Upon launching the WisdomTree U.S. Environment friendly Core Fund (NTSX), beforehand known as the WisdomTree 90/60 U.S. Balanced Fund, we up to date a few of the seminal analysis from Cliff Asness on the diversification advantages that come from making use of leverage to a conventional 60/40 portfolio method. Right now, we’re excited to launch worldwide and rising markets variations of those methods with the WisdomTree Worldwide Environment friendly Core Fund (NTSI) and the WisdomTree Rising Markets Environment friendly Core Fund (NTSE). Whereas this piece focuses on U.S. markets, our analysis has proven comparable outcomes exterior of the U.S.

Moreover, whereas there’s a new mantra that tutorial research fail to duplicate after researchers publish their findings, what was fascinating was that within the 25 years after Asness revealed his paper, the outcomes really improved!

We now have one other three years for the reason that launch of the WisdomTree U.S. Environment friendly Core Fund to check out how this technique works in actual time—along with the analysis and historic hypotheticals.

Primer on the Analysis

In Asness’s 1996 piece, titled “Why Not 100% Equities: A diversified portfolio gives extra anticipated return per unit of threat,” one in all his core arguments was that an “investor keen to bear the chance of 100% equities can do even higher with a diversified portfolio.”

Asness confirmed how the usage of leverage, which we focus on under, when utilized to a conventional 60/40 technique, may obtain an analogous volatility because the 100% fairness publicity however may assist enhance the return.

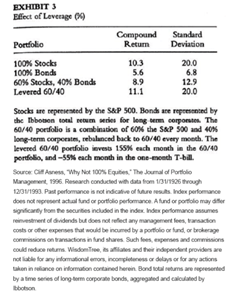

Asness’s paper, primarily based on information from 1926 by way of 1993, utilized a 155% leverage charge to a 60/40 portfolio (utilized month-to-month), the place the borrowing charge used for leveraging his 60/40 portfolio was accomplished at a value of financing by the one-month t-bill charge. This can be a desk from his paper:

Determine 1: Return and Volatility Desk from Asness’s “Why Not 100% Equities” Paper

The Asness Analysis vs. the WisdomTree Environment friendly Core Method

Whereas facets of the 2 are comparable, there are, in fact, some essential variations between the method of the WisdomTree U.S. Environment friendly Core Fund, and its focused exposures, and the analysis that Asness revealed.

The similarities between the 2 methods come from the fairness exposures. The large-cap “fairness beta” publicity in NTSX targets S&P 500-like returns and, as such, overlaps what we see in Asness’s piece. Nevertheless, there are extra distinct variations on the bond publicity facet of the equation.

Asness confirmed returns for bonds utilizing the long-term company collection from Ibbotson, funding these bond returns by borrowing on the one-month t-bill charge so an investor may earn each credit score and length premiums over the t-bill charge.

WisdomTree is implementing bond publicity within the WisdomTree U.S. Environment friendly Core Fund by way of laddered Treasury bond futures. Nobody earns “credit score threat” premiums by way of this Treasury bond futures publicity, so there may be much less extra earnings to be earned from that perspective.

Though there are essential variations between our technique implementation and the Asness examine, we expect that examine may be very helpful in understanding the market dynamics at work in a levered 60/40 method.

In a earlier weblog put up, we confirmed an replace of the Asness analysis within the 24 years after his first publication.

Now we replace that to increase by way of 2020 and present how NTSX has in comparison with his simulations.

Our calculations use the identical Ibbotson information collection and methodology: borrowing -55% on the one-month t-bill charge that funds the 155% publicity each month within the 60/40 mixture of S&P 500 and the Ibbotson company bond collection. Our impartial calculation of Asness’s take a look at confirmed the identical compound return figures.

