Alternate traded fund buyers who're excited by a developme

Alternate traded fund buyers who’re excited by a development alternative can concentrate on the way forward for the web and the way a portfolio of those innovators might help drive return and diversify a portfolio.

Within the latest webcast, Past FAANG: The Web’s Subsequent-Gen Corporations, James Wang, Analyst, ARK Make investments; Nicholas Grous, Analyst, ARK Make investments; and Rebecca Burke, VP, Nationwide ETF Gross sales, Resolute Funding Managers, highlighted the alternatives within the subsequent era of revolutionary firms and the way buyers ought to rethink their portfolio allocations to raised acquire publicity to this new group of market giants. ARK Make investments initiatives that over the subsequent 10 years, about 50% of S&P 500 firms can be changed by fast-growing innovators which might be capable of adapt to a shortly altering market atmosphere.

Particularly, the strategists argued that areas like deep studying, or software program that is ready to be educated, will energy the subsequent era of computing platforms. For instance, conversational computer systems or good audio system responded to 100 billion instructions and questions in 2019 and the quantity elevated 50% in only one yr. Self-driving autos are shortly creating, with Waymo autos touring greater than 20 million totally autonomous miles. Moreover, shopper apps like TikTok use deep studying for video suggestions and is rising its person base 10x quicker than is Snapchat.

Wanting forward, ARK Make investments initiatives that synthetic intelligence software program ought to create a $18 billion marketplace for A.I. {hardware}. AI accelerator chips, which optimize deep studying workloads, generated $four billion in income final yr, and ARK believes it ought to develop 36% at a compound annual development price to $18 billion by 2024.

“The slowdown in Moore’s Legislation means no extra ‘free’ efficiency upgrades each two years. In consequence, the server trade must put money into extra computing {hardware},” the strategists stated.

The strategists additionally argued that deep studying might create extra financial worth than the Web. In simply 20 years, the Web added roughly $10 trillion to the worldwide fairness market cap. Since 2012, deep studying created $1 trillion in market capitalization, and ARK believes it can add $30 trillion by 2037.

A.I. can be increasing from imaginative and prescient to language. ARK believes that 2019 was the yr of conversational A.I., with programs now capable of perceive and generate language with human-like accuracy. This new section might additionally gas oblique development in different know-how sectors since conversational AI requires 10 instances the computing sources of pc imaginative and prescient and may spur giant investments within the coming years.

Moreover, the strategists highlighted 5 ongoing developments that might additional assist the case for the web’s subsequent era of revolutionary firms: Firstly, the way forward for content material distribution will come within the type of digital streaming companies. Secondly, we’re seeing an growth in on-line gaming, particularly in a post-coronavirus atmosphere the place everybody has been looking for extra handy leisure avenues when caught at residence. Talking of which, distant work might turn into the brand new regular. In the meantime, there was elevated demand for zero-contact companies like people who present fast deliveries. Lastly, social commerce has shortly grown and is projected to achieve about $three trillion by 2025.

