Seema Shah, Chief Strategist, Principal World Traders

Seema Shah, Chief Strategist, Principal World Traders

The super efficiency of the U.S. fairness market over the previous six months has confounded many traders. But, look beneath the floor and it would make extra sense. Whereas cyclical segments of the market have floundered beneath the lingering weight of lockdown results and pandemic concern, firms which may complement and enhance life with COVID-19—the likes of Fb, Amazon, Apple, Netflix and Google—have thrived, rolling out stellar outcomes and powering total market efficiency. With populations largely confined to their houses and having to socialize, work, store and discover leisure on-line, households have prioritised their spending to bread, water, and FAANGs.

Supply: Bloomberg, Principal World Traders. Knowledge as of September 30, 2020.

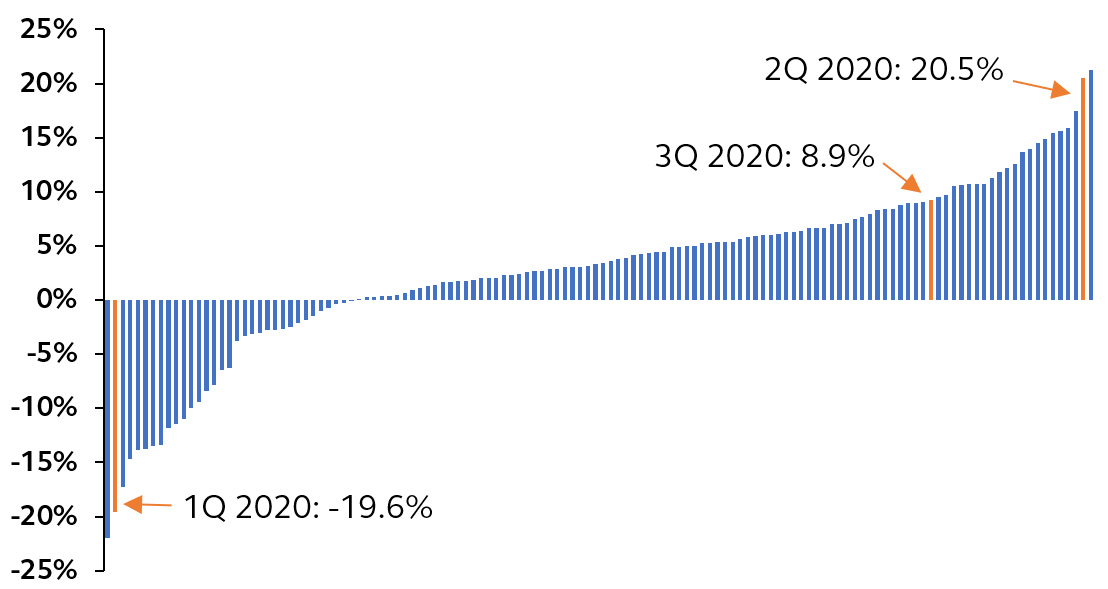

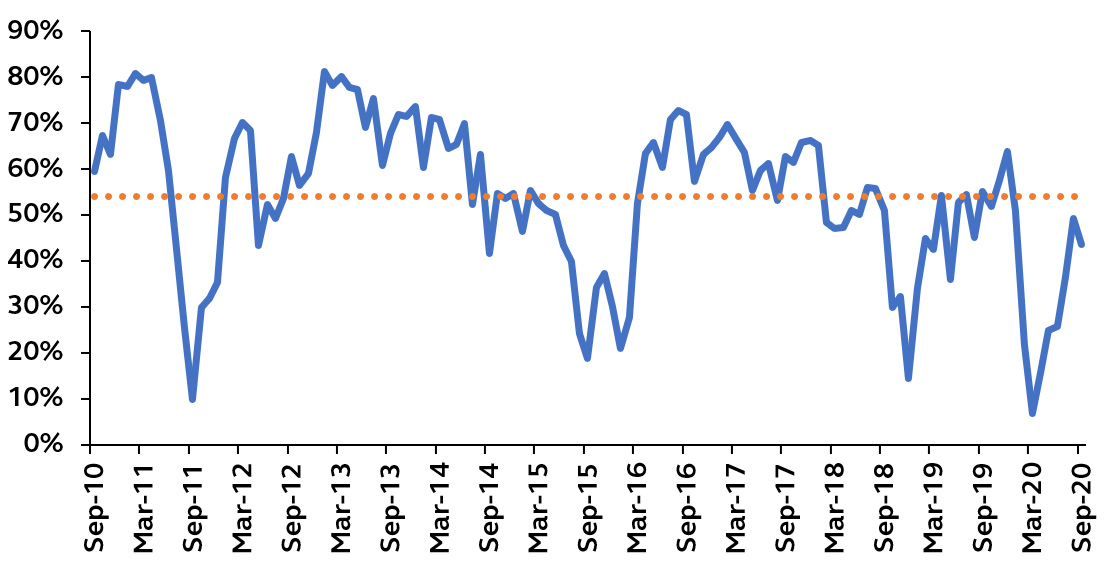

The highest 5 firms within the S&P 500, Fb, Apple, Microsoft, Amazon and Google (inconveniently creating the much less attractive acronym FAMAG), make up over a fifth of your complete market capitalisation of the S&P 500 index and round half of the NASDAQ 100. These tech-ish darlings—Amazon is taken into account a client discretionary firm, not tech—have finished some severe heavy lifting. On the finish of September, whilst lower than half the shares on the New York Inventory Change closed above their 200-day shifting common, the S&P 500 index capped its greatest two-quarter efficiency since 2009, rising some 30% whereas, much more astoundingly, the tech-heavy NASDAQ Composite index has recorded a 45% improve within the previous 6 months alone.

Supply: Bloomberg, Principal World Traders. Knowledge as of September 30, 2020.

These frenzied strikes larger have inevitably stretched traders’ perception within the sustainability of Massive Tech’s outperformance. Worth to earnings ratios have been propelled to ranges related to the dot-com growth, and our personal PGAA Fairness Valuation Composite means that the MSCI USA Development index (which has vital tech publicity) has virtually by no means been dearer. At these elevated ranges, traders more and more require vindication within the type of sturdy earnings progress to be able to preserve their tech publicity, multiplying issues concerning the total market’s heavy reliance on the know-how sector to generate earnings in a post-COVID world.

A September swoon

