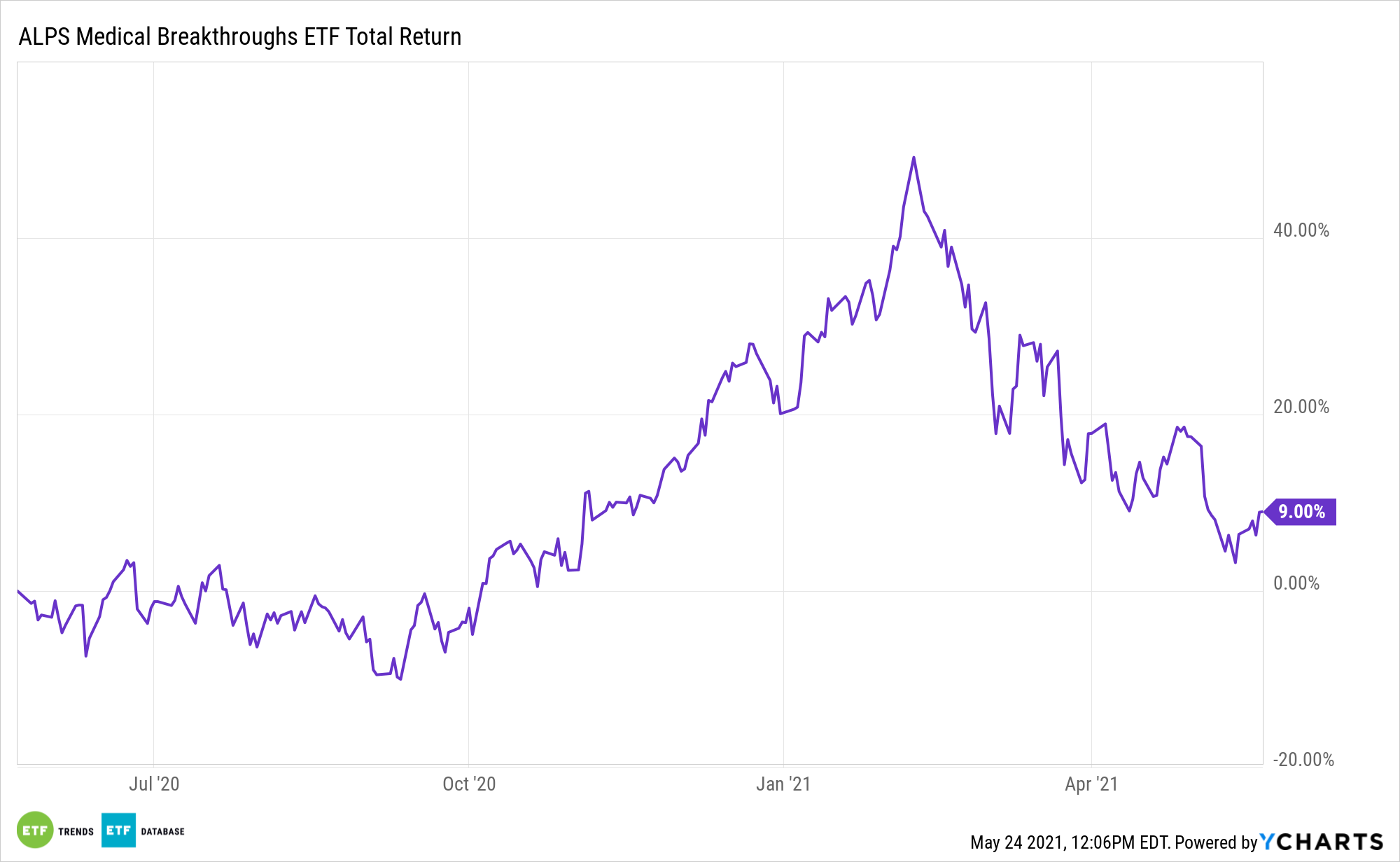

Biotechnology equities are slumping to start out 2021, with the S&P Biotechnology Choose Trade Index down 10% year-to-date.

Mergers and acquisitions exercise, that are usually vibrant within the biotech house, are additionally in a funk. But many specialists consider biotech consolidation is poised to select up the tempo within the second half of 2021. If that occurs, the ALPS Medical Breakthroughs ETF (SBIO) may reap the rewards.

SBIO elements have market values of $200 million to $5 billion on the time of inclusion within the fund. Even the upper finish of that vary is a candy spot for cash-rich prescribed drugs corporations trying to replenish drug pipelines and fend off patent cliffs. With the aforementioned decline by the S&P Biotechnology Choose Trade Index, some prescribed drugs may now be on the prowl for takeover targets.

Final month, Moody’s Buyers Service stated Amgen, Bristol Meyers Squibb, Johnson & Johnson, and Merck are among the many corporations with the assets and potential want to interact in acquisitions with out harming their credit score scores. As only one instance, J&J has north of $25 billion in money, that means any variety of SBIO companies could be simply digestible for the Dow part.

“M&A begin to decide up after

of a big drawdown and as costs ‘normalize’ for sellers,” Jefferies analyst Michael Yee wrote in a observe cited by Josh Nathan-Kazis for Barron’s.

Biotech M&A Due for a Rebound

The torpid begin to 2021 for biotechnology consolidation comes after the tempo of deal-making slowed in 2020. Getting into this 12 months, PwC forecast as much as $275 billion in transactions within the life sciences enviornment.

SBIO’s underlying index mandate that member companies have at the very least one drug or remedy in both Section II or Section III U.S. Meals and Drug Administration (FDA) scientific trials. That limits a few of the volatility related to pre-trial and Section I solely names. Moreover, it makes the fund’s roster probably fertile floor for suitors. Roughly 20 SBIO elements have been acquired for the reason that ETF got here to market in late 2014.

The extent to which biotechnology M&A perks up and the way it impacts SBIO stays to be seen. Nevertheless, Jefferies’ Yee identifies Destiny Therapeutics Inc. (FATE) – SBIO’s largest holding – as a attainable takeover goal.

Different biotech ETFs to think about embody the VanEck Vectors Biotech ETF (BBH), iShares Biotechnology ETF (IBB), and the Virtus LifeSci Biotech Scientific Trials ETF (BBC).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.