Inflation is high of thoughts proper now for a lot

Inflation is high of thoughts proper now for a lot of customers, companies and buyers. Responding to a current Financial institution of America survey, asset managers world wide agreed that inflation is the primary market threat, displacing COVID-19 for the primary time since February 2020.

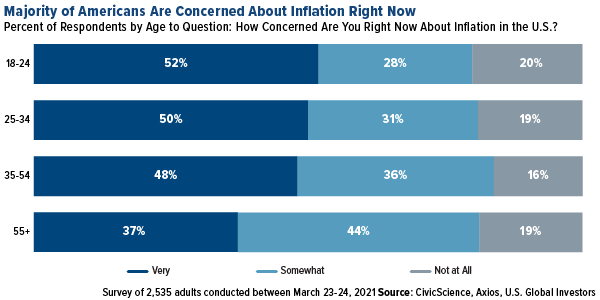

One other survey performed this month discovered that over three quarters of People had been both “very” or “considerably” involved about inflation. Maybe not surprisingly, youthful People who haven’t but reached their peak incomes years had been most anxious.

click on to enlarge

Loyal readers know I’ve been writing about this matter so much currently. There are numerous indicators that inflation is already right here: Commodity costs are up. Residence costs are up. Vitality costs are up. Transport charges are means up. Used vehicles and vehicles are by the roof.

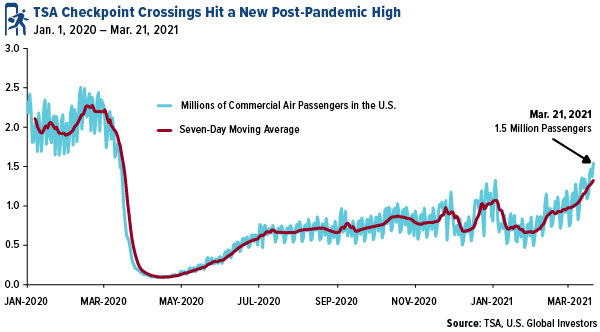

And the pattern is just going to speed up as social distancing is relaxed and the economic system steadily returns to “regular.” Final week, the Division of Labor reported that preliminary jobless claims fell to their lowest stage in a 12 months. Persons are beginning to journey once more. Final Sunday, March 21, greater than 1.5 million individuals boarded business flights, essentially the most since lockdowns started.

click on to enlarge

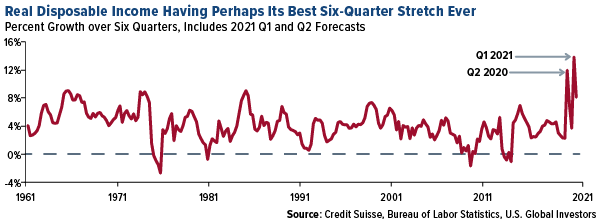

Due to “stimmy” checks and unprecedented cash printing, actual disposable earnings is about to have its largest enhance ever in any given six-quarter interval, says Credit score Suisse. The agency expects U.S. consumption to surge an “excessive” 10% this 12 months, triggering a major bounce in new orders and new hiring—all of which is very inflationary. This month, in actual fact, U.S. producers reported the sharpest rise in new orders since 2014, in accordance with IHS Markit.

click on to enlarge

The Pandemic Might Have Made the CPI Out of date

My query, as at all times, is whether or not we’re measuring inflation precisely. What if we’re doing all of it incorrect? As buyers, we wish to make selections primarily based on the perfect obtainable information, so what ought to we do if the information is incomplete or flawed?

Right here within the U.S., inflation is measured by the patron worth index (CPI), which is up to date month-to-month by the Bureau of Labor Statistics (BLS). The usual means BLS researchers do that is to actually go to shops and ask them for costs.

This strategy might sound intuitive, however a current Bloomberg article lists two elementary issues.

Primary, the CPI is predicated on a basket of products and providers that People could have spent cash on prior to now however whose gross sales suffered throughout the pandemic. Suppose leisure and recreation, eating places and accommodations, new garments and extra.

