As is being broadly famous, loads of particular person equities are benefiting from expectations that President Biden’s $2 trillion infrastructure bundle, even when it is trimmed, will make it to the political end line.

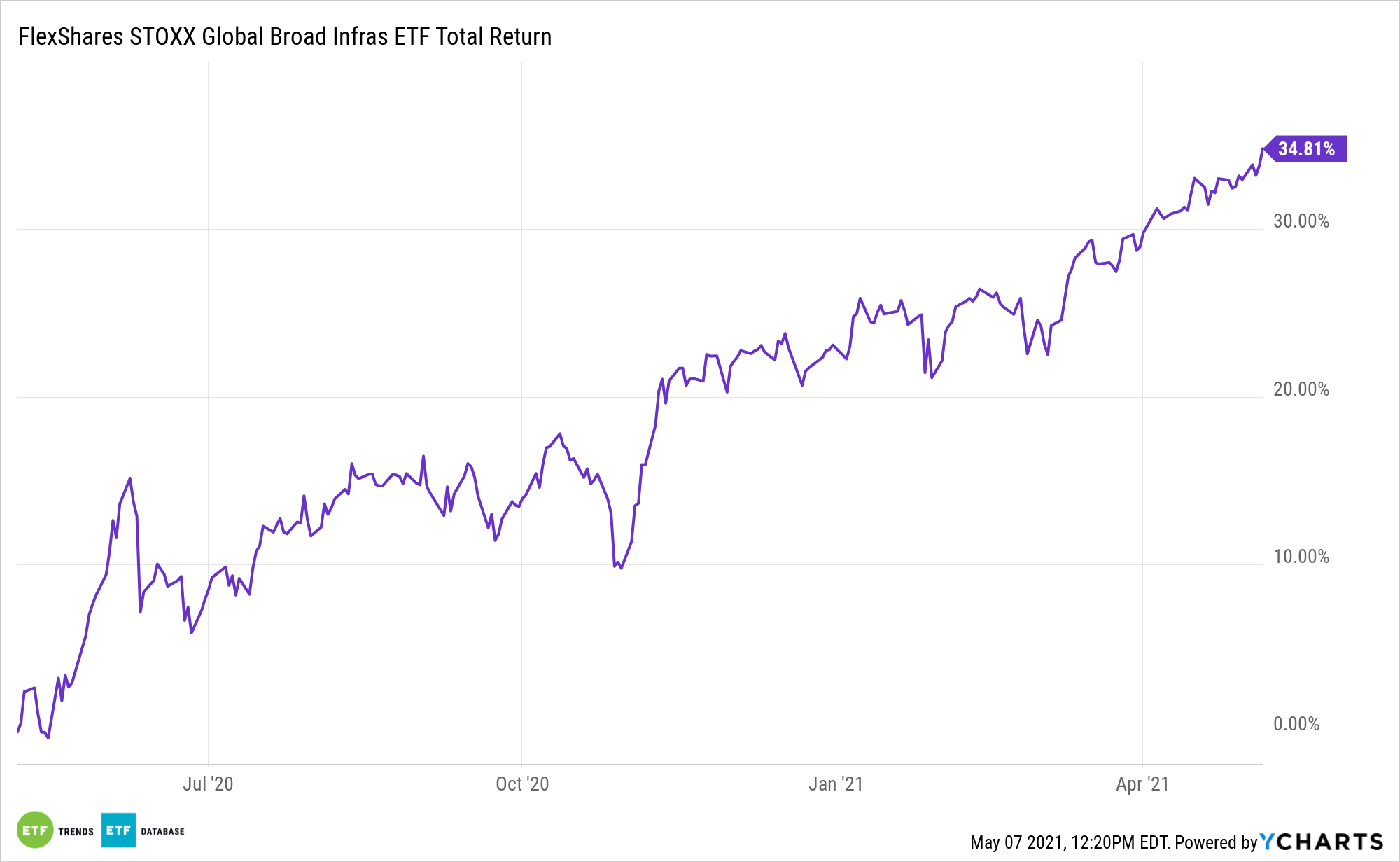

Like every other investing situation with political implications, stock-picking primarily based on infrastructure efforts may be tough. For a lot of traders, a broad-based method may be more practical, with much less threat in addition. Enter the FlexShares STOXX World Broad Infrastructure Index Fund (NYSEArca: NFRA).

