By Brian Manby, Senior Analyst, Analysis

As the primary quarter involves an in depth, there has already been a lifetime filled with headlines in monetary markets. From Bitcoin to GameStop to rising bond yields, there’s no scarcity of market fairy tales, however the renaissance in international small caps and worth shares seems to be extra of a permanent reality than fantasy.

Small caps have dominated to begin the yr, and worth investing is lastly gaining momentum. February was one of the best month for U.S. worth relative to development because the expertise bubble within the early 2000s, outperforming by almost 6%.

Whereas small caps and worth shares have benefitted from a altering paradigm within the U.S., developed market small-cap worth shares haven’t been left behind both.

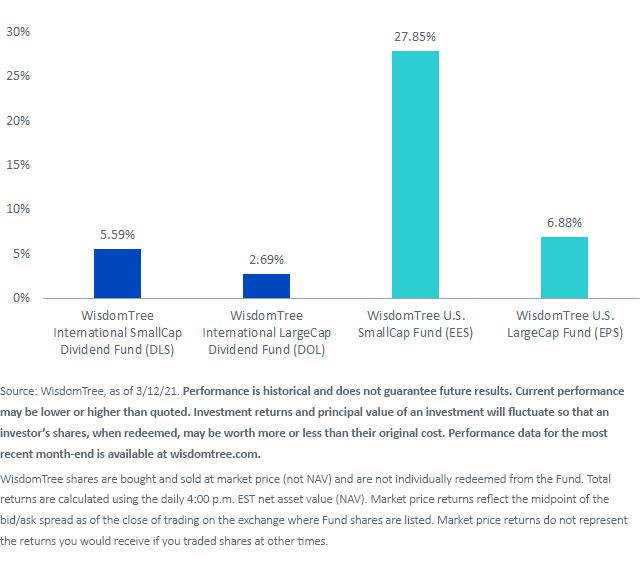

Check out the next chart, which relates the year-to-date efficiency of WisdomTree’s value-focused methods within the U.S. and developed areas.

YTD Efficiency (NAV)

Please click on the Fund’s respective ticker for standardized efficiency: DLS, DOL, EES, EPS.

Whereas the magnitude of outperformance has definitely been extra pronounced within the U.S., developed small-cap worth has doubled the efficiency of its large-cap counterpart as nicely.

We expect that is emblematic of a altering paradigm and a brand new starting for the downtrodden measurement and worth elements.

Sector Catalysts

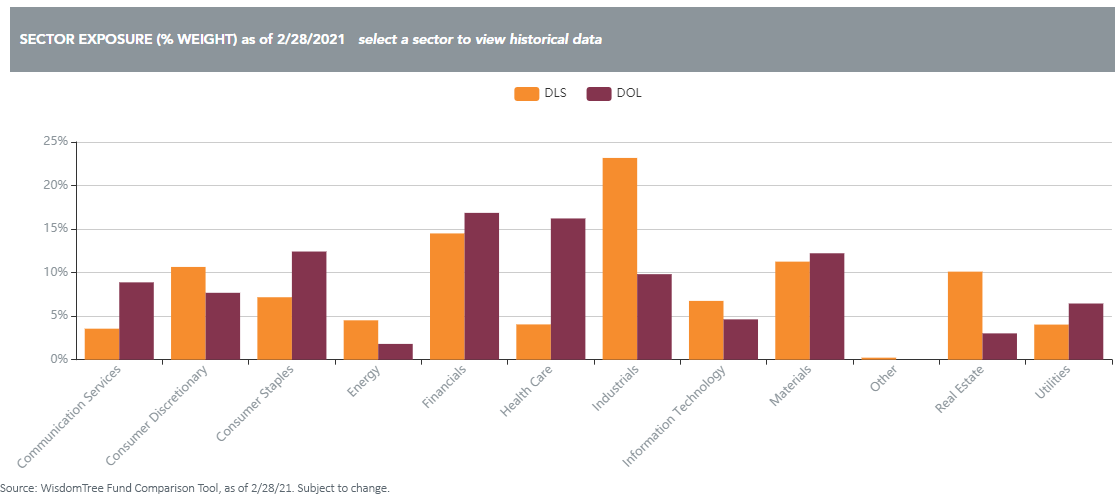

We expect sector composition tendencies have been particularly useful in fueling the latest rally in small-cap worth, particularly in an financial atmosphere that offers cyclical sectors loads of runway.

Many funding strategists anticipate a revival in financial development in 2021, commensurate with the reopening of world economies, the COVID-19 vaccine distribution and a resurgence in shopper exercise. These traits could arrange conventional worth sectors, similar to Industrials, Vitality, Financials and Actual Property, for lasting success—key exposures in WisdomTree’s Worldwide SmallCap Dividend Fund (DLS) and relative over-weights in comparison with its large-cap counterpart (DOL, the WisdomTree Worldwide LargeCap Dividend Fund).

Most notable is the 10% over-weight in Industrials, which alerts two probably useful traits about DLS in in the present day’s market atmosphere.

