If you’ve ever questioned what trillion

If you’ve ever questioned what trillions of {dollars} in financial and monetary stimulus appears like, it seems you bought your reply. All the things is up proper now.

Shares are up. Earnings are up. Shopper spending is up. Commodities are up. Meals costs are up. Dwelling costs are up. Automotive costs are up. Cryptos are up.

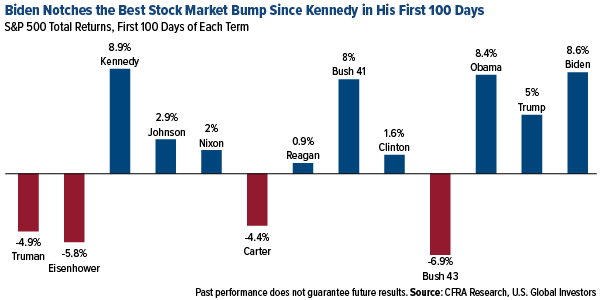

Final week marked President Joe Biden’s 100th day in workplace. Since Inauguration Day, the S&P 500 has elevated a formidable 8.6%. These are the most effective returns for the beginning of a presidential time period since Kennedy in 1961. All these stimmy checks need to go someplace.

click on to enlarge

With the Federal Reserve signaling it is going to preserve accommodative measures in place for a while longer, and Biden making the case for trillions extra in authorities spending, is that this what we will count on going ahead?

And with every thing up, the place are the worth shopping for alternatives?

Ache on the Automotive Lot and Grocery Retailer

Earlier than I get into that, it’s essential I level out that not each instance of value appreciation is being pushed strictly by stimulus checks and money-printing. Pandemic lockdowns are nonetheless having an enormous impact on the worldwide provide of every thing from constructing supplies to semiconductor chips, which is driving up manufacturing prices which might be being handed on to customers.

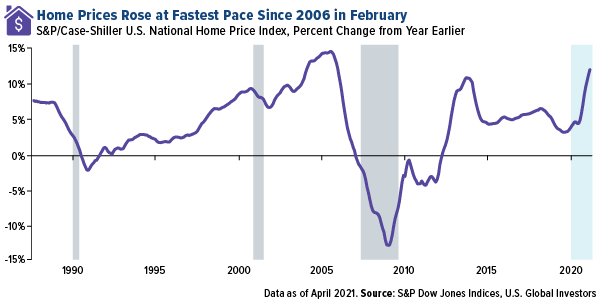

Take lumber. As a result of sawmills have had hassle ramping up manufacturing to fulfill demand, the worth of framing lumber has skyrocketed 250% over the previous 12 months to round $1,200 per thousand board toes. This has added near $36,000 to the worth of a brand new residence, in response to the Nationwide Affiliation of Dwelling Builders (NAHB).

Certainly, residence costs surged 12% in February in comparison with the identical month final yr, S&P Dow Jones Indices reported final week. That’s the quickest annual tempo since 2006, quickly earlier than the housing bubble burst.

click on to enlarge

Or take the continued chip scarcity, which has been exacerbated in latest months by the winter freeze in Texas and a hearth at Japan’s Renesas Semiconductor Manufacturing plant. In accordance with Goldman Sachs, the scarcity has impacted a whopping 169 industries, most notably carmakers. Final week Common Motors President Mark Reuss instructed Fox Enterprise that the disaster “might be the worst disaster I’ve seen within the auto trade, at the least in my profession, by way of provide chain.”

Because of this, the worth of used automobiles, as measured by the Manheim Used Car Worth Index, has elevated 52% over the previous yr. Preowned pickups have jumped an unbelievable 75%.

After which there’s meals and client staples similar to diapers and bathroom paper. Just lately I shared with you that corn costs have virtually doubled over the previous yr, and final week Bloomberg reported that corn has gotten so expensive that some farmers are feeding their livestock wheat meant for human consumption. A number of client items giants, from Procter & Gamble to Kimberly-Clark, have all introduced they’ll be elevating their costs within the coming months as commodity costs proceed to soar.

