Companies in basically each business are turning to enhanced automation strategies and industrial robots for 2 easy causes: to spice up efficiencies and enhance profitability.

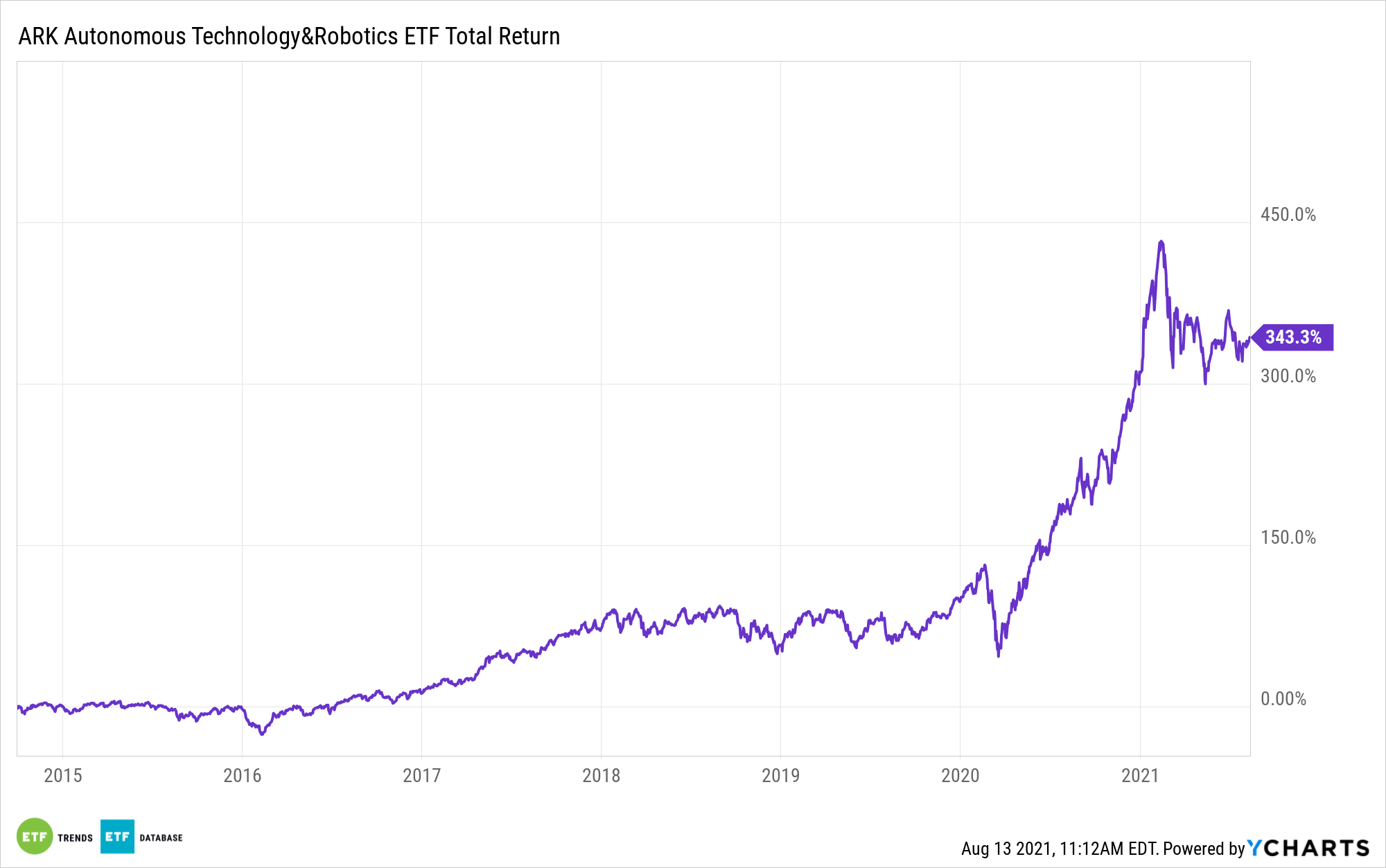

The ARK Autonomous Know-how & Robotics ETF (CBOE: ARKQ) is without doubt one of the alternate traded funds on the epicenter of that shift. Whereas ARKQ addresses new, disruptive ideas, the thought of automation altering industries has been round for a while. For instance, the evolution of farm trackers way back made farming extra environment friendly and worthwhile.

Making ARKQ interesting for socially-conscious buyers involved about automation’s impression on labor is the truth that growing automation might truly facilitate wage progress.

“Particularly, whereas automation may decrease labor’s share of the pie, it tends to spice up not solely working margins but in addition wage progress,” notes ARK analyst Sam Korus.

A Lengthy Runway for Development

Buyers are listening to extra about industrial robots being utilized in venues similar to Amazon warehouses or on car meeting traces, amongst others, however the truth is that this phase is barely scratching the floor of potential progress.

“Throughout the early 1990s, with solely 20 industrial robots per 10,000 staff, automation started to impression US manufacturing. Since then, robotic density has elevated greater than tenfold, and but its impression on agriculture means that the automation of producing nonetheless is in early days,” provides Korus.

On account of its standing as an actively managed fund, ARKQ is arguably higher outfitted to capitalize on automation tendencies and the proliferation of robots as a result of it isn’t constrained on the sector stage as are so many index-based methods.

On the finish of the second quarter, ARKQ allotted 28.6% of its weight to expertise shares – a predictable allocation for a fund of this stripe. Nevertheless, a 27.3% weight to client discretionary names is one instance of the fund’s flexibility.

One factor many ARKQ member corporations are already doing is driving labor as share of income decrease, in flip lifting working margins, a development that might show sticky over time.

“Decoupling bodily labor from output has been a trademark of technological innovation. Have been it not for horses and tractors, a big p.c of the US inhabitants nonetheless can be engaged on farms,” concludes Korus. “As an alternative, the historical past of agriculture means that automation will push labor’s share of producing income right down to unprecedented ranges whereas productiveness boosts the revenue of these nonetheless on the ranch.”

For extra on disruptive applied sciences, go to our Disruptive Know-how Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.