Within the wake of hackers’ hijacking the Colonial Pipeline in Might, {industry} specialists are taking a look at tips on how to enhance cybersecurity measures within the susceptible oil and fuel {industry}.

Three oil and fuel cybersecurity specialists lately sat down with the Wall Avenue Journal to debate what extra measures can be mandatory to make sure the safety of the power sector in America.

Cybersecurity throughout the Vitality Sector Falls Quick

After the Colonial Pipeline hackers demanded a $4.Four million ransom in cryptocurrency, $2.three million of which was recovered later by the Justice Division, the Transportation Safety Administration (TSA) launched an up to date safety directive addressing cybersecurity within the pipeline sector.

This directive requires pipeline operators and homeowners to report any potential cybersecurity assaults to the DHS Cybersecurity and Infrastructure Safety Company (CISA); to nominate a Cybersecurity Coordinator that’s accessible 24/7; and to evaluation present cybersecurity practices due inside 30 days.

Nevertheless, many specialists consider this received’t be sufficient to guard one of the crucial susceptible elements of the nation’s infrastructure.

Jim Guinn, international managing director for cybersecurity in power, chemical compounds, utilities, and mining at Accenture Safety, defined the present elevated dangers: “whenever you evaluate the total yr 2020 to the primary 5 months of 2021, there was a 42% improve in publicly recognized ransomware assaults towards power corporations.”

The power {industry} has gone from the 10th-most focused sector in 2020 to the 4th at the moment, he added, with assaults growing as a result of, by and enormous, corporations are paying the ransoms. That solely incentivizes hackers to maintain hacking.

Suzanne Lemieaux, supervisor of operations safety and emergency-response coverage for the American Petroleum Institute, believes that government-industry information-sharing must be higher.

“There’s a whole lot of intelligence coming via proper now that simply doesn’t make its method to private-sector operators, who want it to make higher defenses for his or her techniques,” she stated.

She believes that the knowledge reported by the non-public sector to the TSA below the brand new directive have to be made nameless, then collated and shared again to your complete {industry}.

Chris Bronk, affiliate professor of laptop info techniques and knowledge system safety on the College of Houston, agrees, emphasizing that this info on hacking assaults and makes an attempt should even be made accessible.

“Declassifying intelligence and quickly kicking it out to entities that don’t have the capability to course of categorized info is simply not possible,” he defined.

He goes on to argue that it isn’t possible to depend on the businesses to course of and launch info in a well timed method, and that the oil and fuel {industry} might want to create its personal requirements. “If an {industry} desires to guard itself, it’s going to need to undertake an industrial-related set of actions,” he stated.

Present issues that make rules tough are antitrust points and the complicated provide chain that features all kinds of corporations of various buildings. There is no such thing as a one-size-fits-all repair for regulators, which makes a normal of protections inside cybersecurity extraordinarily tough and has left this specific sector extraordinarily susceptible.

Cybersecurity Investing with the UCYB ETF

The extra hacking makes an attempt made, the extra potential there’s for cybersecurity companies to develop and revenue.