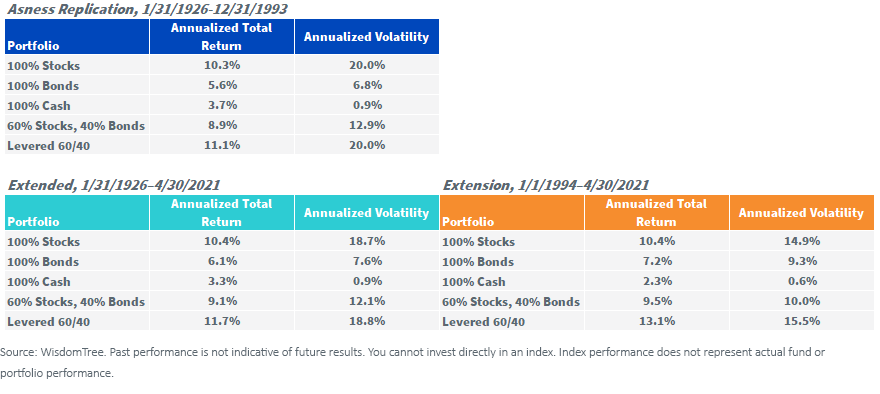

Determine 2: WisdomTree’s Replication of Asness’s Outcomes (1/31/1926–12/31/1993)

For definitions of phrases within the chart, please go to our glossary.

For definitions of phrases within the chart, please go to our glossary.

After we up to date the figures for the following 27-plus years, we noticed that shares returned usually in line, however we additionally noticed decreasing fairness volatility. Whereas the compounded S&P 500 returns ticked up 10 foundation factors (bps) from 10.3% to 10.4% when up to date by way of 2021, the bonds’ compounded returns ticked 160 bps larger, from 5.6% to 7.2%, so a 60/40 portfolio elevated by 20 foundation factors from 8.9% to 9.1%.

As a result of money charges usually additionally ticked down over the 27-year interval after Asness revealed the paper, the levered 60/40 returns utilizing Asness’s assumptions/calculations ticked up 200 foundation factors from 11.1% to 13.1% when up to date to 2021, and the unfold between 100% equities and the levered 60/40 widened out from 80 bps on the time of his authentic examine to 130 bps over the total 1926–2021 interval. When individuals publish analysis, usually the analysis itself will get a repute of “failing to duplicate out of pattern.”

Asness’s examine, and the levered 60/40 portfolio using the identical method he outlined within the paper, really noticed portfolio returns outperform within the following 27-year interval in comparison with its historic again take a look at. The levered 60/40 portfolio returned 13.1% for the 1994–2021 interval, 270 bps forward of the 100% fairness line, in contrast with solely 80 bps throughout his authentic take a look at.

WisdomTree’s Reside Fund out of Pattern Outcomes

Whereas replicating Asness’s analysis has been instructive as to the potential for this technique, how did NTSX fare in actual time?

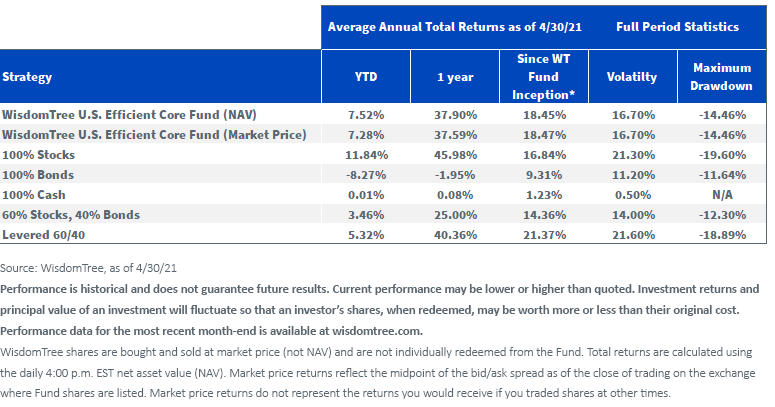

Briefly, NTSX outperformed 100% shares by 1.61% per yr with decrease volatility and drawdowns. Whereas it lagged the hypothetical levered 60/40 by almost 3% per yr, this was primarily a operate of for much longer length for his or her fastened earnings place and credit score over-weights versus NTSX.

