As U.S. markets tumbled once more on indicators of inflationary pressures, traders anxious about continued volatility can contemplate a focused ETF technique.

Traders are refocused on the current spike in inflation and whether or not or not rising client costs will stick round. Many are anxious that the extended interval of quicker development in costs might push the Federal Reserve to hike rates of interest or curb its accommodative financial coverage ahead of anticipated, which has weighed on shares and different property which have benefited from the low-rate surroundings.

“We see this as transitory, however you by no means know: there’s stuff in right here that would take a bit longer,” Lars Skovgaard Andersen, funding strategist at Danske Financial institution Wealth Administration, advised the Wall Avenue Journal. “There might be some volatility in markets nonetheless.”

Fed officers, although, argue that it’s too quickly to be involved. Federal Reserve Financial institution of Atlanta President Raphael Bostic mentioned he wasn’t able to dial again assist for the economic system. Bostic additionally downplayed fears over rising costs and contended that it might take months to see a rising inflation development.

“The dialog round inflation is basically the main focus of the market and everybody’s attempting to get an image on whether or not the Fed is true in saying if that is all short-term or is that this one thing they should take extra critically,” Greg Swenson, founding companion of Brigg Macadam, advised Reuters.

“You may proceed to see rotation (out of know-how shares) not solely due to the outperformance of tech within the final 12 months versus cyclicals, however the one means you’ll be able to keep lengthy equities and hedge towards inflation is personal extra cyclicals – financial institution, power,” he added.

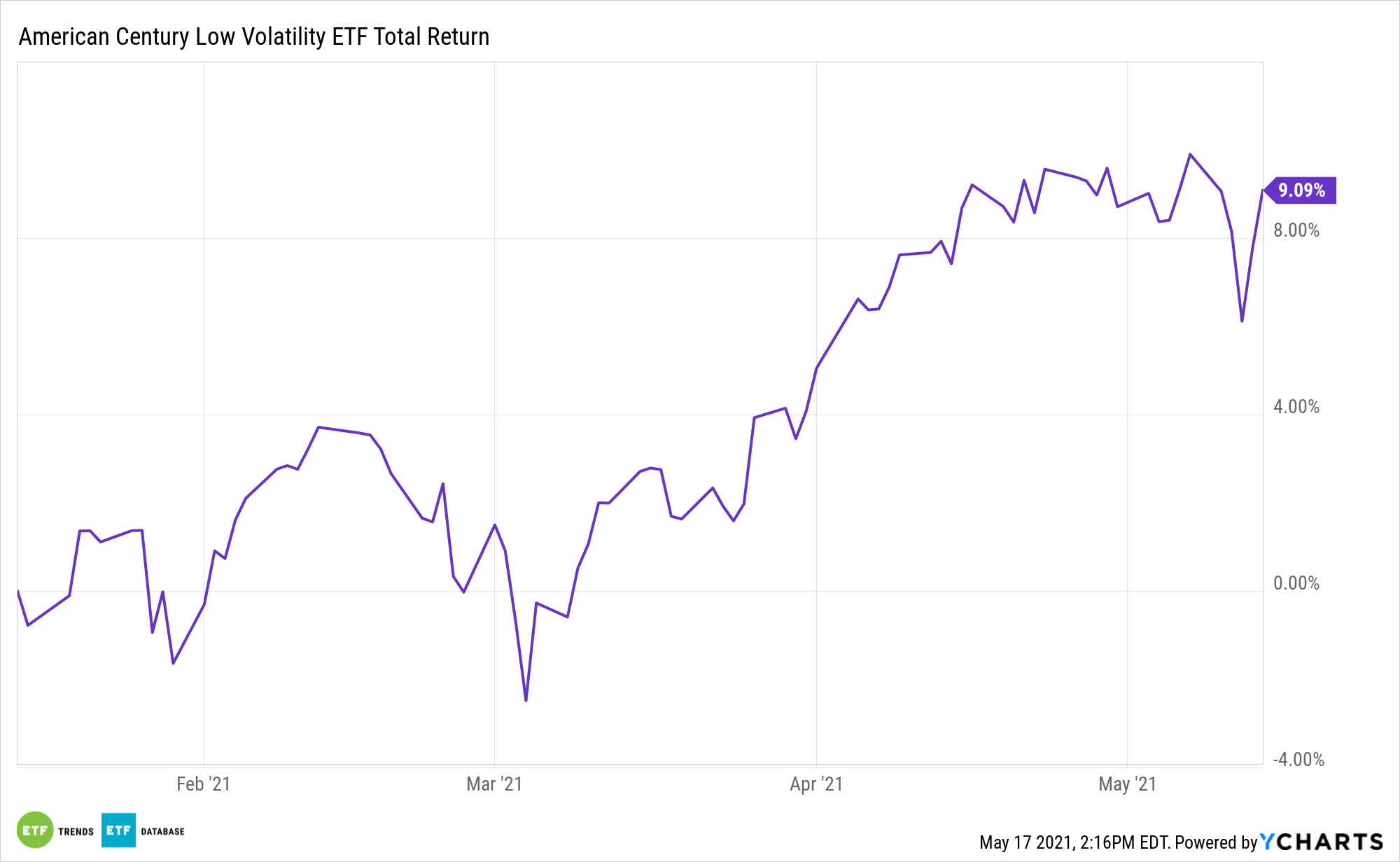

Traders who’re anxious about additional market swings can check out a low-volatility ETF technique to restrict draw back dangers. For instance, the American Century Low-Volatility ETF (LVOL) is designed for traders to mood volatility utilizing American Century’s proprietary lively methodology. American Century Low Volatility ETF’s managers use quantitative fashions to pick securities with engaging fundamentals that they anticipate will present returns that may fairly observe the market over the long-term whereas looking for much less volatility.

For extra information, info, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.