Copper Close to Report Highs

Iron ore and copper are each close to document highs on tight provide and powerful demand from China. Copper traded above $10,000 per tonne final week, its highest stage in 10 years, as buyers anticipate additional provide constraints on world efforts to decarbonize and electrify every thing.

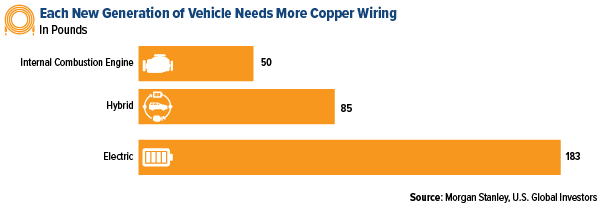

To provide you some concept of what I’m speaking about, the NAHB final week really helpful to homebuilders that they need to begin pre-wiring new homes for electrical automobile (EV) charging. That requires extra copper wiring within the residence in addition to the automobile.

A number of automotive producers have already introduced they’ll be phasing out inside combustion engine (ICE) automobiles in favor of EVs between 2025 and 2040. As I’ve talked about earlier than, EVs require three to 4 occasions as a lot copper wiring as a conventional automobile. Morgan Stanley experiences that ICE automobiles use round 50 kilos of copper on common, in comparison with 85 kilos for a hybrid and as a lot as 183 kilos for an EV.

click on to enlarge

Ivanhoe Mines stays our favourite method to play the copper rally. The corporate, which reported phenomenal manufacturing outcomes in early April at its Kamoa-Kakula mission, has but to report first-quarter earnings. Nonetheless, different copper corporations have, and outcomes up to now have been wonderful. Brazil’s Vale, for example, reported unbelievable internet revenue of $5.6 billion, effectively above Wall Road estimates.

Gold Miners Ought to HODL

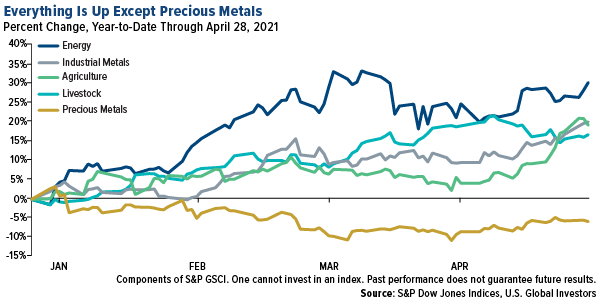

The chart under says all of it. Each commodity subindustry of the S&P GSCI is up double digits for the yr, with the one exception of valuable metals.

click on to enlarge

That’s the place I see the chance proper now. Not solely is gold on sale, however so are the gold and valuable metallic miners, significantly the royalty and streaming corporations. Whereas the NYSE Arca Gold Miners Index is down shut to five% for the yr, the large three royalty and streaming corporations have carried out comparatively effectively, with Franco-Nevada up 12%, Royal Gold up 6% and Wheaton Treasured Metals primarily flat.

As for the producers, I want to see them “HODL” gold as we anticipate larger metallic costs on unprecedented money-printing and monetary stimulus. (HODL, in case you’re not conscious, is crypto-trading lingo to explain a purchase and maintain technique.)

Between the U.S., Europe and China and others, we’ve spent a collective $17 trillion (and counting) to fight the coronavirus and the financial havoc it’s wreaked. Gold has traditionally tracked the expansion in cash provide, and in March, the sum of money circulating the worldwide economic system expanded greater than 17% in March in comparison with final yr, in response to Haver Analytics.

Crypto Costs Are Up, however What Concerning the Miners?

