When it involves state-level renewable power adoption, California has lengthy been a pacesetter. Nevertheless, a lot of the Golden State’s clear power coverage and deployment revolves round solar energy.

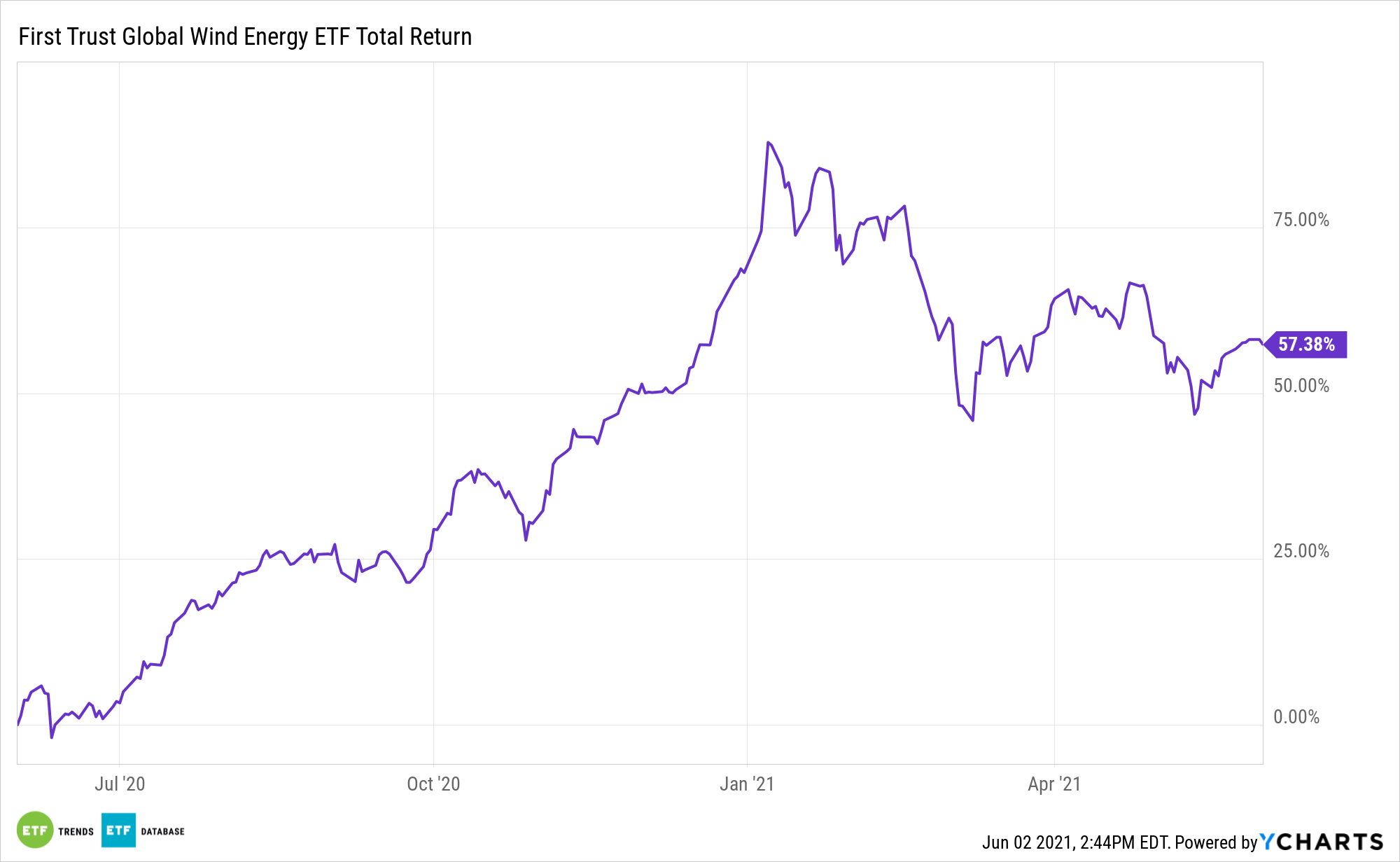

That is beginning to change, and the shift carries with it implications for wind power and belongings such because the First Belief International Wind Vitality ETF (FAN). To little fanfare, FAN jumped 1.44% final week. A case could be made that information out of California could have helped the fund shut Might on a constructive.

Final week, a pair of developments cemented the notion that the most important U.S. state is a rising participant within the wind power market.

“On 25 Might, the federal US authorities designated two areas off the state’s Pacific coast for improvement after overcoming long-standing Division of Protection (DOD) objections. The designation units the areas on the trail to a lease public sale by mid-2022, in accordance with the Division of the Inside (Inside),” in accordance with IHS Markit. “Two days later, on 27 Might, a invoice that may set state offshore wind capability targets and prepare a procurement program handed the decrease chamber of the state legislature. The invoice, AB 525, received overwhelming help in a 71-1 Meeting vote.”

