By Asset Allocation Committee | PDF

By Asset Allocation Committee | PDF

Confluence Funding Administration presents varied asset allocation merchandise that are managed utilizing “high down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e book.

March 26, 2021

(Observe: As a result of upcoming Good Friday vacation, the subsequent report might be revealed on April 9.)

Since peaking in August, gold costs have been underneath stress.

[wce_code id=192]

Technically, costs broke assist round 1750 in early March and have been making an attempt to consolidate.

We have now been holding gold in our asset allocation portfolios since 2018, though the extent was lowered in the newest rebalance so as to add a place in broader commodities. As the value languishes, how ought to buyers view gold? What’s the outlook?

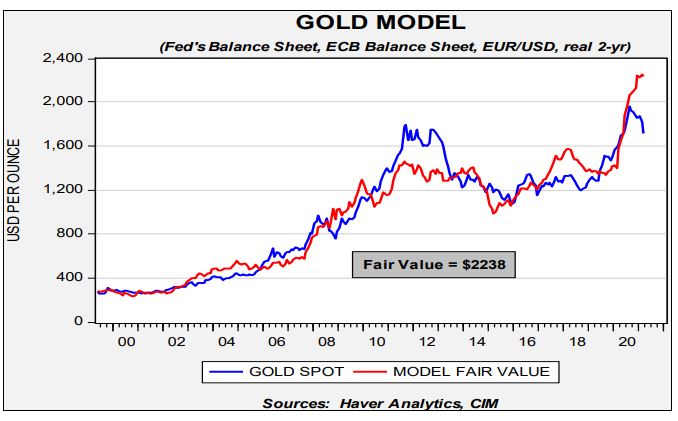

The long-term outlook for gold stays constructive. Our fundamental gold mannequin, which makes use of the stability sheets of the Federal Reserve and the European Central Financial institution, the EUR/USD trade charge, and actual two-year T-note yields, means that costs are considerably undervalued.

Then again, there are a number of short-term components which can be weighing on costs. A very powerful is rising long-duration Treasury yields.

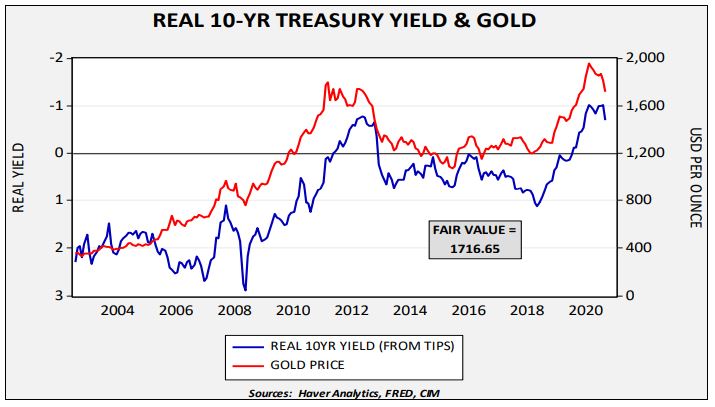

This chart exhibits the actual 10-year yield derived from the TIPS unfold towards Treasuries. The actual yield is inverted on the chart scale. Observe that not too long ago the actual yield started to rise (turn out to be much less adverse). Regressing the connection generates a good worth of 1716.65, which is round the place gold is buying and selling now. As well as, we now have seen gold flows into exchange-traded merchandise wane not too long ago, including further stress.

If the FOMC is critical about boosting employment, financial coverage ought to stay accommodative; the issue for policymakers is {that a} steepening yield curve will are likely to raise long-term rates of interest additional. If the Fed permits the 10-year T-note to “discover its pure stage,” then we might count on charges to succeed in 1.90% to 2.00%. That doubtless means further short-term stress on gold costs. Sooner or later, we do count on the FOMC to take steps to halt the rise in long-term Treasury charges which can doubtless raise gold costs. However, till that occurs, gold will doubtless wrestle to rally.

Previous efficiency is not any assure of future outcomes. Data supplied on this report is for instructional and llustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. The funding or technique mentioned might not be appropriate for all buyers. Traders should make their very own selections based mostly on their particular funding aims and monetary circumstances. Opinions expressed are present as of the date proven and are topic to alter.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s based mostly upon sources and information believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to alter. This isn’t a solicitation or a proposal to purchase or promote any safety.

View PDF

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.