First is the connection between a revival in financial exercise and the way that may profit sectors which can be levered to this exercise. Industrials, by definition, could also be greatest positioned for an industrial comeback.

The Yield Enchantment

Second is the propensity for dividends in developed markets. Worth investing and dividend funds are virtually synonymous. After many European firms suspended their dividends final yr through the throes of the pandemic, their resumption could also be additive for a worth rally that already appears to have caught a tailwind.

However one widespread concern when investing in smaller firms relative to bigger ones is the sacrifice in dividend yield, notably within the U.S.

We concede there’s some advantage there. In spite of everything, smaller firms could also be at an obstacle in comparison with bigger firms, which have extra sturdy operations, stronger stability sheets and enduring profitability. Naturally, bigger firms could have extra flexibility to create worth for shareholders by way of dividend funds, leading to extra enticing yields.

Nonetheless, whereas small-cap investing at the moment requires a dividend yield sacrifice within the U.S., it could reward with a yield pickup in developed markets.

The yield on DLS is about 30 foundation factors greater than DOL as of the top of February. Evaluate that to the U.S., the place bigger firms (proxied by EPS, the WisdomTree U.S. LargeCap Fund) eclipse the yield of smaller ones (proxied by EES, the WisdomTree U.S. SmallCap Fund), and abruptly there’s an much more compelling case for measurement investing overseas.

Decrease Ratios, Larger Enchantment

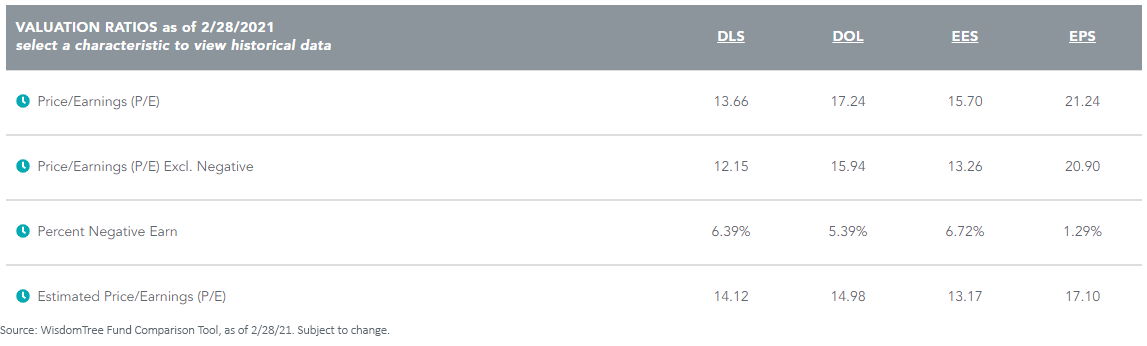

We’d be remiss to disregard the valuation profile of worldwide small-cap worth as nicely. Regardless of the eye they’ve earned this yr, coupled with a powerful efficiency file, small-cap worth shares around the globe nonetheless commerce at snug reductions to their large-cap friends. That tells us that traders aren’t but as critical about small caps as they need to be, which creates an advantageous alternative.

Regardless of their rally to start the yr, each U.S. and developed small-cap worth shares are buying and selling at a 20%–25% low cost to giant caps on a price-to-earnings (P/E) ratio foundation. Equally, there are even reductions accessible in ahead P/E measurements.

Even with their auspicious begin to the yr, worldwide small caps are nonetheless lagging U.S. small caps, so the cheap valuations of the previous ought to reassure you that they might nonetheless have room to rally additional with out concern of overpaying.

A Altering Paradigm

Within the present market atmosphere, we imagine the tables are handing over favor of small caps and worth investing because the financial system continues to get well.

We’ve made the case earlier than for small-cap investing within the U.S., and we imagine now greater than ever it’s simply as vital to think about small-cap allocations overseas. There could also be rewards that the remainder of the market has not found simply but.

Until in any other case said, all information is sourced from WisdomTree, FactSet, and Bloomberg, as of two/28/21.

Initially printed by WisdomTree, 4/6/21

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which incorporates funding targets, dangers, costs, bills, and different data; learn and contemplate rigorously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. International investing entails foreign money, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms could expertise larger value volatility. Investments in rising markets, foreign money, fastened earnings and different investments embrace extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency is just not indicative of future outcomes. This materials incorporates the opinions of the writer, that are topic to alter, and may to not be thought-about or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t a assure that any methods mentioned will work beneath all market situations. This materials represents an evaluation of the market atmosphere at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety particularly. The person of this data assumes all the threat of any use manufactured from the knowledge offered herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Buyers looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially symbolize the views of WisdomTree or any of its associates.

The MSCI data could solely be used on your inner use, will not be reproduced or re-disseminated in any kind and will not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding resolution and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is offered on an “as is” foundation and the person of this data assumes all the threat of any use manufactured from this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can’t make investments immediately in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.