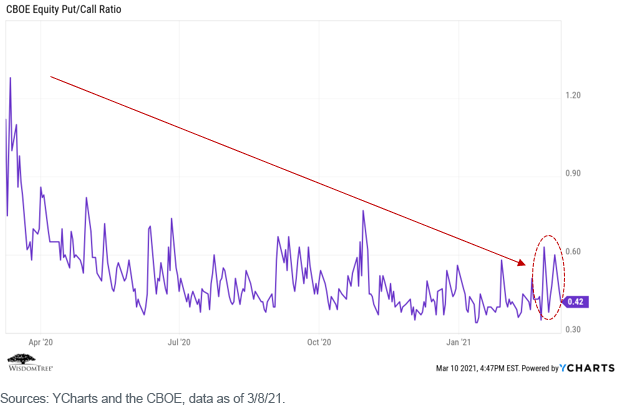

First up is the put/name ratio. This measures the diploma to which buyers are shopping for safety towards the market (shopping for put choices—a bearish indicator) versus shopping for leveraged entry to the market (shopping for name choices—a bullish indicator). The decrease this ratio (i.e., the less put choices bought than name choices), the extra bullish buyers are behaving.

Word the bouncy however regular decline on this ratio over the course of 2020, suggesting elevated optimism. However what’s most noticeable is the volatility over the previous 2–Three months, as rates of interest spiked, and buyers seemingly expressed renewed issues over potential inflation (driving the ratio upward). This was adopted rapidly, nonetheless, by a pointy decline as excellent news about COVID-19 vaccinations elevated, and Congress handed an enormous $1.9 trillion fiscal stimulus bundle.

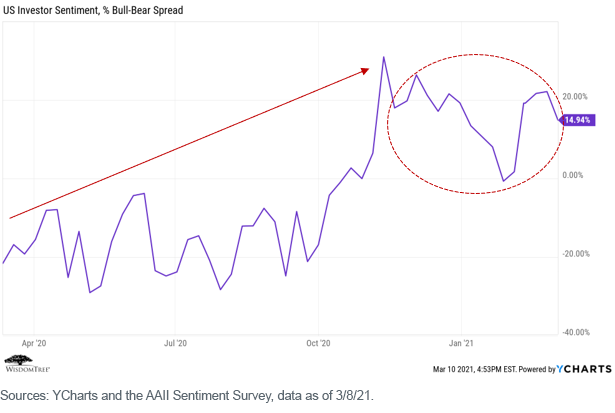

The inverse of the put/name ratio is the bull/bear unfold, which measures the ratio of buyers indicating they’re bullish versus bearish available on the market.

We see comparable outcomes to the put/name ratio—a gentle enhance in bullishness over the course of 2020, adopted by elevated volatility over the previous few months—maybe a sign of investor issues over frothy fairness market valuations and rising rates of interest.

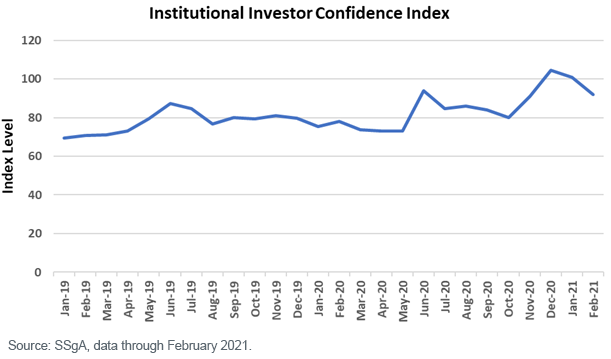

Whereas retail investor habits is attention-grabbing, most market buying and selling nonetheless takes place with institutional buyers (Reddit/Robinhood speculators apart), so let’s study that subsequent.

What we see (not surprisingly) is extra constant habits and a typically bullish development over the previous 12–24 months (however, once more, with a slight decline over the previous month or two).

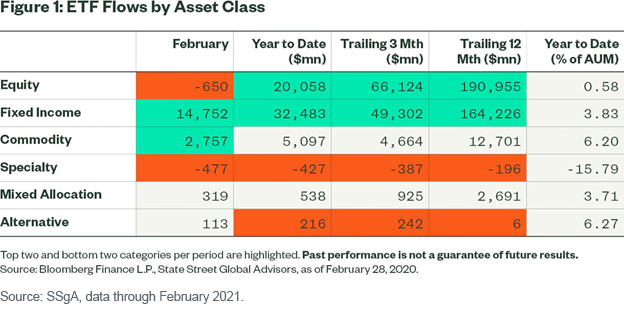

Lastly, let’s have a look at precise fund flows, specializing in ETFs. What we see is a small majority of flows into fairness ETFs over the earlier 12 months (a bullish indicator), however a reversal into bond ETFs up to now in 2021. Given present rate of interest and credit score unfold ranges, it is a pretty bearish indicator.

Conclusions

What can we conclude from inspecting the varied particular person, shopper and investor indicators mentioned in these two weblog posts?

In our opinion, it’s a blended bag. People and buyers appear typically optimistic concerning the present and future state of the economic system and the inventory market, however there are indicators that some degree of warning is creeping into the market “temper.”

This can be the results of any variety of points—uncertainty over the potential impacts of the newly handed fiscal stimulus bundle and/or the effectiveness of the COVID-19 vaccination program, inflation and valuation issues, or maybe simply “fatigue” over persevering with lockdowns and faculty closings.

Given human feelings, most of those sentiment and habits indicators are usually unstable, they usually can and do reverse course and again once more rapidly. So, it’s smart to view them with some degree of detachment and a longer-term time horizon.

However they’re price being attentive to. I participated in a market outlook webinar in late December and was requested: “What’s the one factor that possibly individuals aren’t paying sufficient consideration to that would have an effect available on the market?”

My response was as follows, and I stand by it as we speak. We have to preserve our vigilance “all alongside the watchtower”:

Investor sentiment at the moment is in a euphoria stage. Should you have a look at varied investor sentiment indicators, there’s loads of optimism priced in. So, on the retail degree, we’re in a “risk-on” setting, and I agree with a lot of that optimism.

However a possible shock may be that there’s an excessive amount of optimism constructed into the market. If we get an occasion that turns sentiment round, and folks start to de-risk, it might occur rapidly and dramatically.

Initially printed by WisdomTree, 3/23/21

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding aims, dangers, costs, bills, and different info; learn and think about rigorously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. Overseas investing entails forex, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms could expertise higher worth volatility. Investments in rising markets, forex, fastened revenue and various investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency will not be indicative of future outcomes. This materials comprises the opinions of the writer, that are topic to alter, and will to not be thought of or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a proposal or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work underneath all market circumstances. This materials represents an evaluation of the market setting at a selected time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety particularly. The person of this info assumes all the danger of any use fabricated from the knowledge supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Buyers searching for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info could solely be used on your inner use, might not be reproduced or re-disseminated in any type and might not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding choice and might not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes all the danger of any use fabricated from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or every other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can not make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.