BlackRock, the world's largest asset supervisor, is dropping the well-known iShares model from thre

BlackRock, the world’s largest asset supervisor, is dropping the well-known iShares model from three of the agency’s actively managed mounted earnings ETFs.

These funds are as follows: the BlackRock Brief Maturity Bond ETF (NEAR), BlackRock Brief Maturity Municipal Bond ETF (MEAR), and BlackRock Extremely Brief-Time period Bond ETF (ICSH).

These ETFs “now carry the BlackRock model to mirror the agency’s premier lively administration funding platform. There shall be no influence to the funds’ funding aims, tickers, CUSIPs, whole expense ratios or share costs,” based on an announcement.

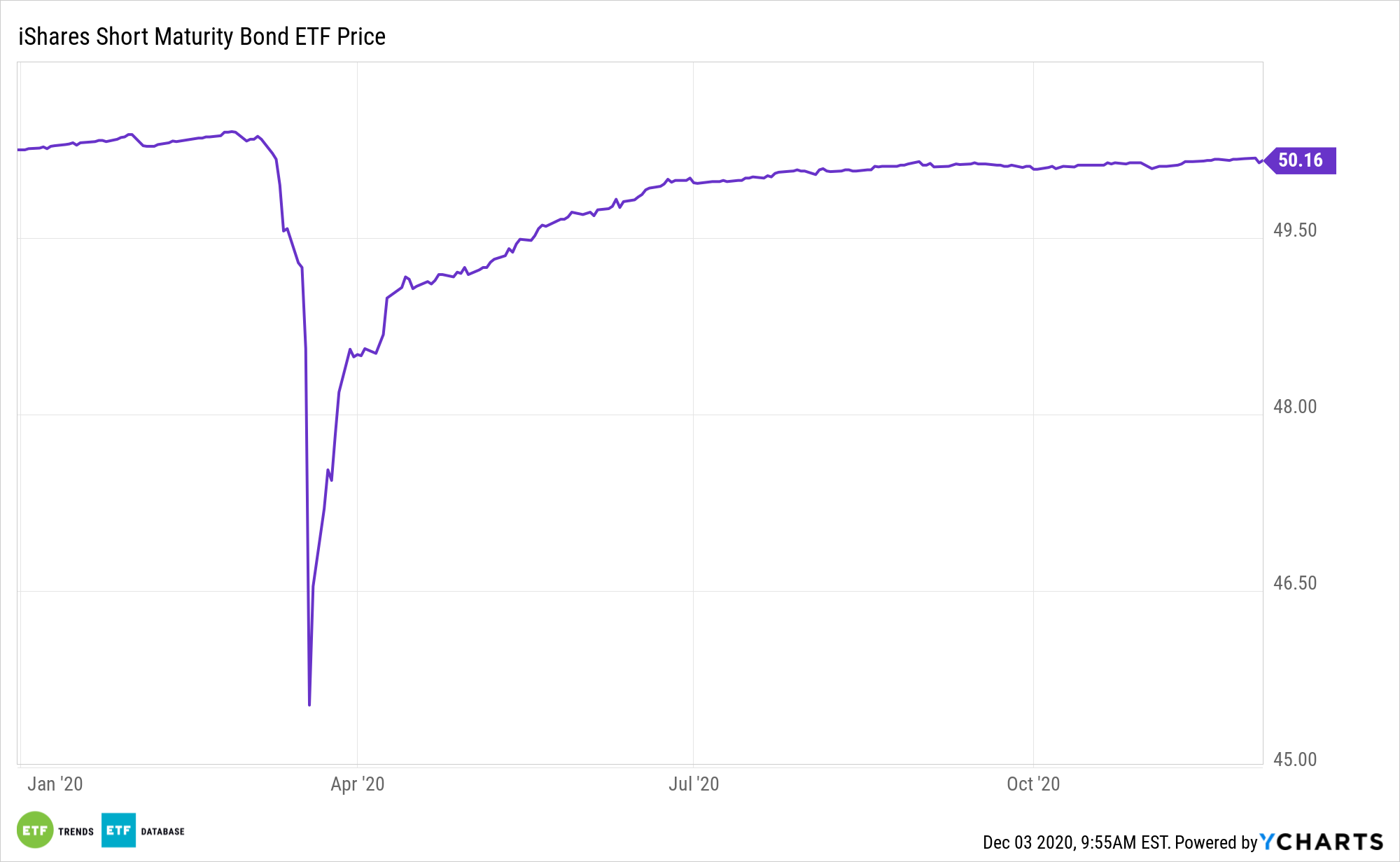

NEAR is a brief length technique. The fund has an efficient length of lower than a 12 months, which means its sensitivity to rising charges is minimal.