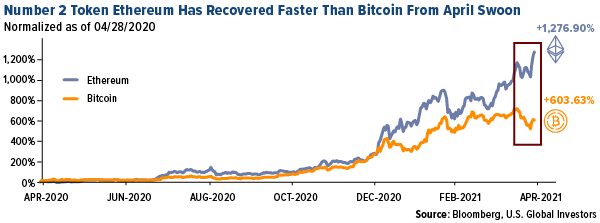

Talking of cryptos… Ether, the quantity two cryptocurrency by market cap, topped $3,000 for the primary time ever this weekend, outperforming Bitcoin, which continues to be off its latest excessive of over $63,000. Ether’s value surge might be associated to experiences that DeFi, or decentralized financing, is now a $100 billion trade. In actual fact, in response to calculations by CoinGecko, the market cap for DeFi cash, which incorporates Ether, now stands at greater than $128 billion.

click on to enlarge

Ether, Bitcoin and different cash additionally proceed to profit from Metcalfe’s regulation, which says {that a} community’s worth will increase geometrically because the variety of customers inside that community will increase. Visa, Paypal and Venmo have lately introduced they may enable their lots of of thousands and thousands of shoppers to use cryptos as a way of cost, whereas PayPal additionally permits buying and selling of Bitcoin, Ethereum, Litecoin and Bitcoin Money.

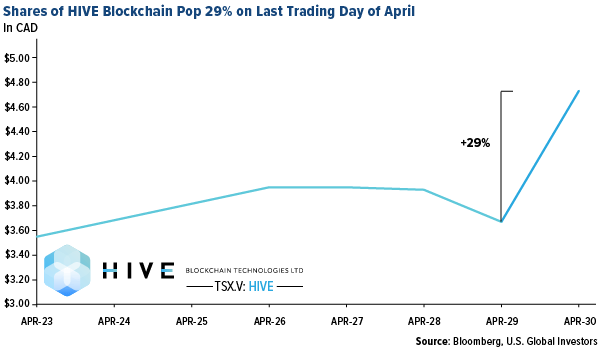

With cryptos up huge proper now, you could be questioning why the miners aren’t. HIVE Blockchain Applied sciences, the one miner that mines each Ether and Bitcoin utilizing 100% inexperienced vitality, is at the moment off about 44% from its 52-week excessive of C$7.25 in February. That’s after a virtually 30% achieve on Friday alone, its finest single-day bounce since December. It goes with out saying that the crypto-mining ecosystem stays extremely risky.

click on to enlarge

There could also be various contributing elements to the discrepancy between cryptos and miners, however as I see it, one of many largest includes Coinbase. As you already know, the crypto trade went public in mid-April in a direct itemizing. This had the impact of siphoning off billions in investor flows that will have as a substitute gone towards shares within the crypto miners. On the primary day of buying and selling alone, Coinbase CEO Brian Armstrong offered practically $292 million in shares. Different administrators and executives offered much more, with one pocketing greater than $1.Eight billion.

It’s essential to remember the fact that Coinbase hasn’t been listed for greater than 30 days proper now, so it nonetheless has that new automotive scent. I imagine buyers will rotate again into the miners similar to HIVE as soon as they see a bounce in earnings.

Initially revealed by US Funds, 5/3/21

All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data equipped by this/these web site(s) and isn’t answerable for its/their content material. Beta is a measure of the volatility, or systematic threat, of a safety or portfolio compared to the market as an entire.

The S&P 500 Index, or the Normal & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest U.S. publicly traded corporations. The S&P CoreLogic Case-Shiller U.S. Nationwide Dwelling Value Index (“the U.S. nationwide index”) measures the worth of single-family housing inside the US. The index is a composite of single-family residence value indices for the 9 U.S. Census divisions and is calculated month-to-month. The Manheim Used Car Worth Index is a measurement of used automobile costs that’s impartial of underlying shifts within the traits of automobiles being offered. Statistical evaluation is utilized to its database of greater than 5 million used automobile transactions yearly. The S&P GSCI serves as a benchmark for funding within the commodity markets and as a measure of commodity efficiency over time. It’s a tradable index that’s available to market members of the Chicago Mercantile Alternate. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded corporations concerned primarily within the mining for gold and silver. Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Blockchain Applied sciences. Mr. Holmes owns shares of HIVE whereas U.S. International Buyers owns convertible securities. Efficient 8/31/2018, Frank Holmes serves because the interim govt chairman of HIVE.

Holdings could change every day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Buyers as of (03/31/2021): Ivanhoe Mines Ltd., Franco Nevada Corp., Wheaton Treasured Metals Corp., Royal Gold Inc., Visa Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.