Confluence Funding Administrati

Confluence Funding Administration presents varied asset allocation merchandise that are managed utilizing “high down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e-book.

Gold moved steadily greater from the late summer time of 2018 into final August. Costs declined towards 1,700 into March however have been recovering since. On this report, we are going to replace our views on the steel.

[wce_code id=192]

We’ve got been holding gold in our asset allocation portfolios since 2018, though we’ve diversified our commodity holdings by including a broader commodity ETF alongside our gold place. After we checked out gold in March, we famous that there was a divergence between the short- and long-term elementary components.

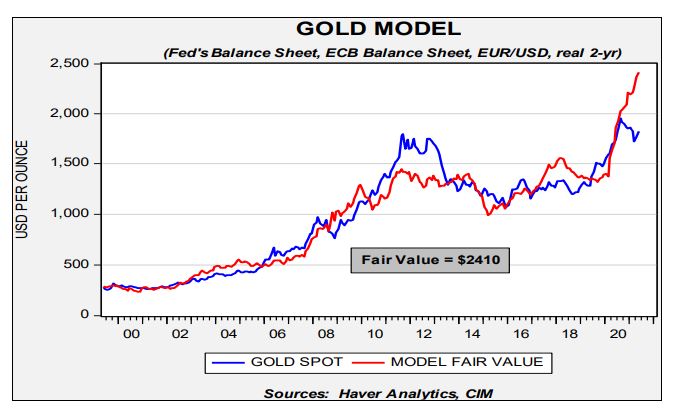

The long-term outlook for gold stays constructive. Our fundamental gold mannequin, which makes use of the steadiness sheets of the Federal Reserve and the European Central Financial institution, the EUR/USD change fee, and actual two-year T-note yields, together with the U.S. fiscal deficit relative to GDP counsel that costs are considerably undervalued and have grow to be extra so since March.

On the identical time, like in March, there are a number of short-term components which are much less bullish than our long-term mannequin. One in all these is longer-duration rates of interest.

This chart exhibits the true 10-year yield derived from the TIPS unfold in opposition to Treasuries. The actual yield is inverted on the chart scale. Observe that just lately the true yield started to say no (grow to be extra unfavourable). Regressing the connection generates a good worth of 1,772.44, which is $55.79 greater than our final replace. This truthful worth is beneath the place gold is buying and selling now. As well as, we’ve seen gold flows into exchange-traded merchandise merely stabilize, which is inconsistent with the latest rally in gold.

In our final replace, 10-year T-note yields had been rising steadily. The rise has stopped, and yield ranges have consolidated. Our 10-year T-note yield mannequin is projecting a good worth yield of round 1.75%. The stall in yields has performed a job in lifting gold costs. Nonetheless, an important issue will be the latest decline in bitcoin.

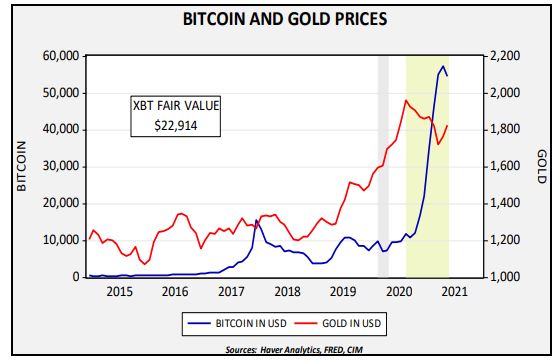

Cryptocurrencies share an identical attribute with gold; they each present retailer of worth. Though they’re considerably positively correlated since 2015 (+66%), since August 2020 (proven in mild inexperienced on the chart), gold and bitcoin are inversely correlated to the tune of 89.1%. This transformation of signal means that the 2 at the moment are seen as competing merchandise and, till just lately, bitcoin was the clear winner. The latest turnaround most likely displays regulatory considerations surrounding bitcoin. Cryptocurrencies are sometimes utilized in ransomware assaults and different legal exercise. The high-profile Colonial Pipeline occasion has raised considerations in regards to the lack of ability of police to hint bitcoin funds. If regulators clamp down on bitcoin, buyers will possible return to gold for defense in opposition to inflation considerations.

Previous efficiency is not any assure of future outcomes. Info supplied on this report is for academic and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a suggestion. The funding or technique mentioned is probably not appropriate for all buyers. Traders should make their very own choices primarily based on their particular funding goals and monetary circumstances. Opinions expressed are present as of the date proven and are topic to alter.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s primarily based upon sources and information believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to alter. This isn’t a solicitation or a proposal to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.