As considered one of this yr’s best-performing teams within the S&P 500, vitality is giving buyers loads of causes to be bullish in 2021. Tempting as that could be, many buyers keep in mind the oil bear market of 2020 and vitality’s popularity for steep declines.

This yr, issues could possibly be completely different for vitality buyers as oil demand bounces again with People trying to journey and spend stimulus money. That could possibly be a good setup for the FlexShares Morningstar World Upstream Pure Useful resource Index Fund (NYSEArca: GUNR).

GUNR tracks the Morningstar World Upstream Pure Sources Index. The FlexShares fund isn’t a devoted vitality sector alternate traded fund. Slightly, it is a broad-based play on pure assets, offering buyers with an alternative choice to “all in” vitality methods.

“Because the demand for or costs of pure assets improve, the Fund’s fairness funding usually could be anticipated to additionally improve. Conversely, declines in demand for or costs of pure assets usually could be anticipated to trigger declines in worth of such fairness securities. Such declines might happen shortly and with out warning and will negatively affect your funding within the Fund,” in line with FlexShares.

GUNR’s Vitality Upside

Conventional vitality bets might be unstable. GUNR is an alternative choice to contemplate to nonetheless lever to grease upside, which some market observers are saying is coming.

“I feel all the vitality complicated is a purchase,” mentioned Fundstrat’s Tom Lee in a CNBC interview. “Structurally, the trade and in addition the vitality corporations are actually seeing one of the best supply-demand alignment in additional than 10 years.”

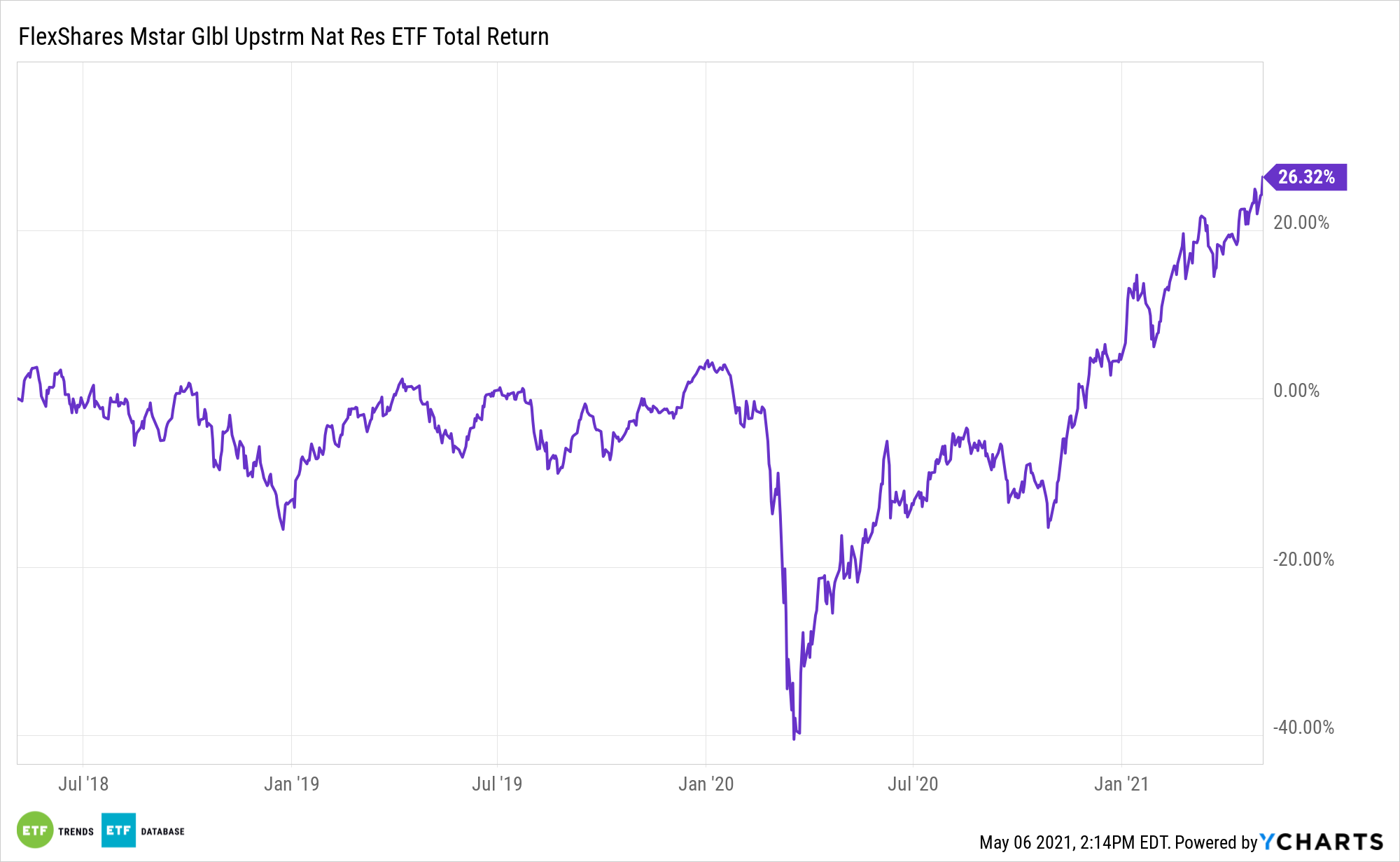

Up 18% year-to-date, GUNR is proving it is greater than adequately uncovered to post-pandemic drivers of vitality sector upside.

“The vitality sector was hit exhausting by the pandemic, as demand for oil fell amid a pointy discount in journey. The rollout of Covid vaccines and optimism across the financial reopening has reignited demand, serving to push the value of oil greater whereas lifting the shares of vitality corporations,” in line with CNBC.

The $5.22 billion asset has different perks. Greater than 88% of its weight is allotted to metals producers, agribusiness names, and vitality shares. That provides fund not solely a pronounced inflation-fighting utility, but additionally a stable worth tilt. Fifty-six % of the fund’s parts are worth shares, exposing it to an ongoing rally by that funding issue as properly.

For extra on multi-asset methods, go to our Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.