Investors who are interested in the investment potential of the nascent clean energy sector can consider a targeted exchange traded fund play.

In the recent webcast, Capitalizing on the Clean Energy Future, Eric Fogarty, Managing Director, Portfolio Manager, and Senior Research Analyst at Duff & Phelps Investment Management Co., explained that clean energy currently represents about 10% of global electricity consumption and is projected to grow to about 33% of all global electricity consumption by 2035.

The growth outlook is supported by a number of factors. Fogarty underscored government policy that is increasing EU and Asian targets for Renewable Energy, the fact that UK legislation will require net zero emissions, and growing state-by-state renewable portfolio standards and clean energy laws. Electrification and electric vehicles (EVs) could also substantially increase overall electricity demand, and there is rising demand from many of the largest global corporations as many are committed to going 100% green. Additionally, improvements in technology are making clean energy cost-competitive with traditional forms of power generation.

Fogarty argued that the adoption of clean energy could fuel major changes to the entire value chain that would affect generation, transmission, distribution, and storage of electricity.

“Clean energy is a long-term capital replacement cycle, not a short-term trend,” Fogarty said.

Looking ahead, U.S. renewables from solar, wind, geothermal, and hydro electricity could contribute to over 2,000 billion kilowatt hours of electricity by 2050, compared to just under 500 billion kilowatt hours back in 2010. According to UBS, achieving net-zero emissions by 2050 implies two to three times the current run rate of renewables additions. Achieving net-zero by 2040 implies around four times the current run rate.

To achieve this call for net zero emissions by 2050, the world will have to aggressively adopt clean energy technologies. Consequently, Fogarty pointed out that average annual capital expenditure investments into areas like wind, solar, batteries, and grid expansions could total $1.2 trillion from 2020 through 2050.

As a way to help investors sift through the clean energy space, Benjamin Bielawski, Managing Director, Portfolio Manager, and Senior Research Analyst at Duff & Phelps Investment Management Co., highlighted the Duff & Phelps investment process. Duff & Phelps Investment Management pursues specialized investment strategies with exceptional depth of resources and expertise. Since its earliest beginnings, providing research and analysis of income-producing securities to Depression-era investors, the firm’s attention has been set on identifying attractive opportunities through active management and fundamental research while managing the associated risks. Today, building on a distinguished legacy, Duff & Phelps has earned a reputation as a leader in investing in global listed infrastructure, global listed real estate, clean energy, and diversified real assets.

Duff & Phelps looks for clean energy companies that exhibit secular growth, pricing power, and growing cash flows, and offer portfolio diversification, among others.

Duff & Phelps defines eligible clean energy companies to include those with either over 30% of revenues allocated to clean energy producers, clean energy technology and equipment providers, and clean energy transmission and distribution categories; over 30% of future capex allocated to any of those three categories; better than average emission metrics as identified by standardized EEI reporting and captured in D&P proprietary ESG scorecards; and companies developing innovative clean energy technologies that displaces current technology and can be deployed at scale.

The investment methodology is more dynamic and results-oriented than a static passive index. It takes into account current revenues, future capital outlays, and future impact. Lastly, the strategy results in a diversified portfolio and balanced risk profile.

