By Michael Venuto,

By Michael Venuto, Co-founder & CIO, Toroso Investments

Final week, Mike Venuto sat down with Connor O’Brien, CEO of O’Shares, to debate markets, thematic ETFs and Mounted Revenue investing. The dialog drifted towards considerations with bonds, going ahead from two key factors:

- Anticipated returns in comparison with danger

- Function in asset allocation as correlation will increase

The controversy on the longer term utility of bonds to traders will proceed, however right here on the ETF Assume Tank, we had been impressed to dive deep into the accessible panorama of fastened earnings ETFs for this week’s analysis notice.

1.1 Trillion Served

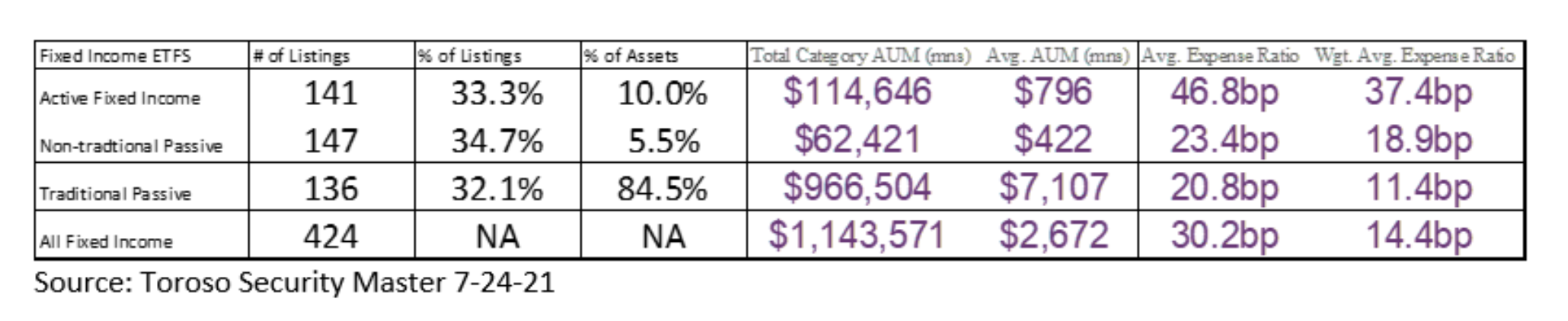

Within the US, there are 424 ETFs centered on fastened earnings, with belongings of about $1.14 Trillion (about 22% of US ETF AUM). This excludes leveraged/inverse, most well-liked, and allocation ETFs in our Toroso Safety Grasp. The weighted common expense ratio for bond ETFs is barely 14.four bps, which is lower than the general trade, at about 18bps.

Unhealthy Bond Benchmarks

The desk above breaks down the belongings, listings, and costs of fastened earnings ETFs by funding method. Not surprisingly, the majority of the belongings (84.5%) are in conventional market weighted passive ETFs. Assume Tank sponsor Jay McAndrew, of Columbia Threadneedle, has usually referred to those kind of passive funds as “unhealthy bond benchmarks,” as a result of they’re structured in a approach that obese the biggest issuers of debt. There are two attention-grabbing surprises within the desk above:

- The variety of listings is about equal; about one-third of bond ETFs are in every funding method.

- There are virtually double the quantity of belongings in Lively Mounted Revenue when in comparison with Non-Conventional Passive.

Mounted Revenue Volatility

Earlier, we requested if bonds are boring. Beneath, nevertheless, we have a look at the very best and worst performing fastened earnings ETFs in 2021 in comparison with 2020, and discover volatility that’s something however boring. Let’s begin with the worst performers:

