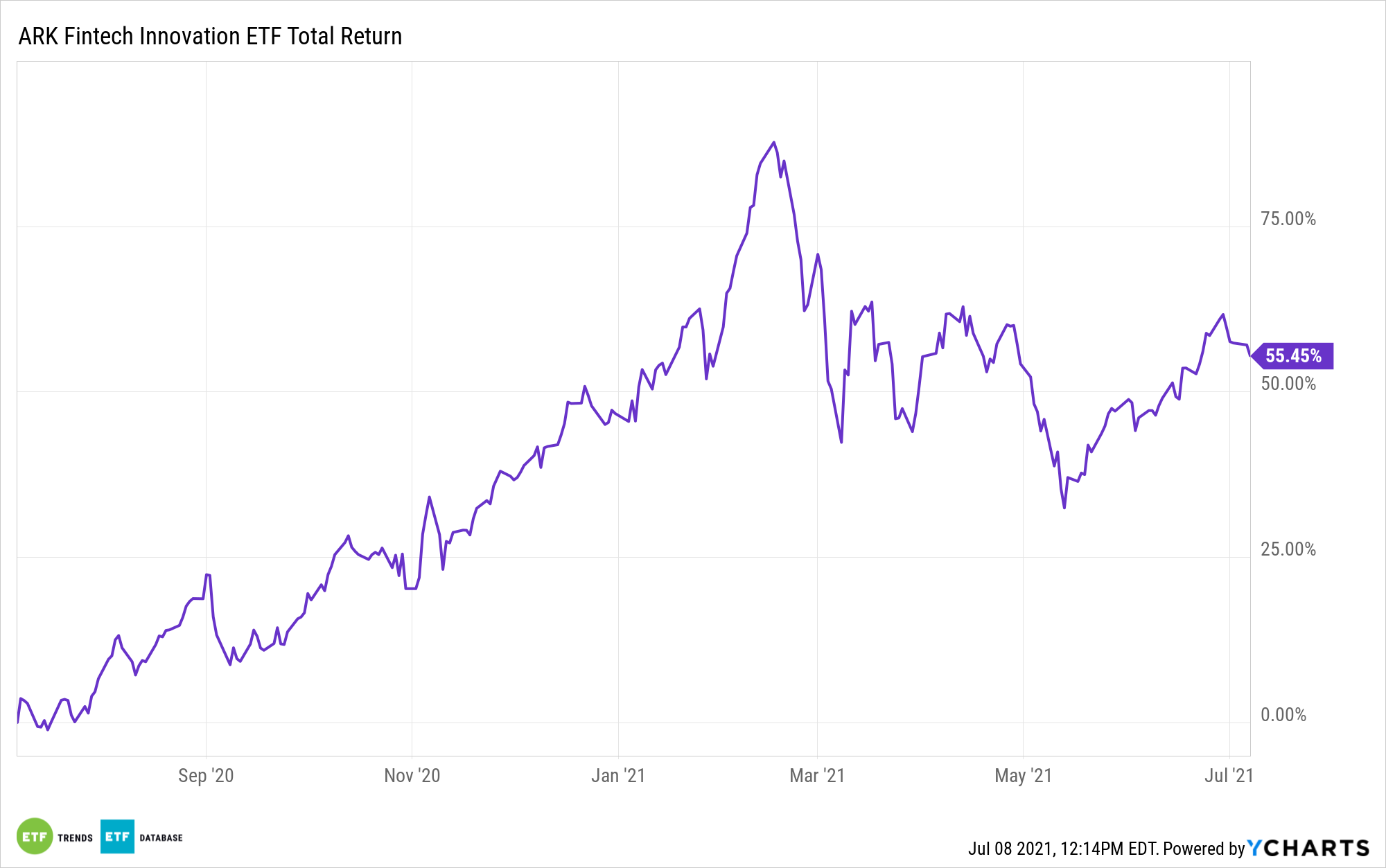

The ARK Fintech Innovation ETF (NYSEARCA: ARKF) is up 7% year-to-date, an admirable efficiency given the lethargy skilled by progress shares within the first quarter.

Whereas ARKF’s efficiency lags that of the broader market, the fintech trade fund may very well be a second half winner as analysts develop bullish on various ARKF’s parts. Take the case of Coinbase (NASDAQ: COIN). The cryptocurrency trade operator went public earlier this yr and ARK swiftly scooped up the inventory, including it to a number of of its ETFs, together with ARKF.

On Wednesday, Oppenheimer reiterated an “outperform” ranking on Coinbase, saying the corporate is poised to ship a “report” quarter when it reveals second quarter outcomes.

“We proceed to see a pointy dislocation between COIN’s fundamentals and its valuation and consider the present value affords a beautiful entry level for long-term buyers,” stated the analysis agency in a observe to shoppers.

Coinbase is the eleventh-largest holding within the actively managed ARKF at a weight of three.29%, as of July 7, in accordance with issuer information.

Extra Bullishness on ARKF Holdings

Cell funds supplier Sq. (NYSE: SQ) is likely one of the engines that makes ARKF go. The inventory accounts for greater than 10% of the fund’s weight, one of many largest allocations to the title amongst all ETFs. That publicity might show rewarding for ARKF buyers as 2021 strikes alongside as a result of Sq. continues rising its enterprise past conventional fee companies for small- and mid-sized companies. Analysts are taking observe.

Lately, Deutsche Financial institution’s Bryan Kean reiterated a “purchase” ranking with a $330 value goal on ARKF’s largest holding, implying vital upside from the place the shares at present reside.

“We consider SQ stays nicely positioned to learn from the accelerated adoption of digital monetary companies, software-based enterprise options, and omni-channel capabilities spurred by the COVID pandemic,” stated the analyst. “Money App continues to considerably outperform as SQ has been in a position to appeal to new prospects and have interaction present prospects whereas concurrently bettering monetization and product adoption.”

Sportsbook operator DraftKings (NASDAQ: DKNG), one other inventory ARK has not too long ago been a diligent purchaser of, is preferred on Wall Road too. Extra states are slated to legalize sports activities betting and web casinos. Not less than one analyst believes the Boston-based firm is poised to beat second quarter income estimates and maybe once more increase 2021 gross sales steering.

For extra on disruptive applied sciences, go to our Disruptive Know-how Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.