Last yr, the pandemic could have tamped down enterprise capital (VC) funding, however as world economies heal, VC is beginning to present indicators of life once more in North America. This presents a possibility for ETFs that concentrate on preliminary public choices (IPOs).

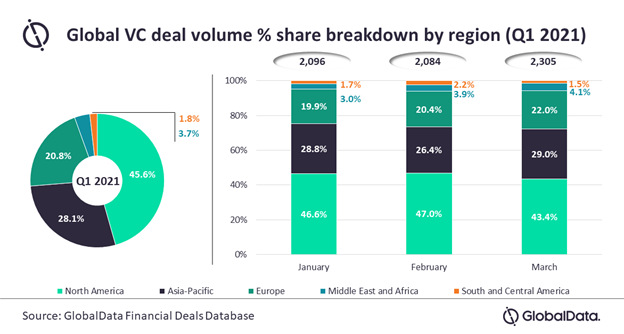

To this point, within the first quarter of 2021, North America dominated the VC funding panorama whereas Europe, the Center East, and Africa (EMEA) collectively confirmed indicators of development.

“World enterprise capital (VC) funding witnessed average development in the course of the first quarter (Q1) of 2021 with North America persevering with to draw the best variety of investments, whereas Europe and Center East and Africa (EMEA) area witnessed vital development in offers quantity in addition to corresponding share, in accordance with GlobalData, a number one information and analytics firm,” a GlobalData press launch famous.

“The variety of VC funding offers that have been introduced globally elevated marginally by 0.7% from 2,069 in January to 2,084 in February, and additional grew by 10.6% to 2,305 offers in March 2021,” the discharge mentioned additional.

As the worldwide vaccine deployment continues, traders are slowly regaining confidence. As such, enterprise capital may very well be on the rise if the pattern continues to persist upward.

“VC funding exercise in 2021 began on a promising observe with March showcasing a major soar in deal quantity,” mentioned Aurojyoti Bose, Lead Analyst at GlobalData. “This may very well be attributed to a revival of investor sentiments because of ongoing vaccination packages. Furthermore, investor sentiments additionally appear to be buoyed extra notably in March with markets such because the UK nearing the tip of lockdown restrictions.”

Getting IPO Publicity through ETFs

ETF traders seeking to get broad IPO publicity with out the one threat of a person firm can look to the Renaissance IPO ETF (IPO). IPO seeks to duplicate the worth and yield efficiency of the Renaissance IPO Index, which is a portfolio of firms which have lately accomplished an preliminary public providing (“IPO”) and are listed on a U.S. trade.

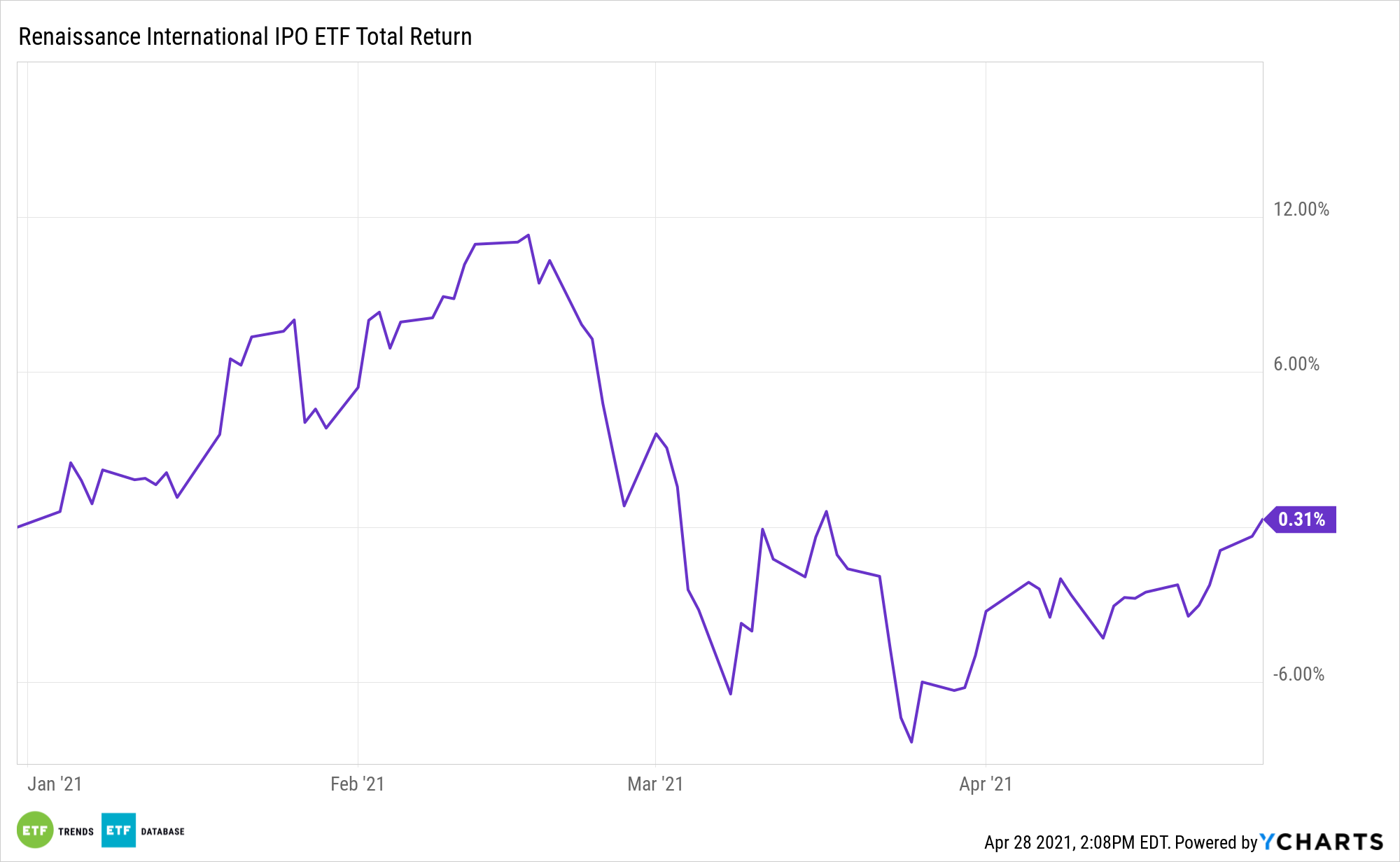

For traders searching for IPO alternatives on a world scale, there’s the Renaissance Worldwide IPO ETF (IPOS), which provides a world spin to the IPO market. IPOS tracks the rules-based Renaissance Worldwide IPO Index, which provides sizeable new firms on a fast-entry foundation with the remainder upon scheduled quarterly critiques. Present IPOS holdings embrace SoftBank Corp, Xiaomi, and China Tower Corp.

For extra information and knowledge, go to the Sensible Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.