The Russell 2500 is up 16% half

The Russell 2500 is up 16% halfway via 2021, highlighting small cap energy, which is propelling positive factors in belongings just like the Constancy Small-Mid Cap Alternatives ETF (FSMO).

Along with the Russell 2500, the Russell Midcap is up 14.5% for the yr. Comparatively, the S&P 500 is up 13%.

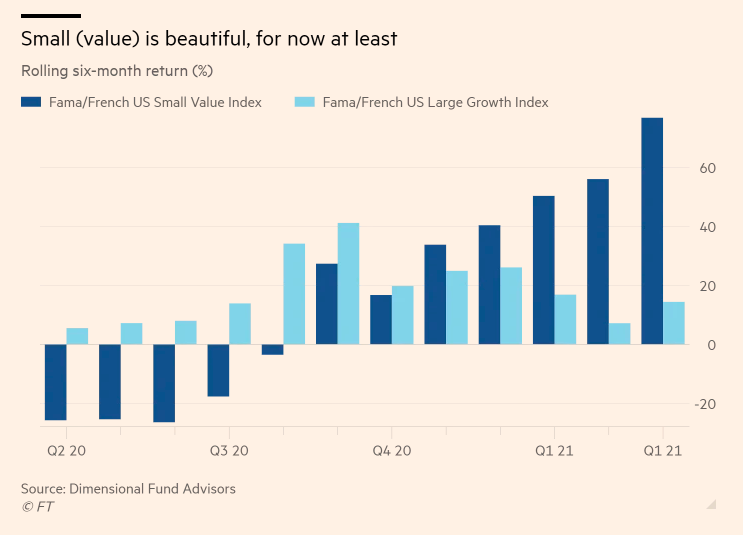

“Crushed up US small-cap worth shares outperformed large-cap progress ones by the most important margin because the depths of the second world warfare within the six months to the tip of March, information present,” a Monetary Occasions report mentioned. “The exceptional bounceback comes after a prolonged interval through which small-cap and worth shares have undershot the broader market, regardless of each being extensively recognised in tutorial papers as funding “fashion elements” which have traditionally generated long-term outperformance.”

The actively managed FSMO seeks long-term progress of capital. The fund operates pursuant to an exemptive order from the Securities and Trade Fee (Order) and isn’t required to publicly disclose its full portfolio holdings every enterprise day.

The fund usually invests not less than 80% of belongings in securities of firms with small to medium market capitalizations (which, for functions of this fund, are these firms with market capitalizations just like firms within the Russell 2500 Index). It invests in home and overseas issuers.

An Eye on Small Cap Worth

With a deal with elementary evaluation, FSMO can seize value-oriented small cap firms. Small cap worth has been on a tear as in comparison with giant cap progress.

“The return distinction [in the six months to March] was fairly eye-catching. It was excessive and it was fairly commonplace across the globe,” mentioned Wes Crill, head of funding strategists at Dimensional.

Including that part of worth may help clean out volatility since small caps could be extra prone to market actions.

“We stretched the rubber band a great distance in [the market] dropping 32 per cent in 23 days in March, and you’ll relaxation assured that small-cap worth in all probability went down twice as a lot relative to large-cap progress,” mentioned Jim Paulsen, chief funding strategist on the Leuthold Group.

“The forces of restoration, once we discovered that the pandemic wasn’t going to kill our civilisation or final for 5 years, meant we might see a powerful snapback within the issues that have been most affected,” added Paulsen. “We are able to’t have gone via one other interval in historical past the place we went from depression-like collapse to wartime growth inside a yr.”

For extra information and knowledge, go to the Sensible Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.