Confluence Funding Administration affords varied asset allocation merchandise that are managed utilizing “prime down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e book.

Could 7, 2021

Yogi Berra is legendary for varied quotes. He famously mentioned, “All the time go to different individuals’s funerals, in any other case, they gained’t come to yours.” He additionally famous that, “A nickel isn’t value a dime anymore.” The one we take care of most in asset allocation is the saying, “It’s powerful to make predictions, particularly in regards to the future.” However, as Hyman Roth remarked, “That is the enterprise we now have chosen.”

So, how can we make predictions? Our asset allocation course of makes use of a committee strategy and provides every member the liberty to create their very own methodologies to reach at their forecasts. This method has labored out fairly effectively, partially as a result of there may be sufficient variety of strategies and opinions to cowl a variety of potentialities. From there, the committee involves a consensus in regards to the return, threat, and yield of 12 completely different asset lessons.

[wce_code id=192]

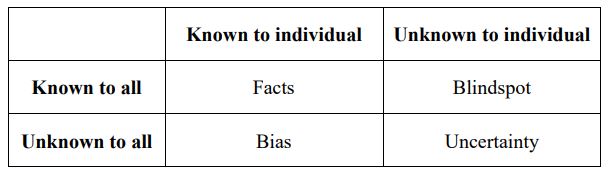

One approach to study this situation is to adapt a instrument from psychology referred to as the “Johari Window.”

This scheme was utilized by Secretary of Protection Rumsfeld in his well-known “known-unknowns” press convention. For our functions, the “Information” quadrant, quadrant one, is actually historical past. This quadrant accommodates factual info—what we all know is true. The second quadrant, “Blindspot,” is the world of known-unknowns. That is the place we all know an element is vital, however we don’t know what the end result will likely be fairly but. That is the world of threat, the place some extent of chance may be assigned. The opposite two quadrants are “Bias” and “Uncertainty.” Quadrant 4, the uncertainty zone, is the place we aren’t even conscious of the excellent dangers. The third quadrant, the zone of bias, is the place we expect we all know one thing however, actually, we don’t.

To an awesome extent, quadrants three and 4 are the place the issues lie. Of the 2, bias is in all probability probably the most harmful. That is the area of perception. John Maynard Keyes summed up this situation with the next quote:

Sensible males, who consider themselves to be fairly exempt from any mental affect, are normally the slaves of some defunct economist. Madmen in authority, who hear voices within the air, are distilling their frenzy from some tutorial scribbler of some years again.

That is the place narratives can dominate pondering and blind us to different doable outcomes. It’s in all probability unattainable to be a bias-free human. All of us carry self-evident truths that assist us handle our lives. The important thing level is to pay attention to them. One of many advantages of a committee construction, at the very least one with sufficient variety, is that the bias threat may be offset by having “competing biases.” An much more efficient committee might help every member develop into extra conscious of their particular person biases as effectively.

Quadrant 4, the world of the unknown, can solely be divined by instinct. For probably the most half, that is the world the place occasions haven’t occurred earlier than or happen so occasionally that there isn’t a lot historical past to work with. It isn’t unattainable to foretell these outcomes, however it isn’t straightforward. And, it’s practically unattainable to get it proper persistently. The historical past of markets is suffering from analysts who had been “one-hit wonders,” having made an awesome name as soon as with out repetition. A course of by which a number of members intuit the unknown at the very least affords the possibility of an accurate evaluation.

Right here is an instance utilizing the Johari Window with a present market situation. There may be presently nice concern about inflation. Here’s what we all know:

- Cash provide progress is at document ranges, up 25% on a yearly foundation;

- The FOMC has modified its coverage to finish its major concentrate on inflation management;

- Fiscal coverage is increasing quickly.

All these components would assist rising inflation dangers. Offsetting these dangers are:

- The majority of money stays on the stability sheets of the prosperous;

- The U.S. economic system stays largely open, which means that imports might help comprise inflation;

- Family debt ranges stay elevated and “scarring” from the pandemic will in all probability preserve households cautious about spending.

So, what did the Asset Allocation Committee do, in gentle of those components?

- We acknowledged the rising inflation threat effectively earlier than the present state of affairs. Now we have had an allocation to valuable metals for practically three years and have utilized bond ladders in portfolios with fastened earnings. Now we have additionally included an allocation to commodities for a yr now.

- On the similar time, given the distribution of money, there’s a likelihood that asset inflation might happen, at the very least within the close to time period. Worth inflation will want much less inequality. Thus, we’re chubby equities.

- We additionally count on that coverage will result in a weaker greenback, and so we maintain a sizeable allocation to worldwide equities.

Basically, Confluence’s asset allocation course of makes an attempt to take what we all know and assess the quantifiable dangers, primarily based on historical past, think about what would possibly occur that’s unsure, and ensure we don’t assume outcomes that is probably not in keeping with what we all know.

Previous efficiency isn’t any assure of future outcomes. Data supplied on this report is for instructional and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. The funding or technique mentioned is probably not appropriate for all traders. Buyers should make their very own choices primarily based on their particular funding aims and monetary circumstances. Opinions expressed are present as of the date proven and are topic to alter.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s primarily based upon sources and knowledge believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to alter. This isn’t a solicitation or a proposal to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.