Admittedly, though the Q3 market efficiency was decidedly strong, this was regardless of a harder September. Market sentiment was tainted by rising issues round a number of points, together with fears across the U.S. Presidential Election, rising COVID instances, and disappointment over U.S. fiscal stimulus. By themselves, none of those occasions had been sufficiently vital to drive a market pullback. But, they coincided with stretched valuations, closely overbought circumstances and investor complacency, bringing a brief finish to the post-COVID rebound in monetary markets.

Massive Tech was not immune, and the most effective performing sector transformed into an underperformer. The Nasdaq Composite fell into correction territory—outlined as a minimum of a 10% drop from the current excessive—simply three periods after hitting a file, the speediest-ever such fall.

Whereas Massive Tech has since regained some floor, traders have expressed concern about their continued rattled efficiency. But, we contemplate the September swoon as a pure pace bump for the sector.

Situations stay broadly supportive of Massive Tech

Whereas different sectors have struggled to outlive, the COVID disaster created the right trio of circumstances for Massive Tech companies to thrive: restricted bodily social interplay, an unsure financial backdrop, and depressed bond yields. These circumstances stay firmly in place.

- COVID-19: The pandemic is certainly not over and instances are as soon as once more rising within the U.S. and even spiking above the April peaks in Europe. Whereas deaths have usually remained low, allowing governments to prioritize financial reopening, a number of European cities have clamped down as soon as once more on social gatherings, whereas New York Metropolis is contemplating reintroducing new public well being restrictions. As such, the acceleration of digital traits for enterprise, training and households within the wake of the pandemic is unlikely to fade anytime quickly. The stay-at-home commerce remains to be in vogue.

- Financial backdrop: The worldwide financial restoration has progressed quicker than many had envisaged, but there may be nonetheless some technique to go earlier than the worldwide financial system returns to pre-pandemic ranges. Beneficiant authorities stimulus and insurance coverage packages which have buffeted the restoration are starting to wind down and financial scarring is more likely to turn into extra obvious as firms more and more report closures and job cuts in This autumn. What’s extra, with the pandemic nonetheless at giant, customers and companies will stay restrained by virus concern, thereby sustaining the unsure backdrop. Massive Tech firms—with their sturdy steadiness sheets, optimistic money circulate and resilient earnings—will proceed to be thought-about as a relative protected haven.

