Confluence Funding Administrati

Confluence Funding Administration affords numerous asset allocation merchandise that are managed utilizing “prime down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e-book.

In March, job openings rose to their highest stage on report. In keeping with the Job Openings and Labor Turnover Survey (JOLTS), there have been over 8.1 million job vacancies, surpassing the earlier report of seven.6 million set in November 2018. The surge in vacancies is supported by knowledge from Certainly displaying that job postings within the final week of March have been 15.7% above their pre-pandemic ranges and have been 24.2% increased within the following month.In distinction to the JOLTS report, the newest employment report from the Bureau of Labor Statistics confirmed a basic slowdown in hiring. Non-farm payroll progress in April got here in at a seasonally adjusted 266,000, properly under the earlier month’s improve of 770,000 and much wanting the anticipated improve of 1,000,000. The hole between job openings and new hires has created angst amongst buyers and policymakers alike. There are rising fears that the hole between openings and new hires might mirror flawed coverage incentives, resembling overly beneficiant employment advantages or a scarcity of childcare. Nonetheless, our analysis means that the underlying explanation for the hole could also be because of individuals weighing choices outdoors of employment.[wce_code id=192]

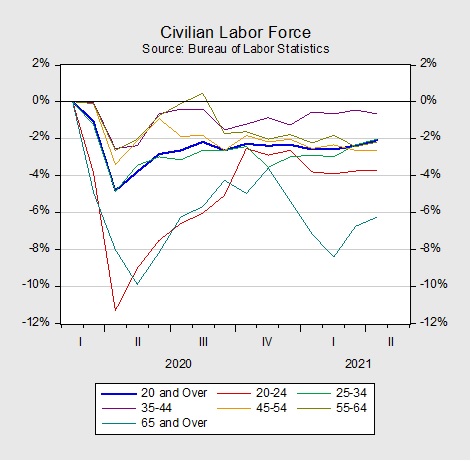

The chart above exhibits the share change within the labor power since February 2020. The civilian labor power, which incorporates employees which might be both employed or on the lookout for work, is 2% under the pre-pandemic ranges for all individuals 20 years and older. The 35- to 44-year-old age group has been probably the most desperate to return to the labor power and is approaching pre-pandemic ranges, whereas the youngest (20-24 years outdated) and oldest (65 years and older) cohorts have been the most important drags on the labor power.

The reluctance of older and youthful employees to rejoin the labor power could also be because of these teams having comparatively extra alternate options to employment. Staff between the ages of 20 to 24 years have the choice of going again to highschool, whereas the older era has the flexibility to enter retirement. Information counsel there could also be some fact to this declare. Though enrollment for bachelor’s levels in 2020 dropped 2.2% from the prior yr, graduate and doctoral levels have truly elevated 5.2% and three.6%, respectively. Furthermore, throughout the top of the pandemic, there was a surge within the variety of individuals 65 years and older who utilized for Social Safety advantages. Though this pattern has cooled in current months, the variety of child boomers retiring greater than doubled from 1.5 million in 2019 to three.2 million in 2020.

A rise in labor’s negotiating energy might have additionally contributed to individuals weighing their choices earlier than returning to the labor power. Desirous to hit the bottom working because the economic system begins to reopen, corporations have begun decreasing their academic necessities for sure positions as a way to entice extra candidates. In consequence, there was a surge in job postings requiring lower than a bachelor’s diploma. Moreover, the current pay will increase at main corporations resembling Amazon (AMZN, $3,174.74), Walmart (WMT, $137.92), and Goal (TGT, $209.29) might have inspired employees to carry out for higher-paying jobs. In keeping with analysis from Tracktherecovery.org, high-wage and medium-wage employment have both surpassed or are approaching pre-pandemic ranges, whereas low-wage employment is down practically 30%. This implies that low-wage earners might need to bide their time earlier than returning to the labor power.

Hostile incentives could also be one other contributing issue to the labor scarcity. The dearth of childcare might have made it troublesome for single and married employees with youngsters to seek for new work, whereas single individuals with no youngsters might discover the beneficiant unemployment advantages a extra enticing choice than taking an precise job. This may increasingly clarify why the labor power for married individuals with no youngsters has virtually returned to pre-pandemic ranges. If we’re right, the choice by some states to take away the pandemic booster to unemployment advantages might raise employment. However, it might not cease the youngest and oldest cohorts from contemplating going again to highschool or getting into retirement.

Briefly, getting again to work could also be a pretty choice to those that have restricted alternate options to employment, have excessive incomes energy, or aren’t burdened by childcare prices. For others, the choice to return to the labor market could also be extra difficult. The prospect of early retirement or persevering with one’s training might be extra enticing than accepting a job supply. The choice is additional difficult by some competing corporations providing increased wages. Lastly, the dearth of childcare and beneficiant unemployment advantages may be complicating components. Nonetheless, all issues thought of, the labor power scarcity will doubtless work itself out over time. Though older employees might enter or stay in retirement, the youthful employees will doubtless come again to the labor power with extra abilities. Within the meantime, we anticipate that the labor power scarcity might have a combined but delicate impression on the economic system. The longer individuals keep out of the workforce, the extra they have to depend on financial savings to fund day-to-day actions, which can’t be maintained perpetually.

View PDF

These stories have been ready by Confluence Funding Administration LLC and mirror the present opinion of the authors. Opinions expressed are present as of the date proven and are based mostly upon sources and knowledge believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to vary. This isn’t a solicitation or a proposal to purchase or promote any safety. Previous efficiency isn’t any assure of future outcomes. Info supplied on this report is for academic and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. Investments or methods mentioned is probably not appropriate for all buyers. Traders should make their very own choices based mostly on their particular funding targets and monetary circumstances.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.