Confluence Funding Administration gives varied asset allocation merchandise that are managed utilizing “high down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e book.

The pandemic-related expanded advantages for the unemployed are anticipated to finish in September. States which have ended the booster early have seen a sharper decline in preliminary claims than states that haven’t ended them. Though the tip of enhanced employment advantages might assist resolve the labor scarcity, there may be additionally the chance that it might result in a rise within the unemployment price. If this occurs, this might drive the Fed to rethink its choice concerning when to scale back its coverage lodging. On this report, we’ll focus on the chance that the unemployment price might rise and the way it might affect financial coverage.

At the moment, the labor market seems to be enhancing. Nationwide persevering with jobless claims have fallen from an all-time excessive of 23 million in March 2020 to three.5 million in June 2021. Moreover, throughout this time-frame, the unemployment price fell from 14.8% to five.9%. The labor market has tightened so rapidly over the previous few months that corporations have struggled to search out employees to fill their open positions. Nonetheless, this labor tightness is considerably deceptive. Persevering with claims, presently at 3.Three million, stay properly above the historic common of two.Eight million. As well as, employment has not recovered to its pre-pandemic peak. Lastly, labor shortages stay particularly unhealthy particularly industries, most notably, Leisure and Hospitality and Transportation and Warehousing.

[wce_code id=192]

Because the begin of 2020, many corporations have been compelled to restrict their working capability to satisfy COVID-19 restriction tips. Corporations, significantly in providers, had been compelled to scale back the variety of clients they might serve, restrict their choices, and, in some instances, briefly shut right down to adjust to restrictions. Consequently, there was an enormous drop-off in hiring within the providers sector initially of the pandemic. Though the removing of restrictions led to a resurgence in hiring, the restoration was uneven.

Because the restoration accelerated, corporations started to quickly enhance hiring. Providers associated to tourism and journey, particularly, noticed a spike in gross sales. Client expenditures on journey and airways have doubled from the prior 12 months. Consequently, corporations that discovered themselves understaffed started elevating wages. When that didn’t work, states voluntarily withdrew from the prolonged unemployment advantages program to extend the dimensions of the out there workforce. Though considerably profitable, the initiative highlights the truth that there are nonetheless lots of employees that haven’t dedicated to in search of work. Therefore, when prolonged advantages finish in September, it might result in a rise within the variety of unemployed folks genuinely in search of work.

Though advantages recipients are technically required to search for work, some states have been lenient on imposing it. Subsequently, the tip of prolonged advantages might result in a rise within the civilian labor drive, thus pushing up the unemployment price. It’s because the unemployment price is calculated as a ratio of unemployed individuals to the civilian labor drive. The civilian labor drive is outlined as these working plus those that are unemployed however actively in search of employment. If those that are counting on the expanded advantages resolve to hitch the labor drive, ending expanded advantages could broaden the labor drive and regular frictional labor market points could, not less than briefly, result in an increase within the unemployment price.

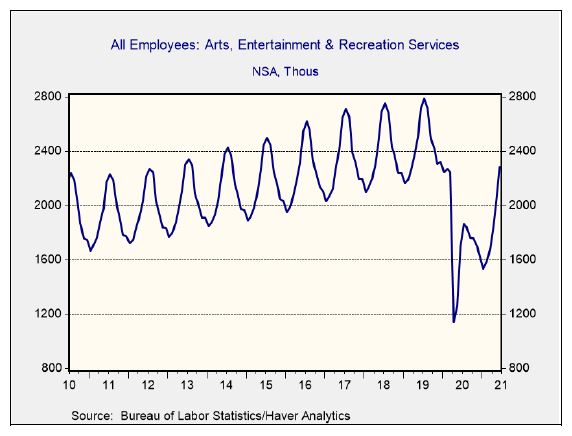

The timing of the expiration of the expanded advantages may additionally play a job. Lots of the new jobs which have been added during the last 5 months have come from industries which are historically seasonal. For instance, leisure and hospitality accounted for 60% of the roles created in that interval. For comparability functions, the sector has accounted for 20% of the roles created within the final decade. This downside turns into extra obvious when you think about {that a} rising share of Leisure and Hospitality jobs are coming from Arts, Leisure, and Recreation, a sector identified for its seasonal swings. In different phrases, ending the expanded advantages may lead folks again into the labor market at a time when corporations are beginning to sluggish their hiring.

In response to the June jobs report, St. Louis Federal Reserve President James Bullard advised that the labor market could also be tighter than it appears. Given Federal Reserve Chair Jerome Powell’s give attention to full employment in guiding financial coverage, Bullard’s feedback had been considered moderately hawkish. Thus, if the removing of the expanded advantages proves profitable in bringing folks again into the labor drive, it might result in an increase within the unemployment price. Though we imagine {that a} rise within the unemployment price will probably be short-term, it might additionally decelerate the drive to take away coverage lodging. Subsequently, an increase within the unemployment price might be favorable for threat belongings.

Previous efficiency is not any assure of future outcomes. Data supplied on this report is for instructional and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. The funding or technique mentioned will not be appropriate for all traders. Buyers should make their very own choices primarily based on their particular funding goals and monetary circumstances. Opinions expressed are present as of the date proven and are topic to vary.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s primarily based upon sources and knowledge believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to vary. This isn’t a solicitation or a suggestion to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.