The complexion of the world's v

The complexion of the world’s vitality combine is altering. Doorways are opening for renewables, whereas many energy suppliers are tiring of soiled sources like coal.

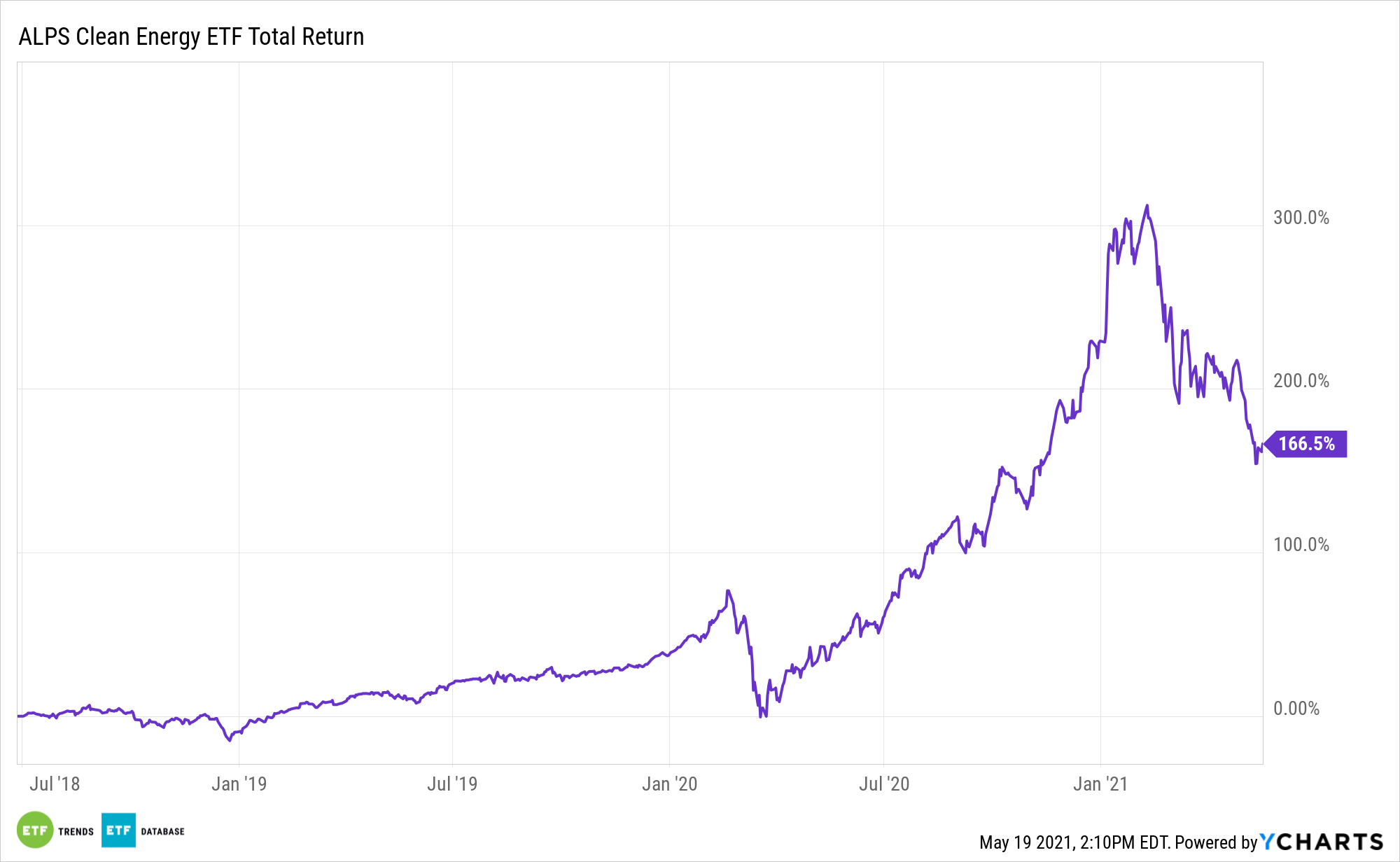

An array of change traded funds, together with the ALPS Clear Vitality ETF (ACES), present publicity to the brand new regular within the vitality realm. Following the set up of 275 gigawatts (GW) of renewable vitality all over the world in 2020, a 45% soar from the yr prior, some analysts imagine {that a} new age of vitality is setting in.

“Annual worldwide renewable era capability additions are set to stabilize round 270-280 GW in 2021 and 2022, knowledge launched just lately by the Worldwide Vitality Company (IEA) present,” says IHS Markit. “The ‘new regular’ far surpasses the IEA’s expectations of a yr earlier, with Europe and the US compensating for a slowdown in Chinese language capability installations after 2020 noticed document newbuild there.”

A World Push

Biden is making good on guarantees to push a broad-based renewable vitality agenda. Whether or not it makes it by Congress within the kind desired by traders and inexperienced vitality followers is one other matter. Thankfully, worldwide alternatives additionally abound within the renewables house with Europe, India, and Latin America upwardly revising forecast additions for this yr and 2022.

Main governments all over the world must capitalize by favoring agendas that “encourage higher funding in photo voltaic and wind, within the further grid infrastructure they’ll require, and in different key renewable applied sciences akin to hydropower, bioenergy and geothermal,” in line with IEA.

As for particular renewable industries, photo voltaic – one of many largest business weights in ACES – is in pole place, augmenting dips in wind energy installations.

“Photo voltaic PV newbuild is about to extend an extra 8% yr on yr in 2021, the IEA stated, largely on account of decrease funding prices and ongoing coverage assist. The IEA expects photo voltaic PV additions to achieve 145 GW in 2021 and 162 GW in 2022, for brand new information and accounting for about 55% of all renewable newbuild in 2021 and 2022,” provides IHS Markit.

Different various vitality ETFs embrace the First Belief World Wind Vitality ETF (FAN) and the SPDR Kensho Clear Energy ETF (CNRG).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.