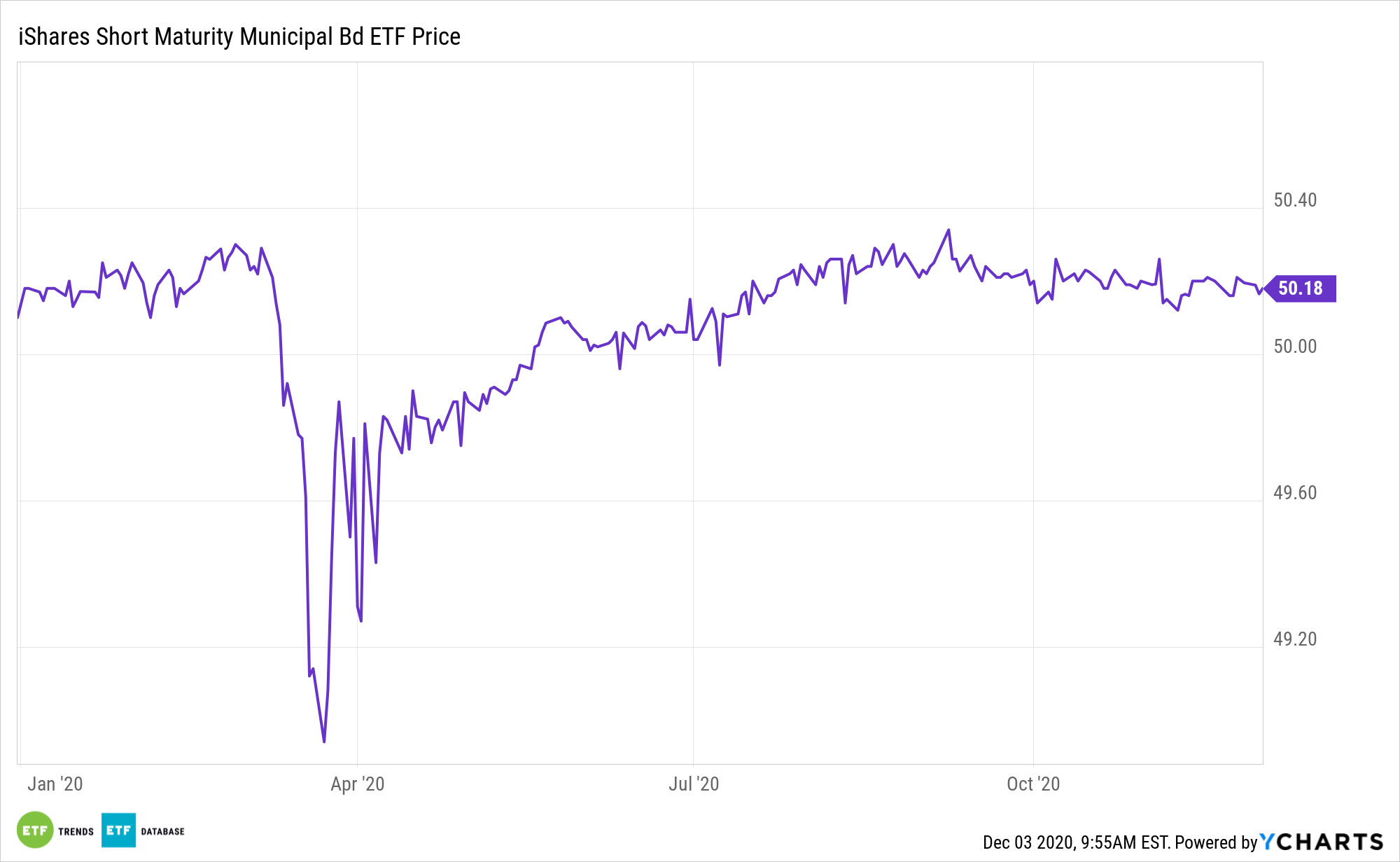

MEAR seeks to maximise tax-free present earnings. The fund usually invests at the least 80% of its internet belongings in municipal securities such that the curiosity on every bond is exempt from U.S. federal earnings taxes and the federal different minimal tax.

MEAR primarily invests in U.S. dollar-denominated investment-grade short-term fixed- and floating-rate municipal securities with remaining maturities of 5 years or much less, similar to municipal bonds, municipal notes and variable fee demand obligations, in addition to cash market devices and registered funding corporations.

BlackRock and iShares Main the Pack

“Alongside BlackRock’s proud custom of lively administration, iShares has served because the beacon of index investing innovation and revolutionized exchanged traded merchandise for over 20 years,” mentioned Armando Senra, Head of iShares Americas, BlackRock. “With greater than 900 ETPs globally, differentiating our alpha-seeking and index-based choices with clearly delineated branding is a crucial step in delivering transparency to our purchasers. We’re dedicated to launching new lively methods once we imagine the exposures will add worth for purchasers and have clear alpha potential.”

Sooner or later, BlackRock’s lively ETFs will carry that model whereas passively managed ETFs will sport the iShares model.

“In October 2020, BlackRock expanded its Megatrends suite by introducing three alpha-seeking ETFs actively managed by skilled portfolio managers from BlackRock’s Basic Lively Fairness franchise. The funds are designed to offer distinctive publicity to the structural shifts influencing the way forward for the worldwide financial system,” based on the assertion.

For extra on lively methods, go to our Lively ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.