June was a unstable, eventful month for cryptocurrency markets, as China cracked down on its home crypto mining business. Many buyers and funds, together with the Amplify Transformational Information Sharing ETF (BLOK), took the chance to shift their crypto investments, shopping for direct exposures at lowered costs.

BLOK is an actively managed ETF and the primary of its sort to trace firms within the blockchain business.

All of the volatility was really a constructive for BLOK, which rebounded 4.04% in June, regardless of Bitcoin’s worth plunge, because the ETF’s energetic administration crew took benefit of the volatility to reallocate the portfolio.

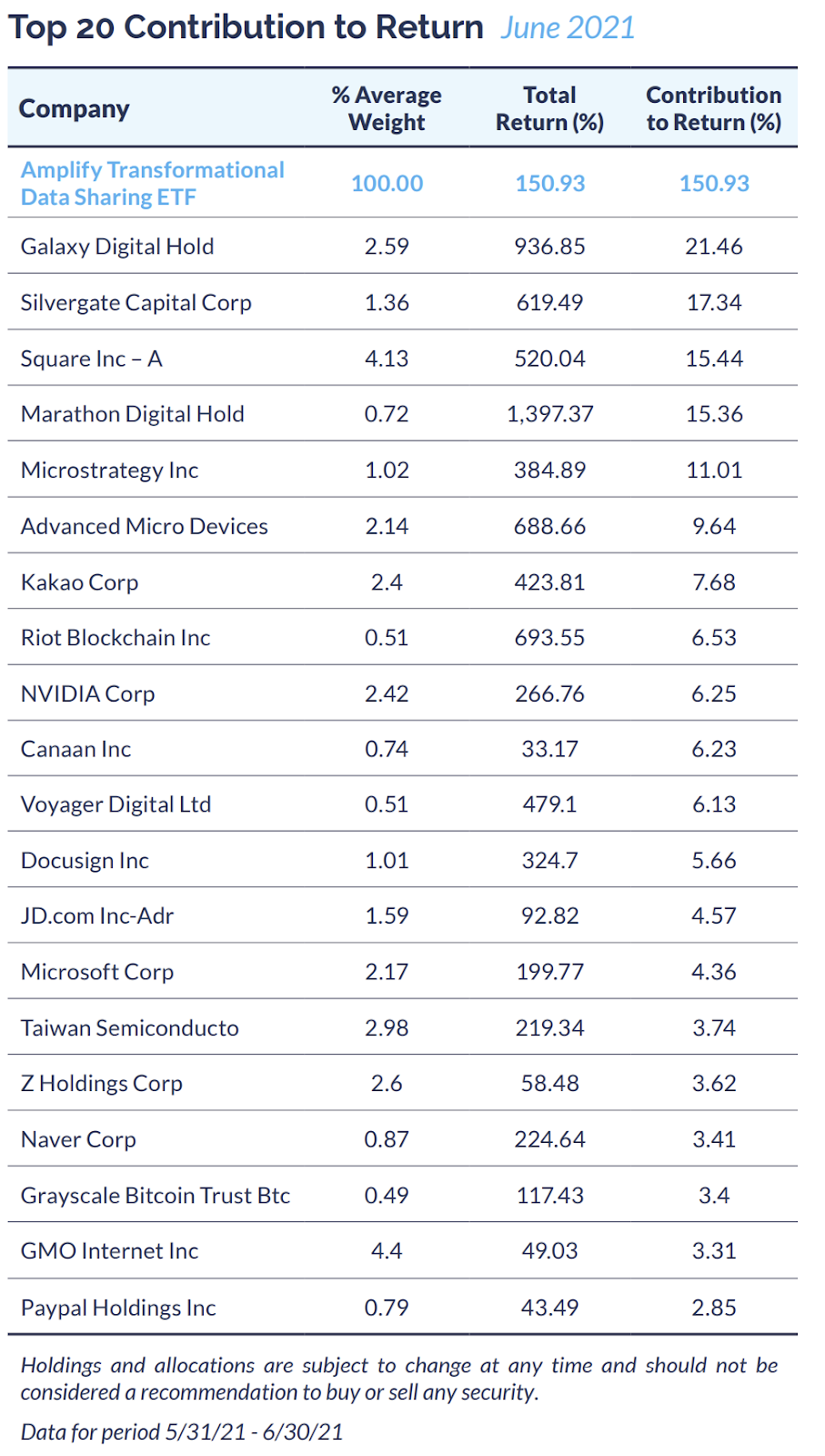

Since inception, the fund is up 150.93%, as of the tip of June.

China’s Crackdown Highlights Miners’ Significance

China’s regulatory shutdown of cryptocurrency and Bitcoin mining resulted in a large drop in crypto mining exercise throughout the nation, which had beforehand been liable for roughly 65% of Bitcoin processing, in line with June’s “The BLOK-Chain Month-to-month” from Amplify.

Consequently, the hash price (the variety of mines actively working on-line) plummeted, and Bitcoin costs tanked.

Earlier than the crackdown, it had taken roughly 10 minutes for a brand new block to be added to the blockchain, however with a big core of the working energy gone from the system, computational occasions rose as much as 20 minutes final month.

The Bitcoin Satoshi algorithm routinely adjusted accordingly on July 3rd to make mining 28% simpler in compensation for the lacking processing energy. It was the most important adjustment within the historical past of Bitcoin and stands to extend gross margin considerably within the interim as mining operations shift elsewhere.

The Bitcoin Mining Council

The report additionally supplied perception in regards to the Bitcoin Mining Council (BMC), an business group comprised of impartial companies that purpose to supply training and knowledge on Bitcoin.

The BMC believes that Bitcoin mining power utilization in comparison with complete international power utilization is minimal, and that Bitcoin mining might even be thought-about ESG. It is a hotly contested stance, as Bitcoin has made headlines final month for its vital carbon emissions profile.

Because the bodily areas of crypto mining operations shift, the BMC factors out that new areas like the US are extra targeted on sustainability.

BLOK Captures the Growing Curiosity in Crypto

As Bitcoin costs fell, BLOK took the chance to put money into mining and transactional platforms, because the fund’s advisors stay bullish on Bitcoin’s long-term prospects.

Mining offers excessive revenue potential, and the fund elevated its publicity to HIVE Blockchain and added BIGG Blockchain. Mining now accounts for 23.46% of the full portfolio.

At the moment, BLOK’s prime 20 holdings characterize 70.83% of the fund’s complete belongings, as of finish of June. The highest three holdings contributing to returns Galaxy Digital Holdings, contributing 21.46% of returns; Silvergate Capital Corp (SI), contributing 17.34% of returns; and Sq. Inc (SQ), contributing 15.44% of returns.

Supply: Amplify ETFs

BLOK carries an expense ratio of 0.71%.

For extra information, info, and technique, go to the Crypto Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.