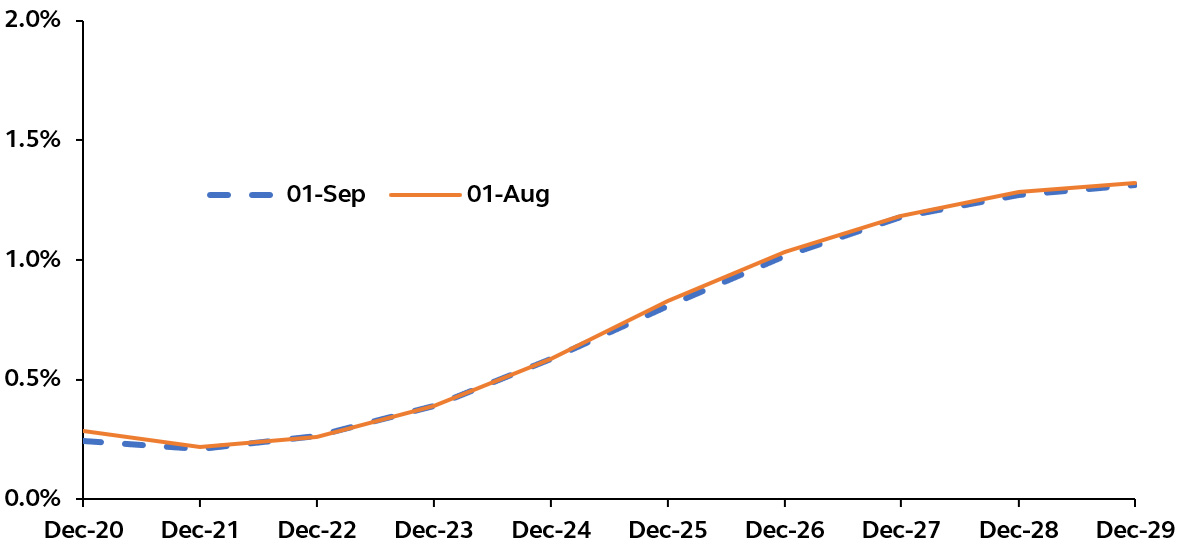

- Bond yields: As a lot of Massive Tech earnings lie far sooner or later, their valuations profit tremendously from low charges. The Federal Reserve’s current adoption of a brand new common inflation focusing on framework explicitly permits inflation to tick above 2% for a while earlier than the central financial institution appears to be like to tighten financial coverage. The implication is that asset purchases will proceed, coverage charges are basically locked close to zero, and traders can count on short-term bond yields to be pinned down for the foreseeable future. What’s extra, whereas the financial system is therapeutic, inflationary pressures will probably be contained, placing little upward stress on long-end bond yields over the subsequent yr or so.

Supply: Bloomberg, Principal World Traders. Knowledge as of September 30, 2020.

With out proof of a broader financial restoration and rekindling of inflation stress, there may be little within the elementary market dynamics to counsel tech disappointment within the near-term.

After all, know-how shares are certainly not bullet proof. Every passing day appears to carry optimistic bulletins concerning a viable and efficient vaccine. Whereas a breakthrough would clearly be nice information, it will be much less optimistic for the tech sector. The pandemic has triggered many behavioral adjustments and, simply as definitive progress on COVID-19 and a pick-up in international progress momentum would seemingly lead to a reflation rotation, a vaccine would set off a re-allocation into less-loved cyclical sectors.

On the similar time, whereas tech sector valuations are elevated, the earnings and income potential within the coming years from areas akin to cloud computing, synthetic intelligence, and cyber safety will stay sturdy, no matter a vaccine. Traders must be reassured that, whereas dependence on know-how will seemingly fade considerably as households and firms look to return to a extra regular lifestyle, know-how will inevitably proceed play a higher function than it did pre-COVID.

Initially printed by Principal World Traders, 10/7/20

Except in any other case famous, the data on this doc has been derived from sources believed to be correct as of October 2020. Info derived from sources apart from Principal World Traders or its associates is believed to be dependable; nevertheless, we don’t independently confirm or assure its accuracy or validity. This materials accommodates common info solely and doesn’t take account of any investor’s funding aims or monetary scenario and shouldn’t be construed as particular funding recommendation, advice or be relied on in any means as a assure, promise, forecast or prediction of future occasions concerning an funding or the markets usually. The opinions and predictions expressed are topic to vary with out prior discover. Any reference to a particular funding or safety doesn’t represent a advice to purchase, promote, or maintain such funding or safety, nor a sign that Principal World Traders or its associates has advisable a particular safety for any consumer account.

Topic to any opposite provisions of relevant regulation, Principal World Traders and its associates, and their officers, administrators, workers, brokers, disclaim any categorical or implied guarantee of reliability or accuracy and any accountability arising in any means (together with by cause of negligence) for errors or omissions on this doc or within the info or information supplied on this doc.

Previous efficiency isn’t any assure of future outcomes and shouldn’t be relied upon to make an funding resolution. Investing entails threat, together with doable lack of principal.

Hyperlinks contained in some weblog posts could take you to third-party websites and Principal World Traders makes no ensures to the accuracy of the data supplied. Principal World Traders doesn’t endorse, authorize, or sponsor any third-party content material.

This materials could include “forward-looking” info that’s not purely historic in nature. Such info could embody, amongst different issues, projections and forecasts or returns. There isn’t any assure that any forecasts made will come to go. Reliance upon info on this materials is on the sole discretion of the viewer.

This materials will not be supposed for distribution to or use by any individual or entity in any jurisdiction or nation the place such distribution or use could be opposite to native regulation or regulation.

Insurance coverage merchandise and plan administrative companies supplied by way of Principal Life Insurance coverage Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities supplied by way of Principal Securities, Inc., 800-547-7754, Member SIPC and/or unbiased dealer/sellers. Principal Life, Principal Funds Distributor, Inc. and Principal Securities are members of the Principal Monetary Group®, Des Moines, IA 50392.

1356299

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.