Evaluating Potential Impression for ‘FAN’

Neither the aforementioned coverage strikes nor the IHS Markit report point out particular corporations, nevertheless it seems California’s wind ambitions will focus on floating wind stations – the improvements extensively used alongside the east coast.

Division of Vitality Principal Deputy Secretary for Vitality Effectivity and Renewable Vitality Kelly Speakes-Backman lately mentioned floating wind may drive as much as 60% of the entire U.S. wind power market.

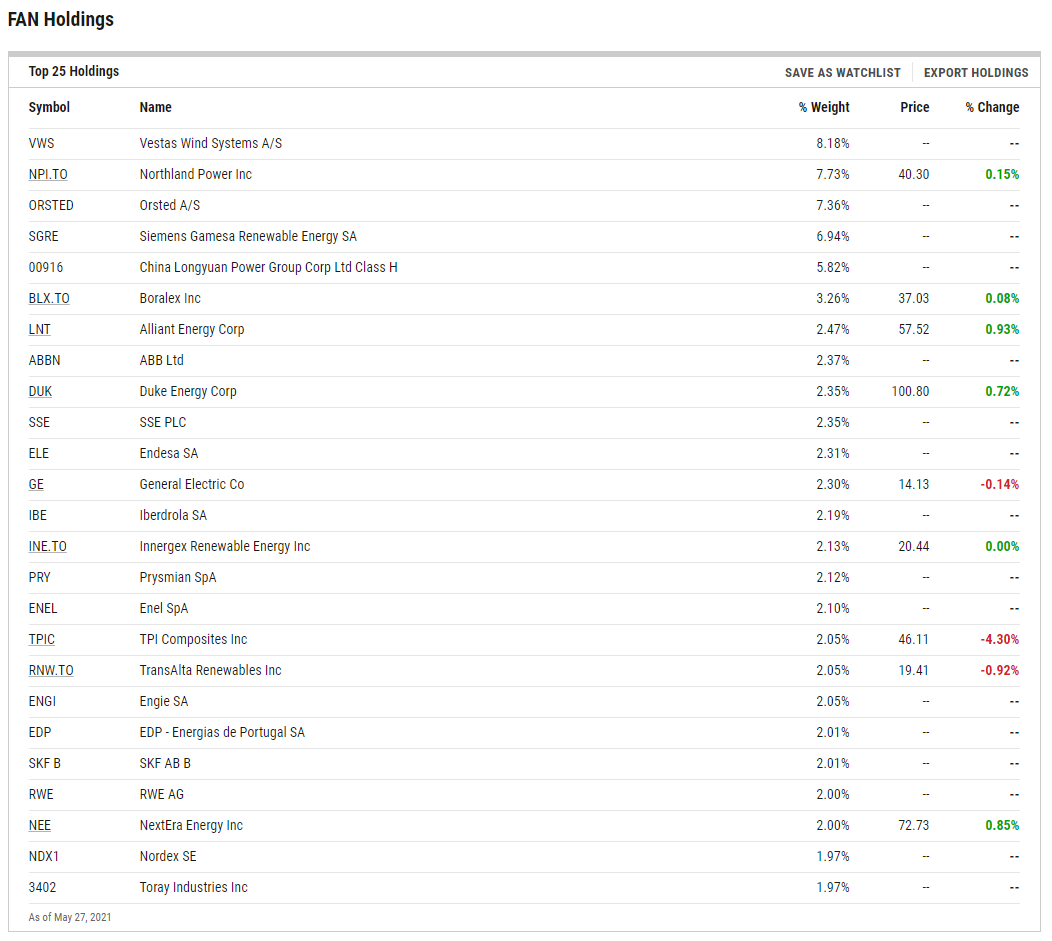

FAN holdings akin to Vestas Wind Methods, Northland Energy, and Orsted A/S are giants within the offshore wind business. These are FAN’s prime three elements, combining for over 23% of the fund’s roster.

Different FAN member companies with leverage to the offshore wind market embody Common Electrical (NYSE: GE) and Spanish utility Iberdrola SA. These two shares mix for 4.42% of the ETF’s weight.

Moreover, the Golden State’s wind power plans at present depart loads of room to be scaled greater.

“A 10 GW by 2040 goal is an formidable purpose, and is on the correct path as a place to begin, however given the SB 100 necessities for 100% renewable energy sourcing by 2045, it’s not formidable sufficient, in addition to being a fraction of the 112 GW of the state’s technical potential, Mainstream Renewable Energy Vice President, US Offshore Wind Paula Main mentioned,” provides IHS Markit.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.