The narrative of a worth comeback goes on, with gro

The narrative of a worth comeback goes on, with growing capital flows into value-based ETFs. Buyers and advisors alike will wish to take into account funds just like the Vanguard Worth ETF (VTV).

VTV displays the everyday traits of a value-based fund that primarily homes giant cap shares. When markets are pushing greater, it might seize upside whereas muting the results of volatility at any time when there’s downward promoting strain.

The ETF isn’t too high heavy in a single explicit inventory. Actually, its huge holdings protect towards focus danger whereas additionally offering diversification throughout a spectrum of sectors.

“Buyers with a longer-term horizon ought to take into account the significance of huge cap worth shares and the advantages they will add to any well-balanced portfolio together with dividends and rock stable stability,” ETF Database evaluation writes. “Corporations inside this section are sometimes thought of among the most secure companies on the planet and are typically in additional steady industries as properly, probably skewing some portfolios which are heavy in worth securities. VTV is linked to an index consisting of roughly 400 holdings and publicity is tilted most closely in direction of financials, power, and industrials.”

The fund additionally presents a quarterly distribution that makes it a great match for a hard and fast revenue portfolio. VTV fund is up 10% to begin 2021.

The Rotation to Worth

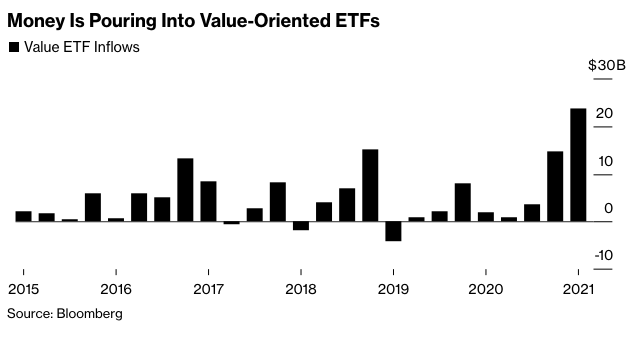

Gone are the times when the FAANGs (Fb, Amazon, Apple, Netflix, Google) dominated the earth, at the least for now it appears. The rotation to worth has been exceedingly obvious by way of the lens of 2021 ETF inflows.

“After a few decade of development shares tearing up the charts, the worth fashion of investing is having its day,” a Bloomberg article duly famous. “Greater than $18 billion this 12 months — already a quarterly report — has gone into about 80 totally different exchange-traded funds that concentrate on firms thought of undervalued relative to their property, like banks.”

“If cash retains shifting this fashion from high-flying shares like tech, what’s been unthinkable for a few years might really occur: A ‘deep-value’ exchange-traded fund might displace the Tesla-fueled ARK Innovation ETF (ARKK) as the subsequent area of interest ETF to vacuum up investor cash, in keeping with an evaluation by Bloomberg Intelligence,” the article added.

For extra information and data, go to the Sensible Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.