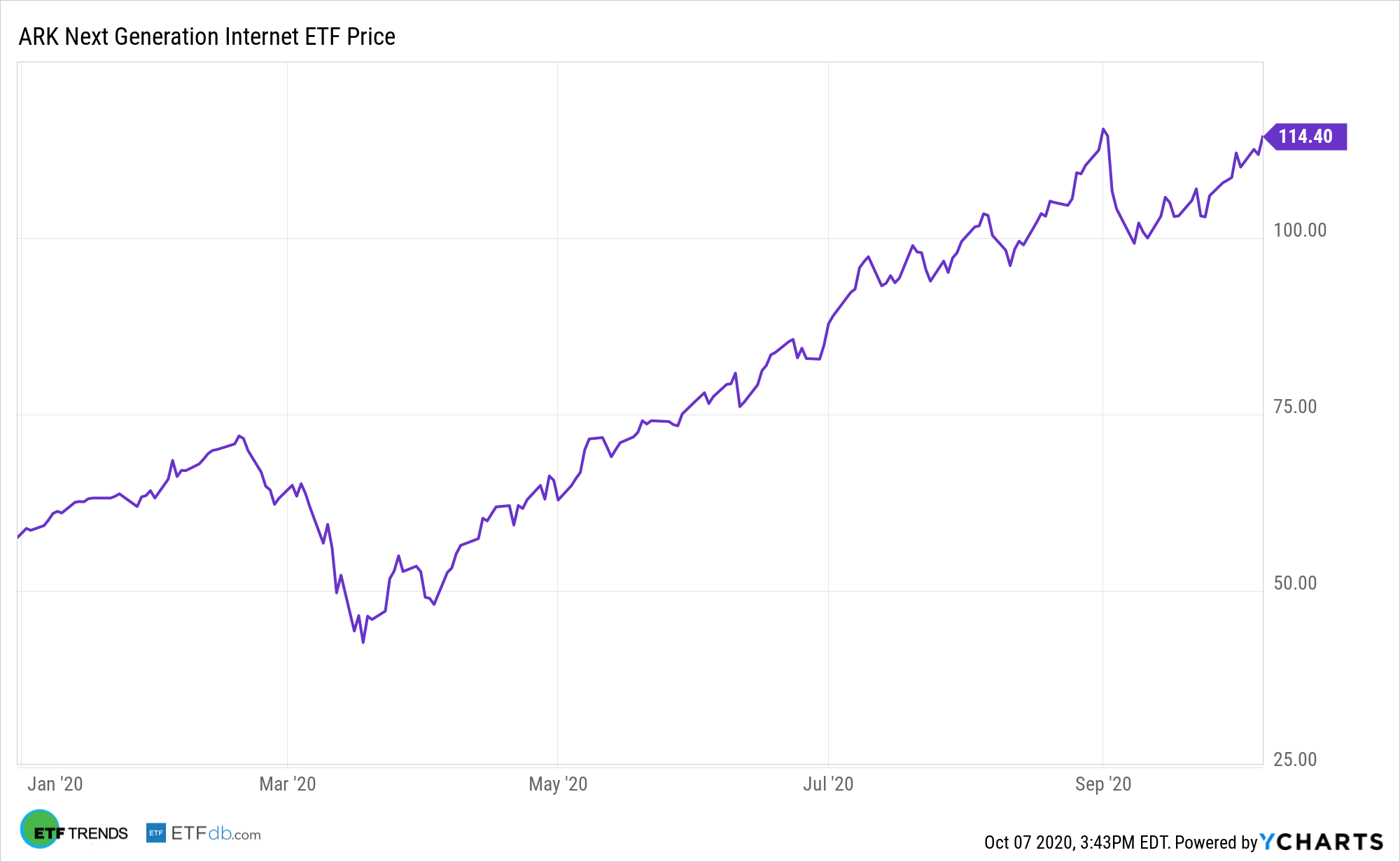

As a manner to assist buyers seize this subsequent era of web names, buyers can look to the ARK Net x.zero ETF (NYSEArca: ARKW), an actively managed ETF technique that’s centered on and anticipated to profit from shifting the bases of know-how infrastructure to the cloud, enabling cellular, new and native companies, reminiscent of firms that depend on or profit from the elevated use of shared know-how, infrastructure and companies, internet-based services, new cost strategies, massive knowledge, the web of issues, and social distribution and media.

ARK Make investments believes that ARKW might help buyers entry thematic multi-cap publicity to revolutionary web applied sciences together with cloud computing, massive knowledge, digital media, streaming, e-commerce, bitcoin and blockchain applied sciences, and the Web of Issues (IoT). The ETF goals to seize long-term development with low correlation of relative returns to conventional development methods and detrimental correlation to worth methods, and it’s a device for diversification as a consequence of little overlap with conventional indices. The actively managed technique combines top-down and bottom-up analysis in its portfolio administration to establish revolutionary firms and convergence throughout markets, and this energetic technique comes within the low-cost and environment friendly ETF wrapper.

Monetary advisors who’re excited by studying extra in regards to the revolutionary web section can watch the webcast right here on demand.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.