Industrial metals are nicely on their technique to being among the many high performers of 2020, su

Industrial metals are nicely on their technique to being among the many high performers of 2020, supported by crimson sizzling demand from China and world provide issues.

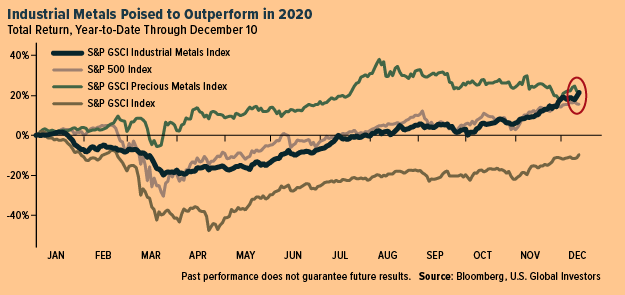

As of Friday, the MSCI Industrial Metals Index—which tracks the value of copper, nickel, aluminum and extra—was up 21.4% year-to-date, slightly below the index of valuable metals, up 21.9%. The broader S&P GSCI, which measures metals in addition to agricultural and energy-related commodities, was underwater by practically 10%.

As I’ve already mentioned, copper costs have been on a tear this yr thanks not solely to the financial energy of China, the metallic’s greatest client, but in addition due to its important position in nascent applied sciences reminiscent of electrical autos (EVs) and renewable inexperienced vitality.

The very hottest main commodity, nevertheless, has been iron ore. Used to make metal, the metallic has elevated practically 70% in 2020, with iron futures buying and selling on the Singapore Trade topping $155 per metric ton Friday for the primary time for the reason that contract got here on-line in 2013.

On the very coronary heart of this rally is quickly strengthening manufacturing unit exercise across the globe. In November, numerous nations’ manufacturing sectors had been in enlargement mode, in response to the month-to-month buying supervisor’s index (PMI), which is a number one indicator for demand.

However the large standout is China, the one main financial system to see a strong restoration following the pullback that was triggered by the coronavirus pandemic.

The U.S., by comparability, is rebounding properly, but it surely nonetheless has an extended technique to go earlier than it reaches pre-pandemic ranges. As of November, the variety of jobs within the nation was nonetheless under the February peak by practically 10 million.

Loads of Fuel within the Tank

I consider the rally is barely getting began, and we might see ever greater asset costs in 2021, for a few important causes.

Primary, President-elect Joe Biden plans to make infrastructure one in every of his high priorities quickly after taking workplace subsequent month. Proposals have the U.S. spending as a lot as $2 trillion not solely to enhance roads, bridges and seaports but in addition beef up the EV sector, add charging stations, convert faculty buses to zero emissions and extra.

Biden’s plans might appeal to non-public funding in infrastructure, together with from pension and insurance coverage funding funds, in response to Reuters. This, in flip, might prop up the bottom metals market.

The second large motive has to do with inflation pushed by extra stimulus packages and money-printing. Final week, legendary Bridgewater Associates cash supervisor Ray Dalio held an “Ask Me Something” occasion on Reddit, throughout which he stated that the “flood of cash and credit score” was unlikely to recede subsequent yr. As such, “property is not going to decline when measured within the depreciating worth of cash,” the billionaire investor urged.

All that cash might want to go someplace, in different phrases, and that features base metals and different commodities.

Congress is at the moment contemplating a $908 billion stimulus invoice that’s supported by the White Home. In response to Barron’s, the Worldwide Financial Fund (IMF) chief economist Gita Gopinath is urging Congress to move the aid bundle even on the danger of heating up inflation, which might be supportive of commodities.

Keep in mind, the Federal Reserve appears now not desirous about containing inflation. In August, Fed Chair Jerome Powell unveiled a brand new coverage method that may enable inflation to common 2% over time, that means value spikes month-to-month could be tolerated.

Rising Markets: “The Most Necessary Chart” as We Head Into 2021

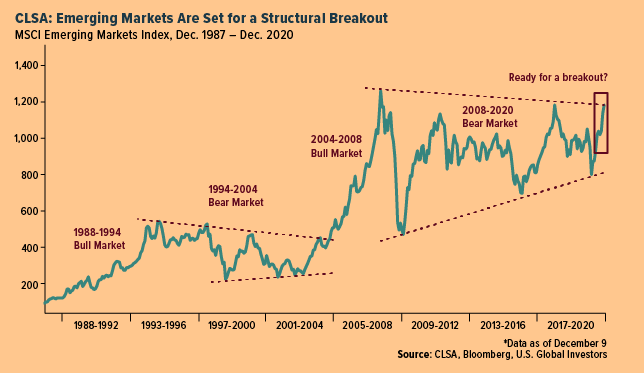

Apart from base metals, I’m additionally bullish on rising markets. Under is a chart that CLSA calls “a very powerful chart for world buyers to concentrate to as we go into 2021.”

In a report dated December 10, analysts on the Hong Kong-based monetary agency write that they see rising markets (EMs) providing the “best alternative” subsequent yr. In case you check out the chart, you possibly can see that the EM universe, as measured by the MSCI Rising Markets Index (MXEF), is at the moment testing resistance that goes again to late 2007.

If a breakout happens, CLSA says, it might be “just like the popularity part in 2004 following the 1994 – 2004 secular bear market sample.” To present you some thought of the returns EM buyers could have seen on the time, the MXEF elevated over 200% within the four-year interval ended December 31, 2007.