During times of rising charges, we’d anticipate NTSX so as to add worth in comparison with the levered 60/40 hypothetical method quoted within the Asness examine. Moreover, we consider that Treasuries could also be a greater diversifier than company credit score in serving to to dampen fairness volatility.

For standardized efficiency of NTSX, please click on right here.

For standardized efficiency of NTSX, please click on right here.

Present Fairness vs. Bond Debates

Proper now, one of many core asset allocation conundrums stays: Rates of interest usually are nonetheless close to their lowest ranges, and, as such, one doesn’t earn as a lot from bonds as previously. Equally, fairness valuations are prolonged from historic ranges, so forward-looking fairness returns are additionally decrease than regular.

The conundrum for conventional asset allocators, nonetheless, is that fairness premiums (how a lot compensation shares are providing over comparatively “protected” property like bonds) are doubtless nonetheless favoring shares in asset allocation fashions.

Professor Jeremy Siegel, below whom I’ve studied extensively, believes the present fairness premium over bonds is greater than 5%, whereas his work during the last 200 years exhibits the actual fairness premium was nearer to three% traditionally.

Shifting bond exposures to equities, which have larger volatilities, when they’re at excessive valuations isn’t straightforward to do. Substituting a few of the conventional equities with a package deal of equities that additionally will increase bond publicity may maybe assist resolve one in all these key asset allocation debates going through buyers: shares or bonds? Why not each for a similar greenback invested?

Initially revealed by WisdomTree, 5/20/2021

Necessary Dangers Associated to this Article

There are dangers related to investing, together with attainable lack of principal.

Dangers associated to NTSX, NTSE and NTSI: Whereas the Funds are actively managed, their funding processes are anticipated to be closely depending on quantitative fashions, and the fashions could not carry out as meant. Fairness securities, similar to widespread shares, are topic to market, financial and enterprise dangers which will trigger their costs to fluctuate. The Funds spend money on derivatives to realize publicity to U.S. Treasuries. The return on a spinoff instrument could not correlate with the return of its underlying reference asset. The Funds’ use of derivatives will give rise to leverage, and derivatives might be risky and could also be much less liquid than different securities. In consequence, the worth of an funding within the Funds could change shortly and with out warning, and you could lose cash. Rate of interest threat is the chance that fastened earnings securities, and monetary devices associated to fastened earnings securities, will decline in worth due to a rise in rates of interest and adjustments to different components, similar to notion of an issuer’s creditworthiness.

Further dangers particular to NTSI: Investments in non-U.S. securities contain political, regulatory and financial dangers that will not be current in U.S. securities. For instance, overseas securities could also be topic to threat of loss as a result of overseas forex fluctuations, political or financial instability, or geographic occasions that adversely affect issuers of overseas securities.

Further dangers particular to NTSE:

Investments in non-U.S. securities contain political, regulatory and financial dangers that will not be current in U.S. securities. For instance, overseas securities could also be topic to threat of loss as a result of overseas forex fluctuations, political or financial instability, or geographic occasions that adversely affect issuers of overseas securities. Investments in securities and devices traded in creating or rising markets, or that present publicity to such securities or markets, can contain extra dangers regarding political, financial or regulatory circumstances not related to investments in U.S. securities and devices or investments in additional developed worldwide markets.

Please learn every Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding aims, dangers, prices, bills, and different data; learn and contemplate fastidiously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. International investing entails forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations could expertise better value volatility. Investments in rising markets, forex, fastened earnings and different investments embody extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency isn’t indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to alter, and may to not be thought-about or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work below all market circumstances. This materials represents an evaluation of the market atmosphere at a selected time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety specifically. The person of this data assumes the whole threat of any use manufactured from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Buyers in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI data could solely be used on your inner use, will not be reproduced or re-disseminated in any type and will not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a advice to make (or chorus from making) any type of funding resolution and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is supplied on an “as is” foundation and the person of this data assumes the whole threat of any use manufactured from this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Social gathering have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can not make investments instantly in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.