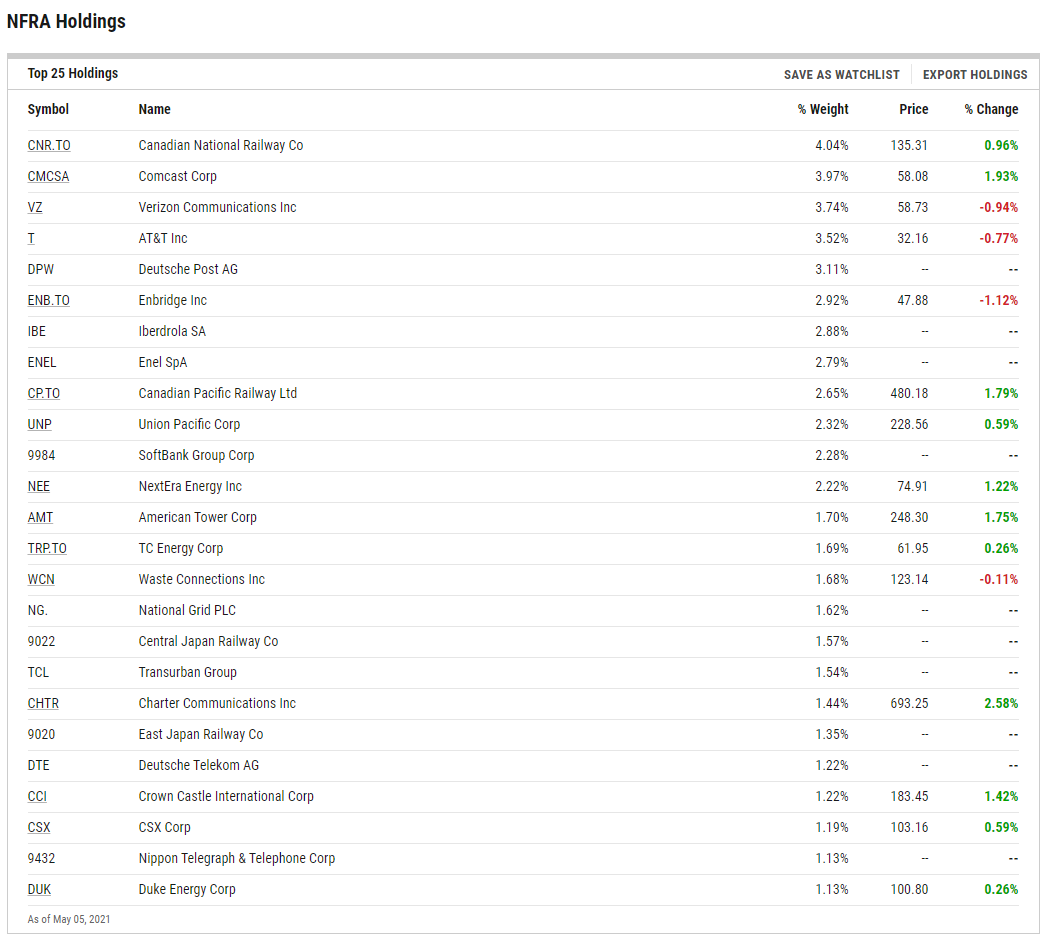

The $2.65 billion NFRA has 250 holdings, confirming its deep bench and broad method to infrastructure investing. Infrastructure is a long-ranging theme, however NFRA is related proper now.

“We count on that this plan will probably be enacted as quickly as this summer time and, for essentially the most half, be of comparable dimension to the model that is presently on the desk,” writes Morningstar analyst Dave Sekera. “Whereas the scope of the plan is massive and wide-ranging, we don’t count on that it’ll have an effect on our long-term projections for financial progress in america.”

2 Extra Issues

NFRA may be a reputable near-term concept in that lots of the logical infrastructure names traders would gravitate to are already priced in Biden’s proposal and are buying and selling at elevated multiples. By embracing NFRA, traders can mitigate the chance of frothy valuations.

“With the U.S. market close to its highs–and barely overvalued, in our view–many of the businesses that may be capable of capitalize on the infrastructure plan are both already pretty valued or overvalued,” added Sekera. “For instance, inventory costs for the apparent conventional infrastructure candidates have already run increased. We expect that essentially the most alternative for presently undervalued 4-star shares may be present in sectors that aren’t historically thought-about infrastructure performs.”

The standard of NFRA’s holdings might additionally show tempting.

“As well as, traders might look to put money into a basket of 3-star shares which have a excessive chance of being positively affected by the infrastructure plan. Since these shares are presently pretty valued, it helps to restrict draw back threat if the ultimate infrastructure plan doesn’t play out as anticipated however might present extra upside potential if the infrastructure plan involves fruition,” concluded Sekera.

For extra on multi-asset methods, go to our Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.