By Jeff Weniger, CFA, Head of Fairness Technique

By Jeff Weniger, CFA, Head of Fairness Technique

“Nessie.” That’s the nickname for the lake-living, reclusive beast that has lured spellbound vacationers to a fabled Scottish lake—Loch Ness—for many years. This raging inventory market has gotten to such some extent that you might be forgiven for considering the Loch Ness Monster hoax is extra plausible than claims of recognizing a low P/E fairness basket nowadays.

By and enormous, there’s not a lot you are able to do in order for you a extremely low P/E within the U.S.—not with the S&P 500 Index loitering round 3,800, its ahead P/E at 23.

To get there, you would possibly take into account turning to rising markets (EM).

We’ve got a few Funds that personal a bunch of cheap shares, the kind of Funds you would possibly personal if you find yourself decidedly bulled up on worth relative to progress.

Listed below are two of our deepest worth concepts:

DGS: The WisdomTree Rising Markets SmallCap Dividend Fund

DEM: The WisdomTree Rising Markets Excessive Dividend Fund

In case you suppose 2021 will witness shares with no dividends successful once more, you don’t need these. However if you’re scouring the panorama for corporations with low multiples, these are the 2 Funds to analyze.

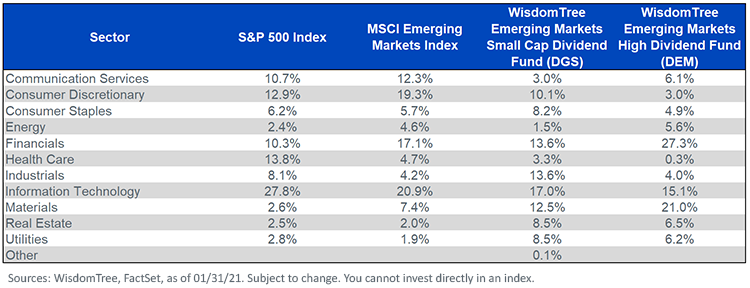

Observe the return on fairness (ROE) percentages in determine 1. Fairly good for EM worth, proper? Each DGS and DEM are larger on that measure than the MSCI Rising Markets Index, with notably decrease P/Es. Moreover, the dividend yields are a number of proportion factors larger than the 1.55% of the S&P 500.

Determine 1: DGS & DEM’s Valuations

For standardized efficiency of the Funds talked about within the desk please click on their respective tickers: DGS, DEM.

Like your seek for Nessie or Bigfoot, you might be trying for a very long time when you anticipate to bump into massive slugs of Tech or Shopper Discretionary in DGS or DEM. These are reflation-based Funds which can be chubby Fundamental Supplies and Actual Property (determine 2).

Determine 2: Sector Weights

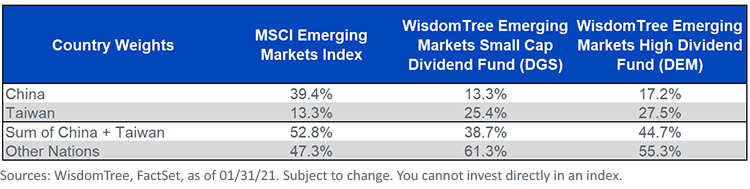

One other factor: DGS and DEM are underweight China (determine 3).

Determine 3: China + Taiwan in DGS & DEM

In case you are bullish on China relative to the remainder of EM, then look away from DGS and DEM and towards one thing just like the WisdomTree Rising Markets ex-State-Owned Enterprises Fund (XSOE), which has extra in that nation.

For the remainder of you, guess what, worth hunters content material with an underweight in China, guess what? In contrast to Nessie, DGS and DEM do exist.

Lastly, to reiterate a essential argument: look once more on the ROEs in determine 1 on DGS and DEM. That profitability measure is a contact decrease than the S&P 500for each DGS and DEM, but the 2 Funds commerce at 10.1 and eight.four occasions ahead earnings, respectively. In 2021, these multiples may very well be about as uncommon as a Bigfoot sighting.

Initially revealed by WisdomTree, 3/5/21

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. Overseas investing entails particular dangers, resembling threat of loss from forex fluctuation or political or financial uncertainty. Funds specializing in a single sector and/or smaller corporations usually expertise larger worth volatility. Investments in rising, offshore or frontier markets are usually much less liquid and fewer environment friendly than investments in developed markets and are topic to extra dangers, resembling dangers of antagonistic governmental regulation, intervention and political developments. As a result of funding technique of those Funds, they could make larger capital acquire distributions than different ETFs.

Please learn every Fund’s prospectus for particular particulars concerning the Fund’s threat profile.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.