Communication is essential, and one mor

Communication is essential, and one more strategy to play the reopening commerce. ETF buyers in search of a pure play on the communications sector can look to funds just like the Invesco S&P 500 Equal Weight Communication Providers ETF (EWCO).

FX Road just lately cited communications as one of many enhancing sectors amid the reopening. Inventory holdings in EWCO embrace acquainted communications names like T-Cellular and Verizon Communications, but in addition large tech names like Fb and Netflix.

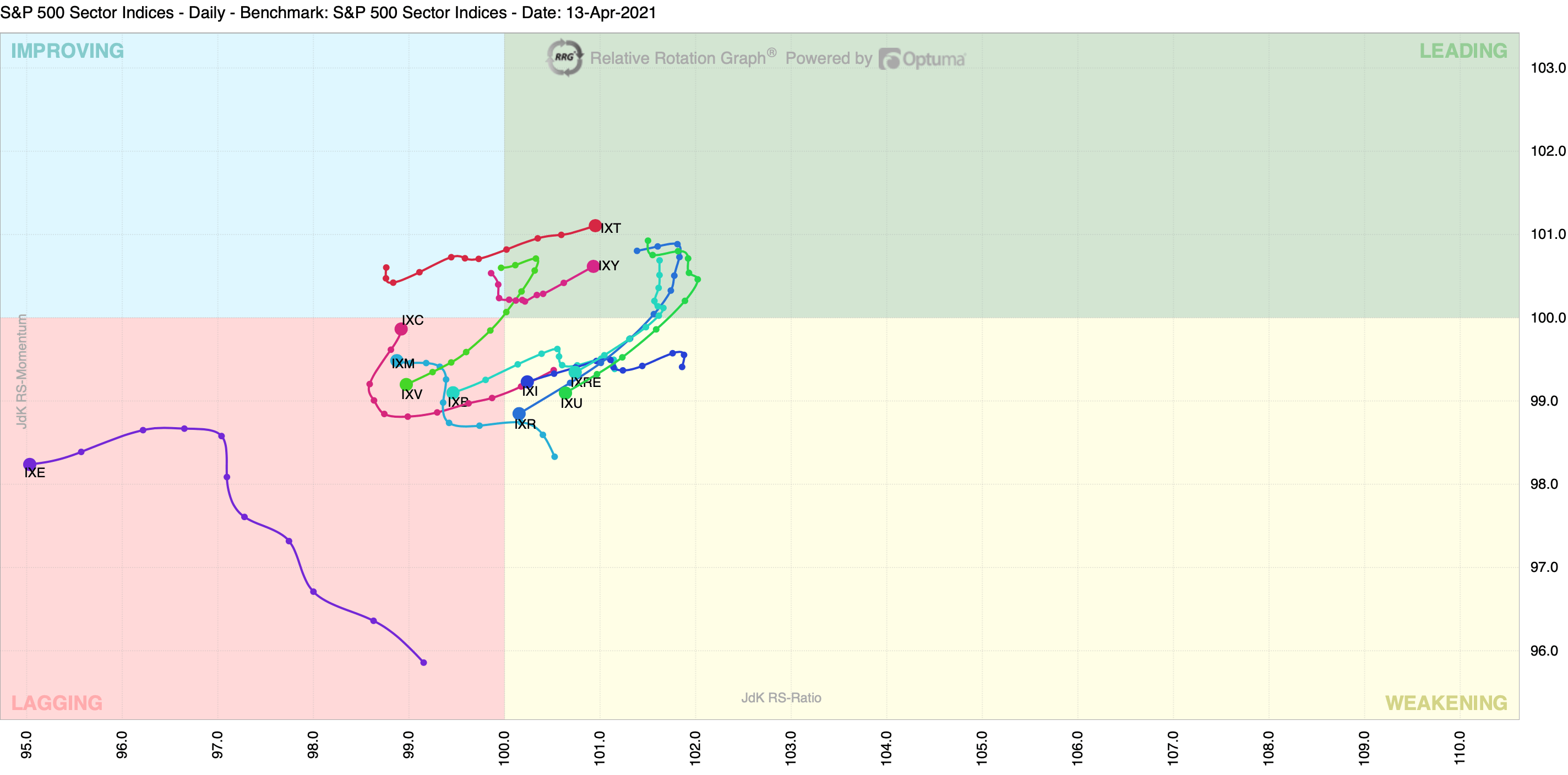

“Relative Rotation Graphs, generally known as RRGs, are a novel visualization instrument for relative energy evaluation,” Inventory Charts defined. “Chartists can use RRGs to investigate the relative energy traits of a number of securities towards a typical benchmark, and towards one another. The actual energy of this instrument is its capacity to plot relative efficiency on one graph and present true rotation.”

Under is the precise graph:

EWCO, which is up about 20% year-to-date, seeks to trace the funding outcomes of the S&P 500® Equal Weight Communication Providers Plus Index. The fund typically will make investments no less than 90% of its complete property within the securities that comprise the underlying index.

The underlying index consists of all the elements of the S&P 500® Communication Providers Plus Index, an index that incorporates the widespread shares of all corporations included within the S&P 500® Index which can be categorised as members of the communication providers sector, as outlined in keeping with the World Business Classification Commonplace (GICS). The fund makes use of a mixture of allocation kinds, however primarily operates inside giant cap worth, mix, and progress, with some mid cap worth and mix kinds added in.

Historical past Favoring an Equal Weight Technique?

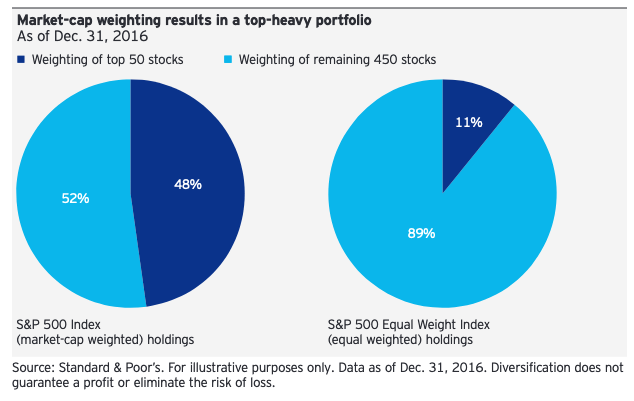

An Invesco “Technique Insights” report just lately highlighted the advantages of utilizing an equal-weighted funding method. The method contains diversification potential and traditionally greater returns when evaluating the S&P 500 Index and S&P 500 Equal Weight Index (EWI).

“Attributable to market-cap weighting, efficiency of the S&P 500 Index might be dominated by a small variety of shares,” the report mentioned. “The 50 largest securities within the index symbolize almost 50% of its weight, leaving the following 450 shares to account for the remaining 50%. The highest 50 shares within the S&P EWI, on the different hand, comprise simply 11% of that index.”

“Equal weighting means each inventory has the identical potential affect on the returns of the S&P EWI, whereas within the S&P 500 Index, a inventory with a weight of two% has 10 occasions the affect of 1 with a weight of simply 0.2%,” the report added.

For extra information and data, go to the Modern ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.