Saying Chinese language shares are encountering controversy this yr is an understatement. Between delisting chatter within the U.S. and Beijing’s regulatory crackdown on web corporations, a lot of which raised billions of {dollars} in U.S. preliminary public choices (IPOs), 2021 is a making an attempt time for lengthy Chinese language development shares.

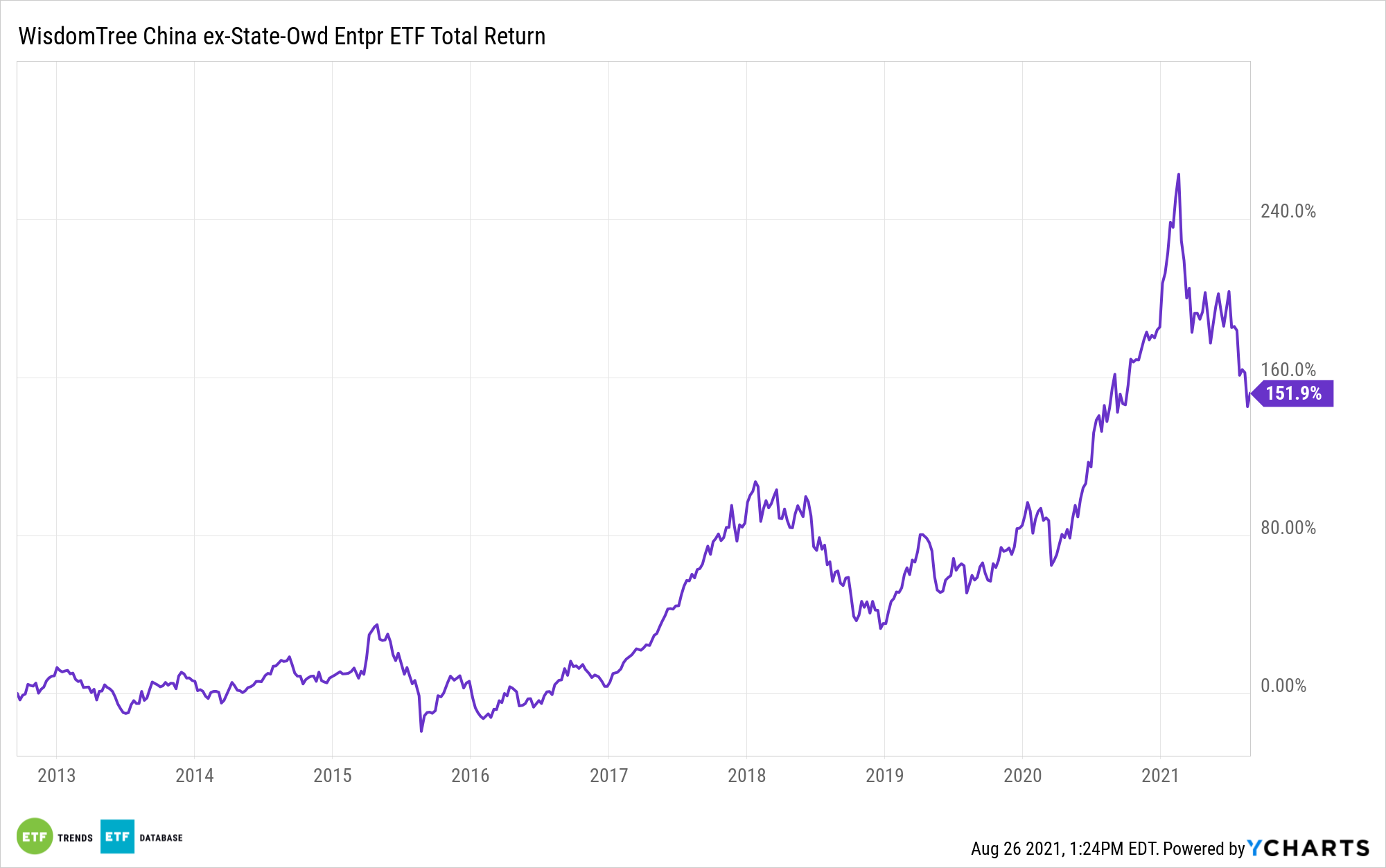

Nevertheless, this week introduced a bounce in some beforehand high-flying Chinese language web shares, luring loads of retail buyers again to the asset class. For people who imagine this rebound has legs, or for these seeing worth in some beaten-up names, the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) could also be a extra sensible wager than inventory selecting.

“Web purchases of American depositary receipts of Chinese language corporations surpassed $400 million with the ‘apex’ of shopping for occurring in Monday’s session as e-commerce behemoth Alibaba was probably the most purchased single inventory within the US, Vanda Analysis mentioned in a Wednesday notice,” stories Enterprise Insider.

The $1 billion CXSE, which turns 9 years previous subsequent month, allocates 6.48% of its weight to Alibaba (NYSE:BABA). The so-called Amazon of China is the second-largest part within the ETF at a weight of 6.48%.

CXSE tracks the WisdomTree China ex-State-Owned Enterprises Index and, because the fund and index names indicate, state-controlled corporations are restricted. WisdomTree defines equivalent to companies as situations the place “authorities possession of greater than 20% of excellent shares” is in play.

As such, CXSE allocates practically 52% of its weight to the buyer discretionary and communication companies sectors — two of the teams most weak to the aforementioned regulatory clampdown. Whereas Beijing’s efforts to foster extra competitors and shield client information are crimping the likes of Tencent and Alibaba — CXSE’s prime two holdings — and lots of extra, some smaller buyers seem undaunted.

“A very powerful singularity of retail purchases of ADRs is that they weren’t contrarian. Because the regulatory crackdown began, retail buyers elevated their shopping for on dips, offering liquidity to institutional buyers who had been exiting lengthy positions,” says Giacomo Pierantoni, an analyst at Vanda Analysis.

Whereas it is a stretch to say that purchasing in Chinese language web names is reaching GameStop/AMC/meme inventory proportions, it is apparent that retailer buyers are sensing alternative in China.

Nonetheless, CXSE could possibly be a safer wager as a result of a lot of its client discretionary and communication companies sectors do not qualify as meme shares. Moderately, some are extremely worthwhile with surprisingly sturdy high quality traits, underscoring the case for the WisdomTree ETF even in opposition to a difficult regulatory backdrop.

For extra on how one can implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com