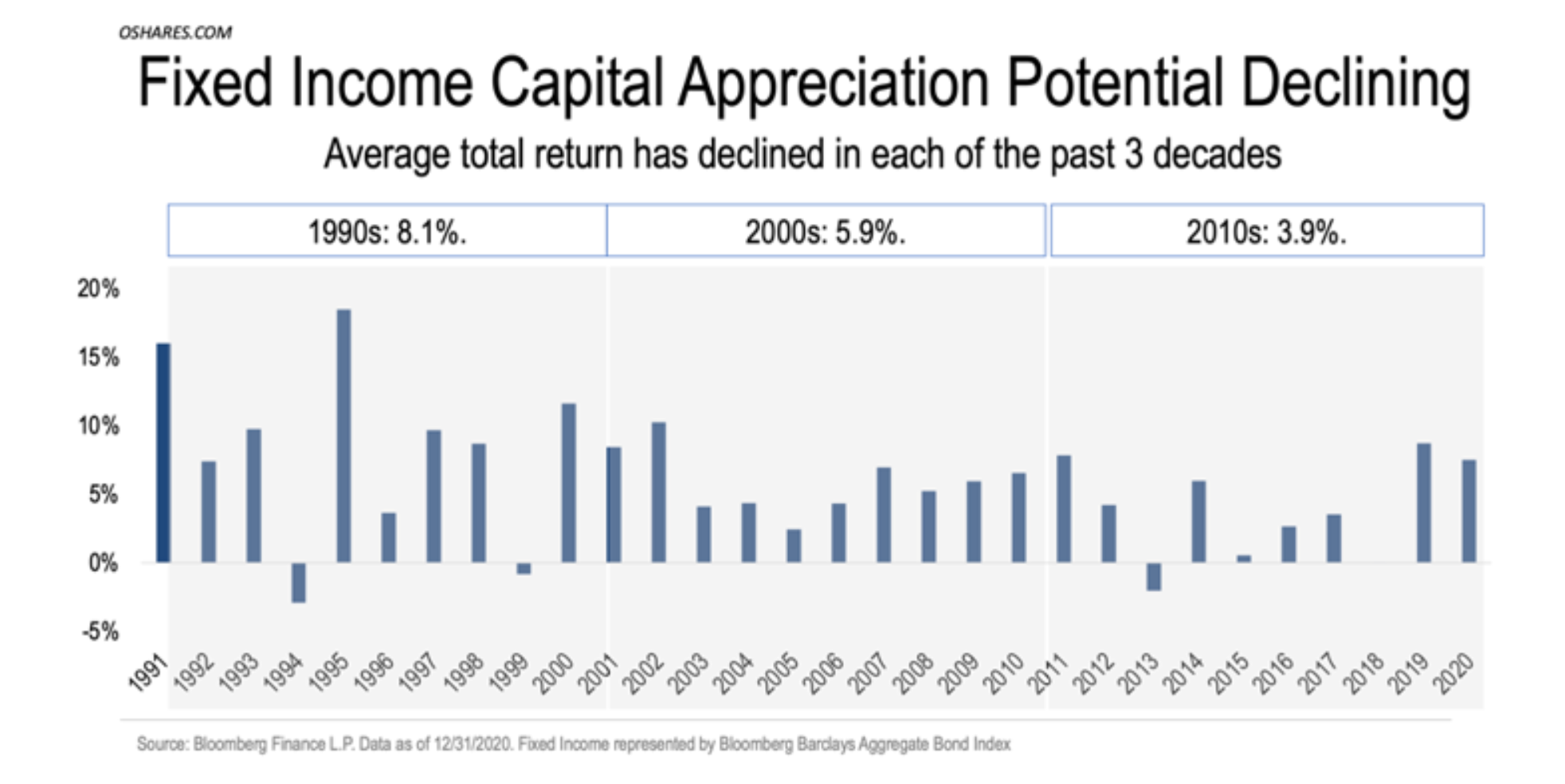

The perfect performers in 2021 are bonds with equity-like traits: excessive yield and convertibles. There are additionally 4 energetic funds that make the listing. There are stark variations with approaches, volatility and outcomes when evaluating the very best and worst performing fastened earnings ETFs of 2021 and an indication of the occasions. The actual fact is that given an virtually 40-year bull marketplace for bonds the situations for a static 60/40 mannequin don’t make sense if an investor is seeking to bonds for preservation of capital, shopping for energy or money circulation. Our level is that any bond allocation as we speak must be reviewed. We anticipate thrilling occasions on this space for traders and subsequently these taking a look at this allocation have to evaluation how they are often totally different somewhat than conventional.

*Previous efficiency just isn’t indicative of future outcomes.

Disclosure

All expressions of opinion are topic to vary with out discover in response to shifting market situations. Knowledge contained herein from third occasion suppliers is obtained from what are thought of dependable sources. Nevertheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never meant to be reflective of outcomes you’ll be able to anticipate to realize.

All investments contain danger, together with doable lack of principal.

The worth of investments and the earnings from them can go down in addition to up and traders might not get again the quantities initially invested, and will be affected by adjustments in rates of interest, in alternate charges, basic market situations, political, social and financial developments and different variable elements. Funding includes dangers together with however not restricted to, doable delays in funds and lack of earnings or capital. Neither Toroso nor any of its associates ensures any price of return or the return of capital invested. This commentary materials is offered for informational functions solely and nothing herein constitutes a proposal to promote or a solicitation of a proposal to purchase any safety and nothing herein needs to be construed as such. All funding methods and investments contain danger of loss, together with the doable lack of all quantities invested, and nothing herein needs to be construed as a assure of any particular consequence or revenue. Whereas we now have gathered the knowledge offered herein from sources that we imagine to be dependable, we can’t assure the accuracy or completeness of the knowledge offered and the knowledge offered shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to supply revised opinions within the occasion of modified circumstances.

The data on this materials is confidential and proprietary and might not be used apart from by the meant person. Neither Toroso or its associates or any of their officers or workers of Toroso accepts any legal responsibility in any respect for any loss arising from any use of this materials or its contents. This materials might not be reproduced, distributed or revealed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.