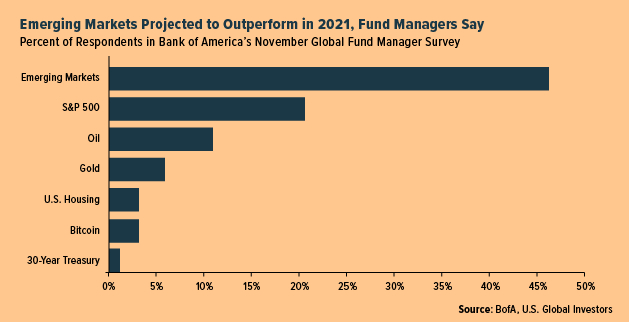

Waiting for 2021, I agree with CLSA and others in believing EMs look well-positioned to outperform, notably now that a couple of completely different COVID-19 vaccine candidates have gotten obtainable. In November, near half of fund managers taking part in a Financial institution of America survey stated they consider rising markets are poised to outperform subsequent yr, forward of the S&P 500, oil and gold.

In the meantime, JPMorgan factors out that EMs are at the moment under-owned on a relative foundation, and that after being largely ignored by buyers this yr, they may rally as a lot as 20% in 2021.

Engaging Dividend Yields

The EM funding case is strengthening much more because the U.S. has joined Europe and Japan in providing near-zero and even adverse actual yields. Greater than 75% of all debt issued by governments in developed markets (DMs) now trades at a adverse actual yield, in response to JPMorgan.

This phenomenon isn’t reserved only for authorities debt, although. For the primary time ever, investment-grade company debt within the U.S. trades with an efficient actual yield of 0%, the Wall Road Journal stories.

That is forcing yield-starved buyers to hunt options.

EMs might be such another. A few of the most tasty dividend yields are provided by shares listed in rising economies, notably these in Central and Jap Europe (CEE). For the yr up to now, dividend yields for Russian shares, as measured by the MOEX Russia Index, have averaged 6.5%. That’s practically 3.5 instances larger than the typical yield provided by U.S. shares over the identical interval. At just one.9%, the yield for the S&P 500 was just a few foundation factors above inflation.

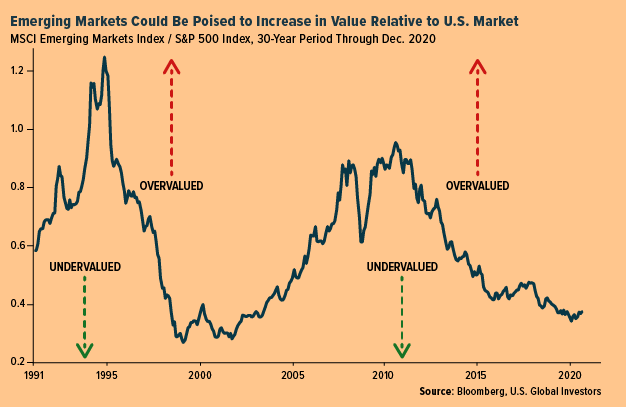

Undervalued In comparison with U.S. Market

In comparison with the U.S. market, EMs additionally look like undervalued, making now an thrilling entry level. The chart under exhibits you the ratio between the MSCI Rising Markets Index and S&P 500. As you possibly can see, EM shares are extra undervalued on a relative foundation now than at every other time for the reason that early 2000s.

HIVE a Crypto Proxy

A lot of you listened in to the current HIVE Blockchain Applied sciences webcast, the place we reported file income and money stream for the second quarter of fiscal 2021. I discussed that buyers are buying and selling HIVE as a proxy for the cryptocurrencies it mines, primarily Ethereum and Bitcoin.

Final week, the favored Motley Idiot funding recommendation web site advisable HIVE for that very motive.

“You may straight buy and maintain Bitcoin in your portfolio. However for many buyers, this can be too technical or too dangerous,” the location writes. As an alternative, it says, you may wager on HIVE, the primary publicly traded crypto-mining agency.

HIVE “is a handy proxy for cryptocurrency publicity,” Motley Idiot provides.

Shares of the corporate are up near 1,270% for the yr.

In search of tips about shopping for airline shares? Watch my most up-to-date instructional video by clicking right here! Remember to like and subscribe.

Initially revealed by US Funds, 12/14/20

All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions will not be applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. International Traders doesn’t endorse all info equipped by this/these web site(s) and isn’t liable for its/their content material.

Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Blockchain Applied sciences. Each Mr. Holmes and U.S. International Traders personal shares of HIVE. Efficient 8/31/2018, Frank Holmes serves because the interim government chairman of HIVE.

The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. corporations. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index relies on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment surroundings. The S&P GSCI Industrial Metals Index offers buyers with a dependable and publicly obtainable benchmark for funding efficiency within the industrial metals market. The S&P GSCI Valuable Metals Index offers buyers with a dependable publicly obtainable benchmark for funding efficiency within the valuable metals market. The S&P GSCI serves as a benchmark for funding within the commodity markets and as a measure of commodity efficiency over time. The MSCI Rising Markets Index is a free-float weighted fairness index that captures massive and mid-cap illustration throughout Rising Markets (EM) nations. The index covers roughly 85% of the free float-adjusted market capitalization in every nation. MOEX Russia Index is a cap-weighted composite index calculated primarily based on costs of essentially the most liquid Russian shares of the biggest and dynamically growing Russian issuers introduced on the Moscow Trade. The dividend yield, expressed as a share, is a monetary ratio (dividend/value) that exhibits how a lot an organization pays out in dividends every year relative to its inventory value. There isn’t any assure that the issuers of any securities will declare dividends sooner or later or that, if declared, will stay at present ranges or enhance over time.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.