Inflation fears have crept again into the capital markets, in keeping with international funding ag

Inflation fears have crept again into the capital markets, in keeping with international funding agency Goldman Sachs. A current Reuters article famous {that a} confluence of different elements like a weaker greenback and rising demand for commodities may accompany inflation.

“A weaker U.S. greenback, rising inflation dangers and demand pushed by extra fiscal and financial stimulus from main central banks will spur a bull marketplace for commodities in 2021, Goldman Sachs mentioned on Thursday,” the article mentioned. “The financial institution forecast a return of 28% over a 12-month interval on the S&P/Goldman Sachs Commodity Index (GSCI), with a 17.9% return for treasured metals, 42.6% for power, 5.5% for industrial metals and a unfavourable return of 0.8% for agriculture. Markets are actually more and more involved concerning the return of inflation, the Wall Avenue financial institution mentioned.”

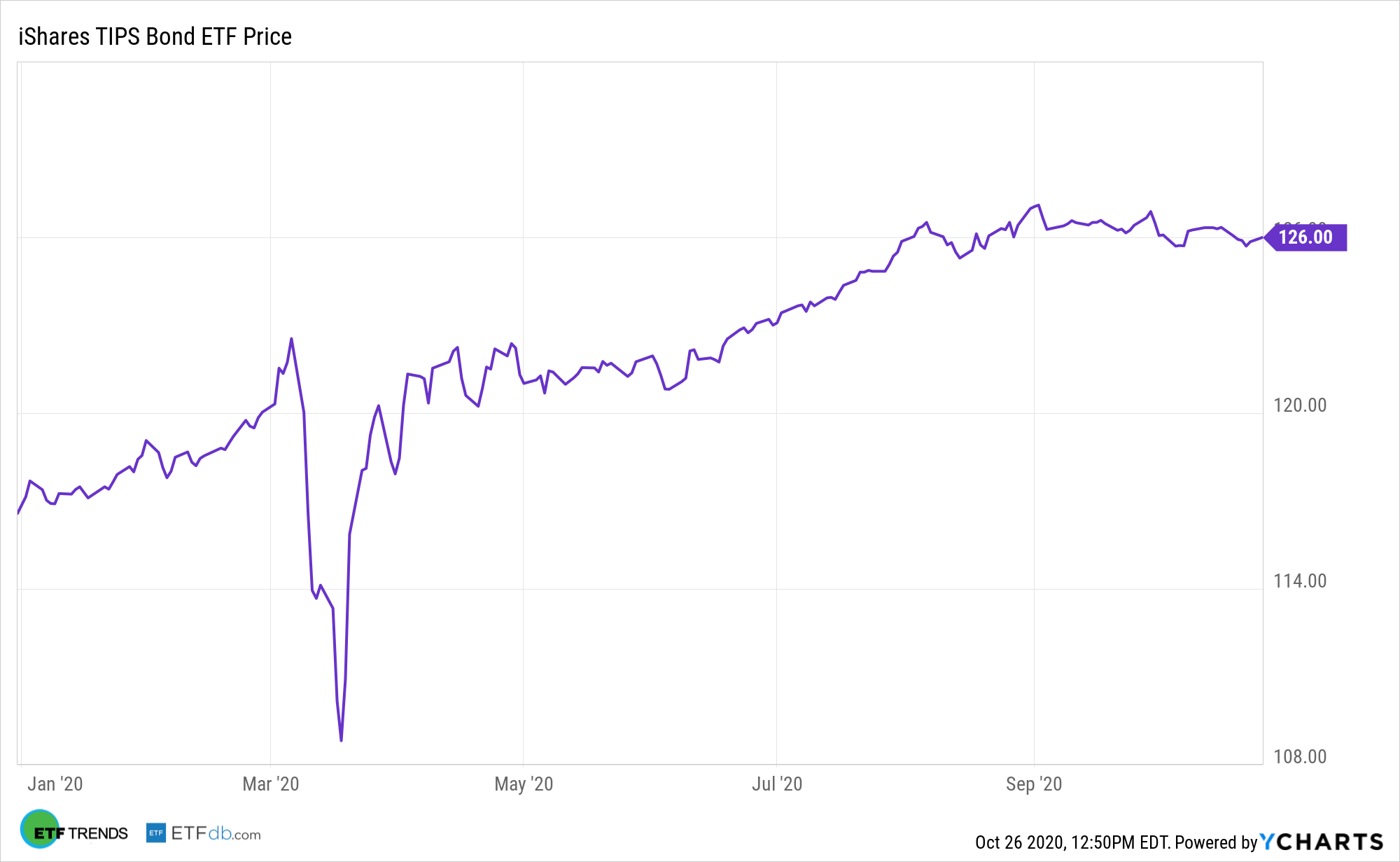

With inflation forward, one ETF to think about is the iShares TIPS Bond ETF (TIP). TIP seeks to trace the funding outcomes of Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index (Sequence-L) which composed of inflation-protected U.S. Treasury bonds.

The fund typically invests no less than 90% of its property within the bonds of the underlying index and no less than 95% of its property in U.S. authorities bonds. It could make investments as much as 10% of its property in U.S. authorities bonds not included within the underlying index, however which BFA believes will assist the fund observe the underlying index, and may additionally make investments as much as 5% of its property in repurchase agreements collateralized by U.S. authorities obligations and in money and money equivalents.

TIP provides traders:

- Publicity to U.S. TIPS, that are authorities bonds whose face worth rises with inflation.

- Entry to the home TIPS market in a single fund.

- Search to guard in opposition to intermediate-term inflation.

“Gold, extensively seen as a hedge in opposition to inflation and foreign money debasement, has gained 26% this 12 months, benefiting from unprecedented international stimulus and near-zero rates of interest,” the article added.

That mentioned, one other iShares ETF to think about is the iShares Gold Belief (IAU). IAU seeks to mirror typically the efficiency of the worth of gold, and the Belief seeks to mirror such efficiency earlier than fee of the Belief’s bills and liabilities.

The Belief doesn’t have interaction in any actions designed to acquire a revenue from, or to ameliorate losses brought on by, adjustments within the worth of gold. The advisor intends to represent a easy and cost-effective technique of investing just like an funding in gold. An funding in bodily gold requires costly and generally difficult preparations in reference to the assay, transportation, warehousing, and insurance coverage of the steel.

For extra market developments, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.