And two, with hundreds of shops and companies closed over the previous 12 months, researchers haven’t been in a position to make in-person visits, leaving gaping holes within the information. An entire lot of purchasing moved on-line in 2020—as a lot as $105 billion, in accordance with one estimate—the place month-to-month worth volatility could be far higher and extra speedy.

As Worldwide Financial Fund (IMF) economist Marshall Reinsdorf not too long ago put it: “Spending patterns modified abruptly, and the CPI weight abruptly grew to become out of date” (emphasis my very own).

Consequently, there could also be an enormous quantity of inflation that merely isn’t being detected.

The BLS is allegedly contemplating changes to its methodology to account for altering spending habits and preferences—which is a method of admitting that the information it produces is skewed.

However within the meantime, what will we as buyers do? One supply I’ve turned to time and again is Shadow Authorities Statistics, or ShadowStats, which offers alternate inflation information primarily based on the pre-1980 and pre-1990 methodologies. Utilizing these methodologies, client costs are growing by 9% or sooner, not 1.7%.

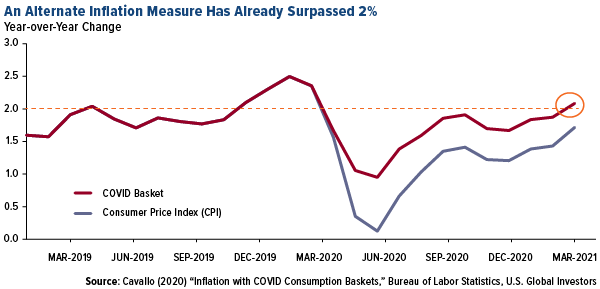

A Harvard economist, Alberto Cavallo, apparently constructed his personal index of products and providers that People truly purchased throughout the pandemic, primarily based on bank card transaction information. What this index exhibits is that inflation has been operating barely hotter than the CPI. In February, it truly surpassed the Federal Reserve’s goal inflation price of two%.

click on to enlarge

Time to Get Publicity to Actual Property?

With costs climbing sooner than what’s being reported, buyers could be sensible, I feel, to get publicity to belongings which can be seeing a number of the highest inflation proper now and which can be able to rise much more because the economic system expands. Which means actual belongings—metals and minerals, lumber, cement, power and different commodities and uncooked supplies. As I wrote in February, we could also be on the verge of a new commodities supercycle, and it’s not too late to start out collaborating.

That’s particularly the case now that President Joe Biden has signaled his subsequent legislative challenge might be infrastructure. This week we’re imagined to get additional particulars on his proposed $Three trillion spending bundle, however from what I’ve seen, $1 trillion of that might be dedicated to bettering roads, bridges, rail strains, ports, electrical grids and extra.

There’s a lot work to be finished, in any case. The American Society of Civil Engineers (ASCE) not too long ago gave U.S. infrastructure a C- and estimated the funding hole to be as excessive as $2.6 trillion.

Treasury Secretary Janet Yellen instructed the Home final week that taxes will possible should be raised to pay for such a large-scale operation. All of the extra cause to rotate into commodities and the businesses that produce them.

Initially revealed by US Funds, 3/29/21

Some hyperlinks above could also be directed to third-party web sites. U.S. World Traders doesn’t endorse all data equipped by these web sites and isn’t liable for their content material. All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions will not be acceptable to each investor.

The ASCE Committee on America’s Infrastructure, made up of 28 devoted civil engineers from throughout the nation with many years of experience in all classes, volunteers their time to work with ASCE Infrastructure Initiatives workers to arrange the Infrastructure Report Card and the US infrastructure grade scale. The Committee assesses all related information and studies, consults with technical and trade specialists, and assigns grades utilizing the next key standards: capability, situation, funding, future want, operation & upkeep, public security, resilience and innovation. The Shopper Worth Index (CPI) is a measure that examines the weighted common of costs of a basket of client items and providers, equivalent to transportation, meals, and medical care. It’s calculated by taking worth adjustments for every merchandise within the predetermined basket of products and averaging them.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.