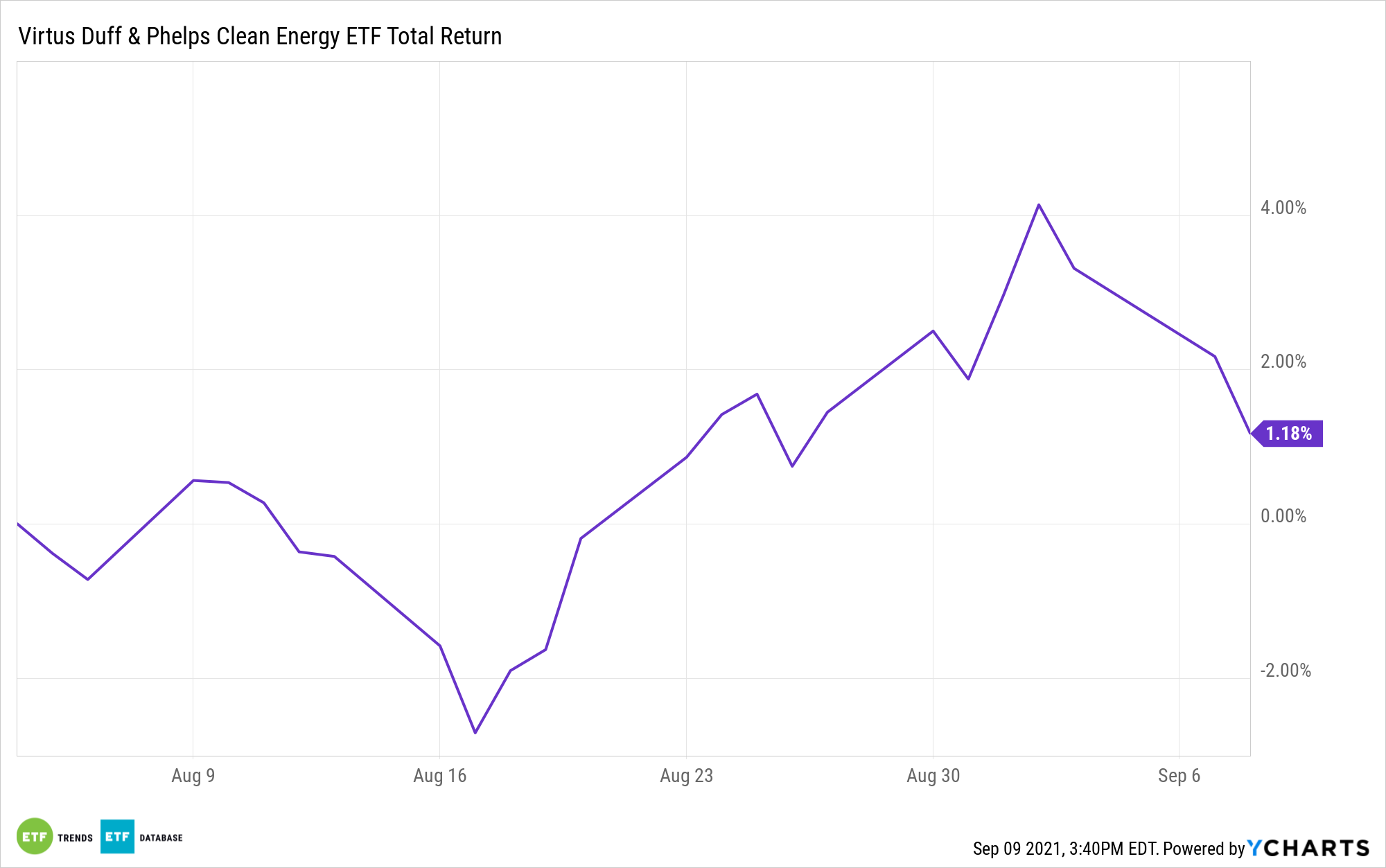

The recently launched Virtus Duff & Phelps Clean Energy ETF (NYSE: VCLN) is the first ETF strategy managed by Duff & Phelps. The ETF seeks attractive total returns by investing globally in a portfolio of clean, renewable, and sustainable companies and technologies that will power future energy needs. Actively managed, VCLN focuses on well-positioned market leaders at the forefront of clean energy innovation and commercialization.

VCLN’s investment process contrasts favorably with passive clean energy indexes’ less-defined investment processes, which are often driven by market capitalization and clean energy exposure scores derived from static, sometimes opaque, criteria. By contrast, the Duff & Phelps active investment management approach is more comprehensive than those of its passive competitors, resulting in a high-conviction stock portfolio with a more balanced risk profile.

Financial advisors who are interested in learning more about clean energy investments can watch the webcast here on demand.

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com