Looking to construct up revenue

Looking to construct up revenue in a sustainable approach? Take into account dividend progress ETFs.

Not like high-yield ETFs, which offer a large revenue enhance immediately, dividend progress ETFs concentrate on shares that steadily develop the dimensions of their dividends over time.

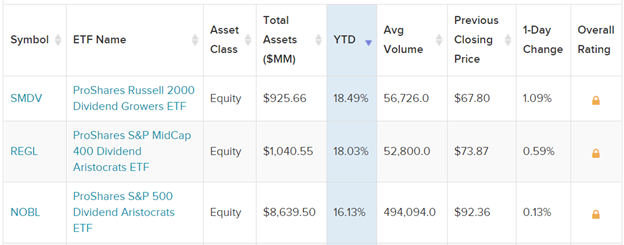

12 months-to-date, the highest performing dividend progress ETFs are all from ProShares, with small-, mid-, and large-cap focuses respectively.

Supply: ETF Database. Knowledge as of June 2nd, 2021.

Dividend Grower Reveals Small Cap Development Energy

Excessive-yield ETFs usually concentrate on established corporations that may make sizable payouts to shareholders relative to their inventory costs. That skews them towards massive cap shares.

In distinction, dividend progress ETFs are inclined to concentrate on the small- or mid-cap areas.

The ProShares Russell 2000 Dividend Growers ETF (SMDV) is simply such an ETF. SMDV focuses solely on the best high quality dividend growers within the Russell 2000 Index, which means the businesses have raised their dividends constantly over at the very least the previous ten years. The fund’s 75 holdings, that are equally weighted, usually exhibit robust monetary fundamentals, together with steady earnings and regular progress.

25% of the portfolio is in monetary shares, whereas one other 23% is in utilities and 20% in industrials. SMDV’s largest holding is in Aaron’s Firm (AAN), at 1.92% of its complete portfolio.

REGL Provides Regal Payouts

Up 18.03% on the 12 months, the ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) invests completely in mid cap corporations which have posted at the very least fifteen consecutive years of dividend progress.

Like SMDV, REGL’s portfolio is closely weighted towards industrials (29%), financials (28%), and utilities (18%).

At 2.03%, REGL’s prime holding is Nu Pores and skin Enterprises (NUS).

NOBL: Massive Caps Nonetheless Have Room to Develop

With a strong 16.13% progress on the 12 months, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) can also be a terrific possibility for dividend progress.

This ETF chooses investments based mostly on S&P 500 shares which have hit at the very least 25 years of consecutive dividend progress, searching for constant excessive payouts in addition to progress. Most of NOBL’s holdings have grown their dividends for 40 years or extra.

Not like the opposite two ETFs, NOBL has a big allocation to shopper staples shares (18%). One other 25% are in industrials. 11% resides in financials.

NOBL’s greatest holding is Nucor Corp (NUE), at 2.13% of the portfolio.

For extra information, data, and technique, go to the Dividend Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.