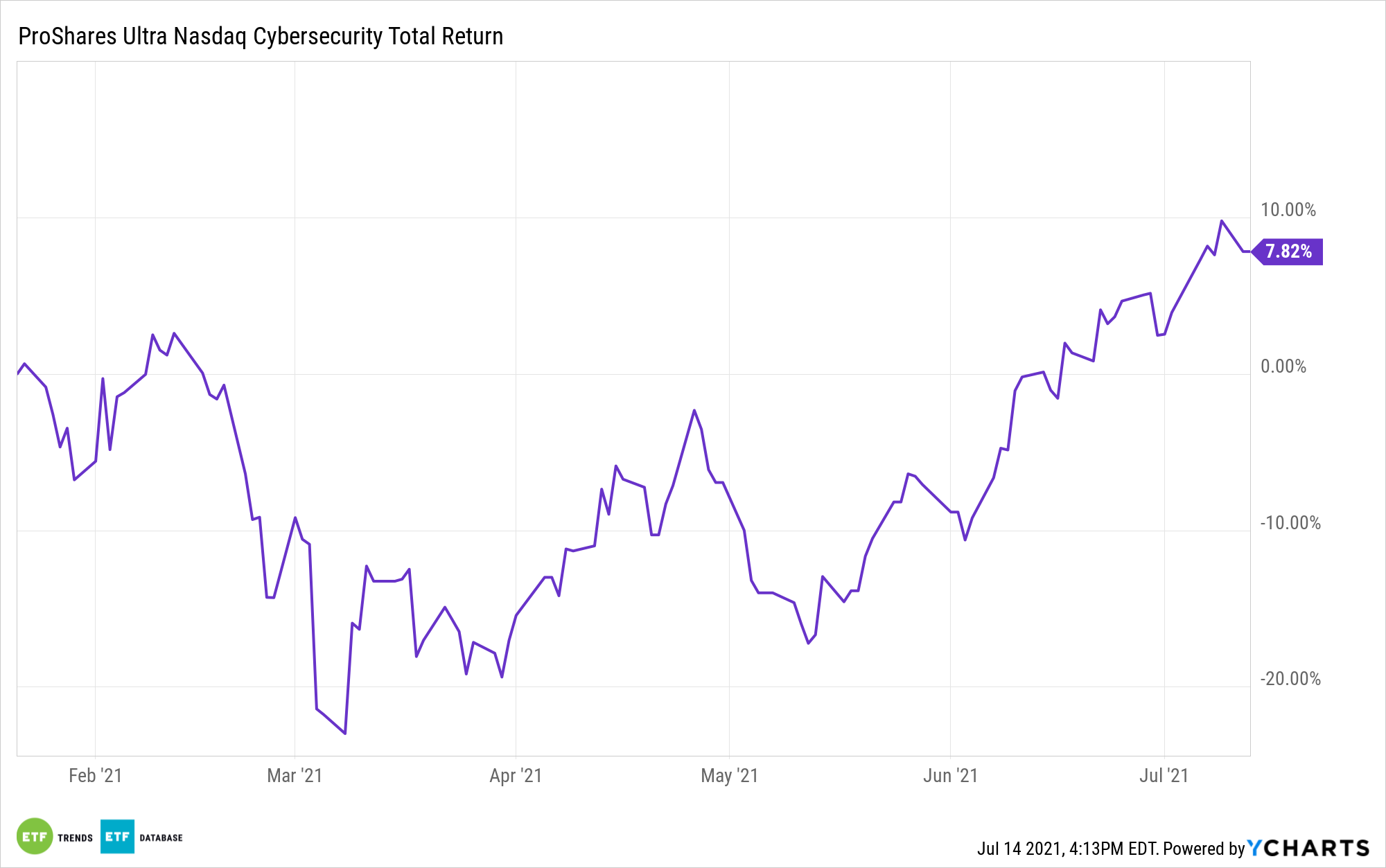

The ProShares Extremely Nasdaq Cybersecurity ETF (UCYB) is a leveraged ETF that tracks twice the day by day returns of the Nasdaq CTA Cybersecurity Index, the identical index as tracked by the First Belief Nasdaq Cybersecurity ETF (CIBR). The ETF actually holds CIBR, then makes use of swaps contracts on that ETF to acquire leveraged publicity.

UCYB’s underlying benchmark tracks corporations that construct, implement, and handle safety protocols for private and non-private networks which have a minimal market cap of $250 million. Inside the index, no singular safety can carry greater than 6% weight; decrease quantity securities have even tighter weighting restrictions.

As a leveraged fund, UCYB carries totally different, higher dangers than non-leveraged benchmarked funds, and ought to be actively monitored.

UCYB carries an expense ratio of 0.98%, with a contractual waiver that ends on 9/30/22.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.